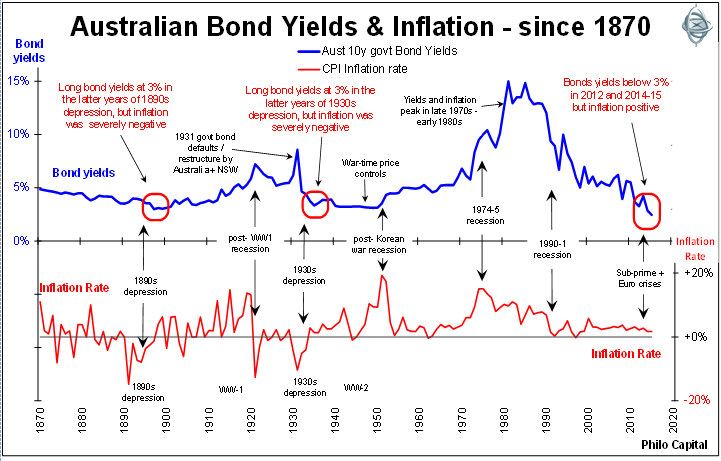

Australian bond yields and inflation

4.6 (555) In stock

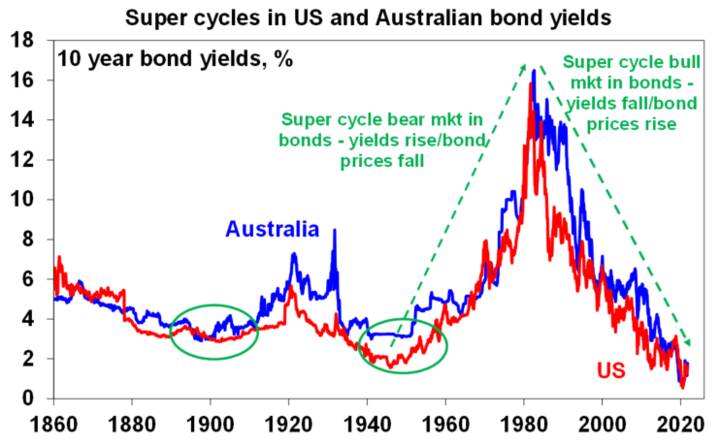

Current bond yields and prices haven’t been seen in Australia since the 1890s and 1930s depressions. The market is being supported by foreign buyers and central bank liquidity.

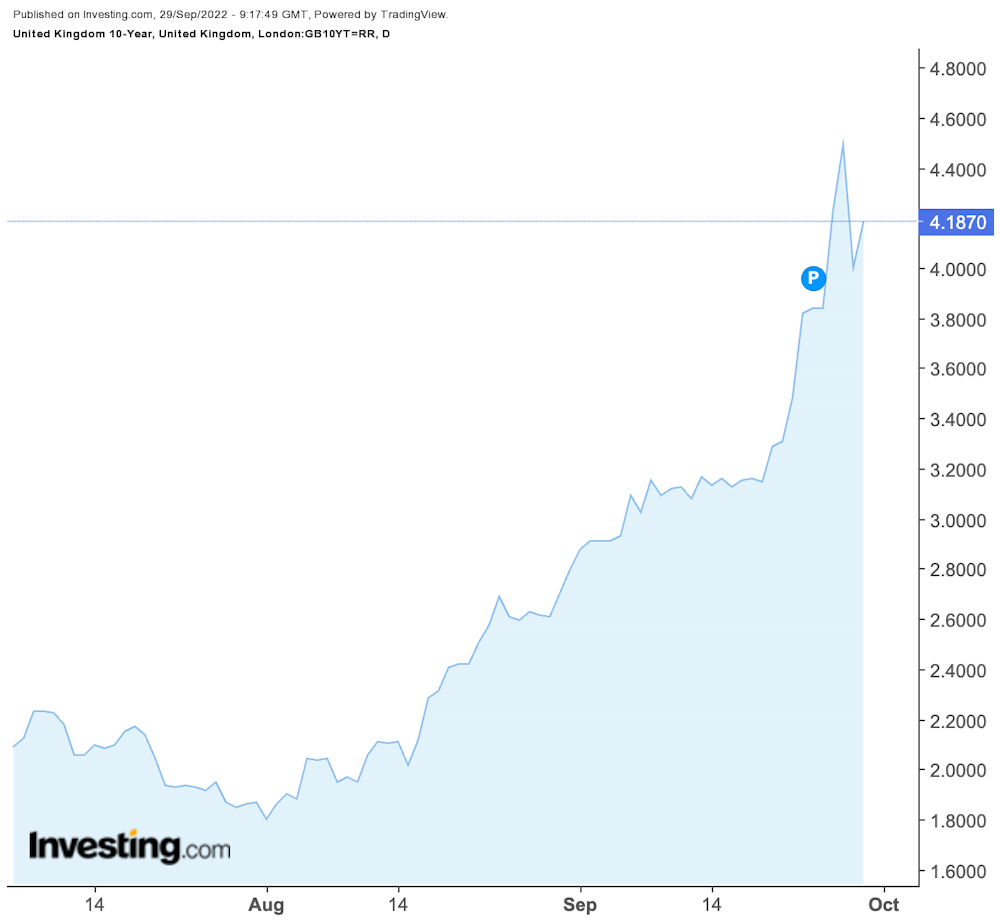

GOVERNMENT-BOND YIELDS

Why analysts are flagging these three stocks as inflation hedges

Australia Unexpectedly Raises Key Rate, May Tighten Further - Bloomberg

Market Monitor - October 2023 wrap-up: Central banks not done yet with rate hikes, military tensions rise

How bonds work and why everyone is talking about them right now: a finance expert explains

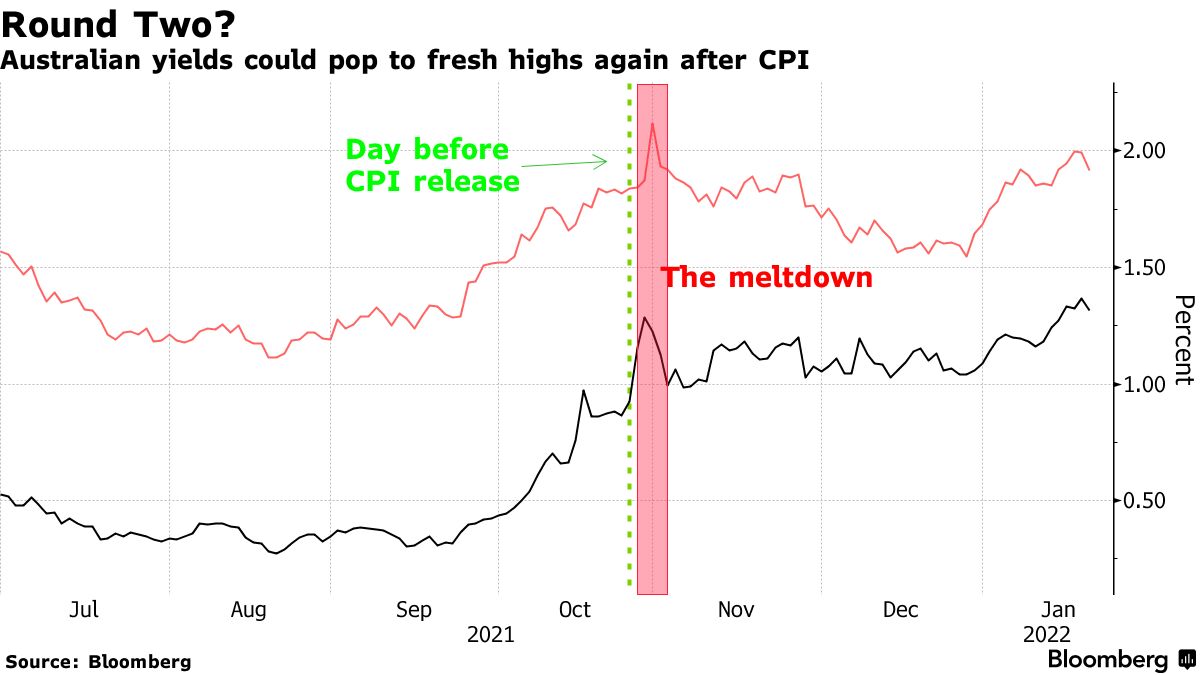

Bond Meltdown Haunts Australian Central Bank as Inflation Builds - Bloomberg

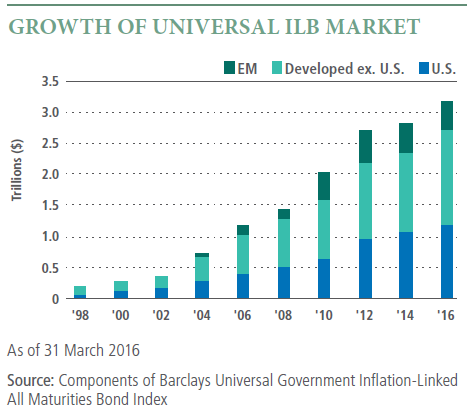

Understanding Inflation-Linked Bonds

What's happened to the 10-Year Government Bond Yield? - Bond Adviser

How To Buy Bonds In Australia (2024)

Steeper by the dozen: What Australia's yield curve movements mean for active investors - Lonsec

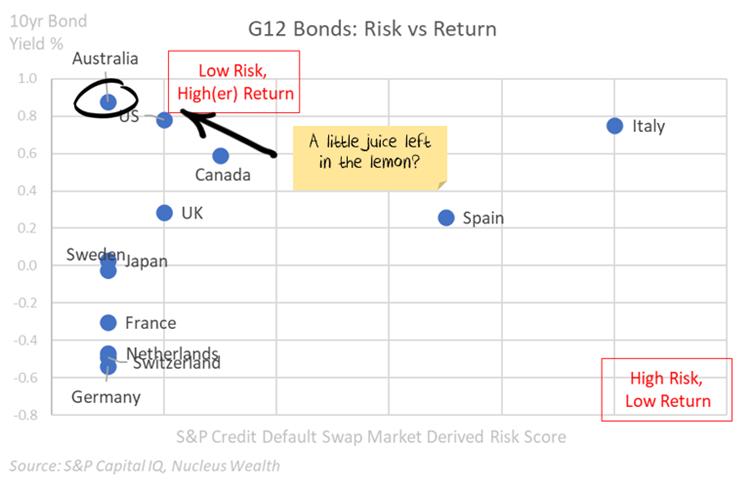

One last hurrah for the 60/40 portfolio?

The End of the Super Cycle Bull Market in Bonds - ShareCafe

How Bond Yields Affect Currency Movements

Australian Bond Yields Jump as Inflation Boosts Rate-Hike Bets - Bloomberg

How Much Will the New 30-year Government Bond Pay? - Fixed Income News Australia

Bonds Australia Shorts Pajamas Set + Pouch

Investment Bonds Explained – Forbes Advisor Australia

NWT VICTORIA'S SECRET BLACK LEOPARD MESH SPLIT BACK HIGH NECK

NWT VICTORIA'S SECRET BLACK LEOPARD MESH SPLIT BACK HIGH NECK Lace Shell Dress by bonprix

Lace Shell Dress by bonprix Women Yoga Leggings With Pocket Slim Shark Pants High Waisted Hip Lifting Exercise Yoga Pants Fitness Running Sports Tights Pant - AliExpress

Women Yoga Leggings With Pocket Slim Shark Pants High Waisted Hip Lifting Exercise Yoga Pants Fitness Running Sports Tights Pant - AliExpress- High Waist Corset Jeans

- City Fitness

Blisset 3 Pack High Waisted Leggings for Women-Soft Athletic Tummy Control Pants for Running Yoga Workout Reg & Plus Size : Buy Online at Best Price in KSA - Souq is now

Blisset 3 Pack High Waisted Leggings for Women-Soft Athletic Tummy Control Pants for Running Yoga Workout Reg & Plus Size : Buy Online at Best Price in KSA - Souq is now