1095 Forms: 1095-a vs. 1095-b vs. 1095-c

4.7 (198) In stock

Employers may become overwhelmed by health insurance paperwork and reporting responsibilities. Under the Affordable Care Act (ACA), the IRS requires all applicable employers and qualified health plan providers to report information about their health plans and health coverage enrollment using tax Forms 1095 A, B, and C. However, there are different requirements for each of these documents.

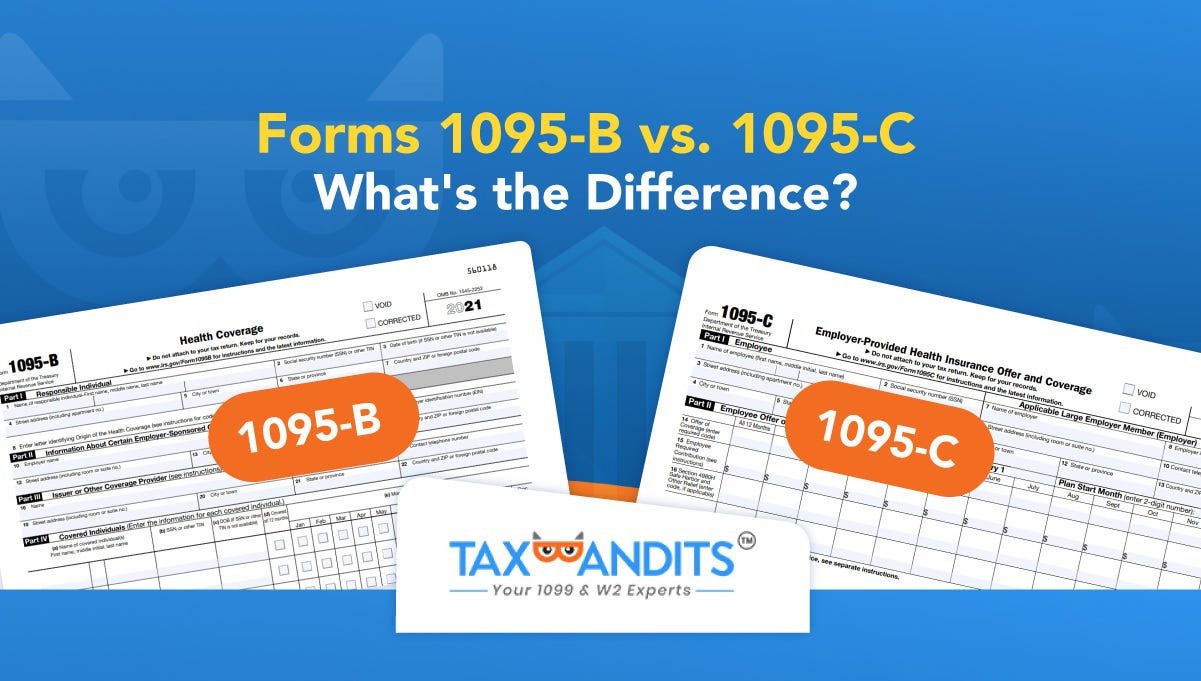

Forms 1095-B vs. 1095-C — What's the Difference?, by TaxBandits - Payroll & Employment Tax Filings, Modern Payroll

Form 1095-C or 1095-B Deadline Extended

Sample Print of 1095-B and 1095-C

What Is Cyber Liability Insurance & Why Is It Important?

Comparing 1095-A vs 1095-C: Key Differences and Benefits

Sample 1095 1094 ACA Forms

How to reconcile your premium tax credit

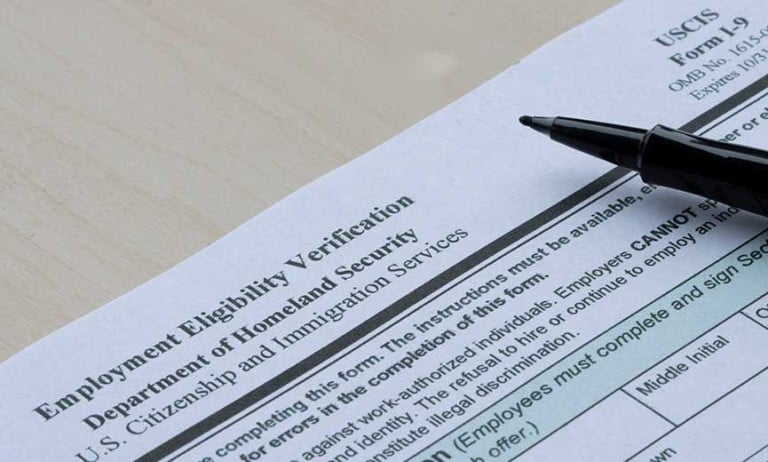

Florida Mandates Use of E-Verify for Private Employers with 25 or More Employees

What Is Cyber Liability Insurance & Why Is It Important?

Form 1095-C, Forms, Human Resources

What Is Cyber Liability Insurance & Why Is It Important?

401(k)s & Retirement Laws in California

What is a Consumer-Driven Health Plan?

401(k) vs 403(b): What's the difference?

Mini USB vs. Micro USB: What�s the Difference?

Spanish Spelling With B and V: Word List, Verbs, and Pronunciation

- Alo Yoga Airlift Game Changer High-Waist 7/8 Leggings

Club Pilates Natomas Reformer Pilates Studio

Club Pilates Natomas Reformer Pilates Studio- Lacoste Three Tone Waistband Iconic Trunks, Pack of 3, Navy Blue

Gelmart Leads Sustainable Intimates Innovation With New Sugarcane-Based Bra

Gelmart Leads Sustainable Intimates Innovation With New Sugarcane-Based Bra Dragonball Z 6 Inch Scale Accessory S.H. Figuarts - Son Goku's Effect

Dragonball Z 6 Inch Scale Accessory S.H. Figuarts - Son Goku's Effect Girls Coats and Jackets 2-16 Years

Girls Coats and Jackets 2-16 Years