Severance Pay in California – What You Need to Know

4.9 (797) In stock

Neither California law nor federal law requires employers to provide severance pay or severance packages upon termination of a worker. However, many companies elect to provide severance benefits either as a courtesy to long-term employees, in exchange for a severance agreement, and/or as a way of minimizing their exposure to potential claims and lawsuits. Severance

Severance Package: California severance agreements

Video What to know about severance pay - ABC News

What is important to California employees when considering a

Severance Agreement Template for Your Business

Is Severance Pay Taxable? A Tax Guide to Severance Pay and Taxes

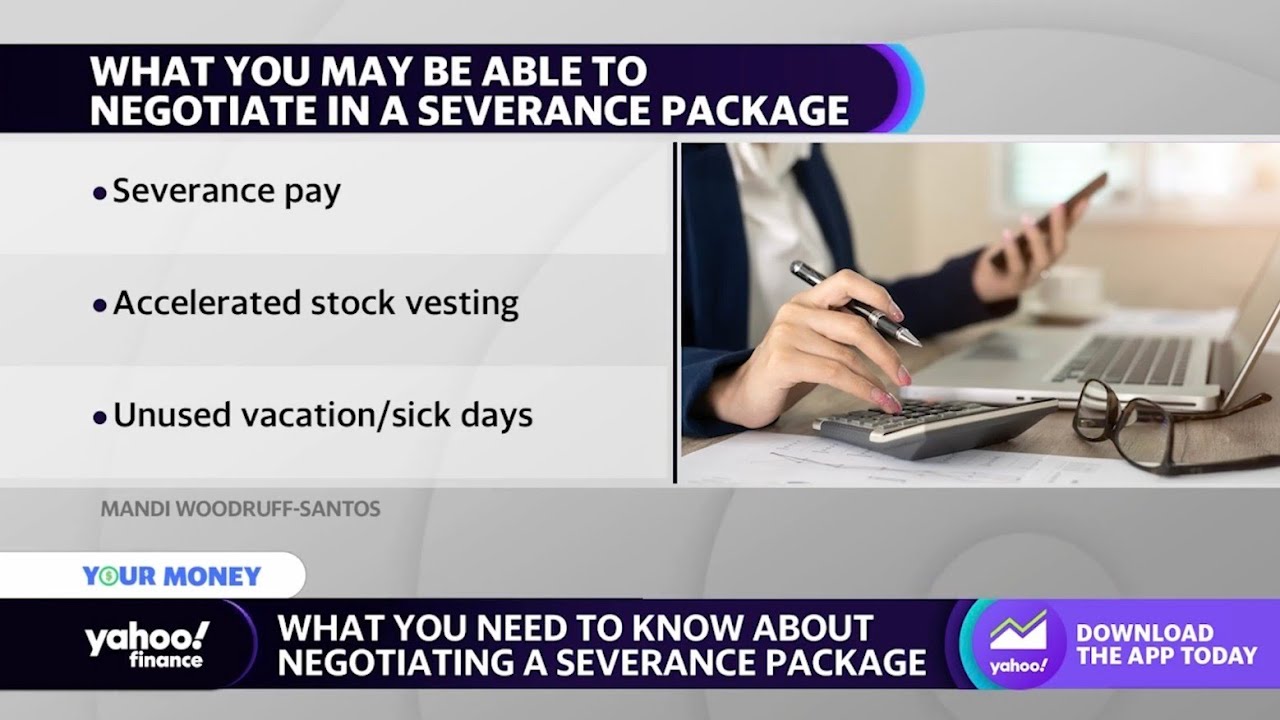

Layoffs: What you need to know about negotiating a severance

Severance Pay and Severance Agreements—What You Need to Know

Severance Packages How Much Money Should You Get? Attorney Review

Severance Package Agreements: California Law Explained (2023)

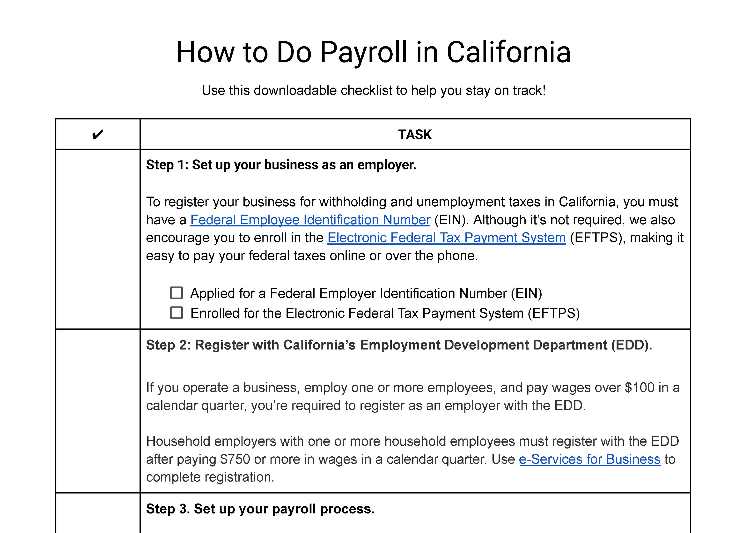

How to Do Payroll in California: Payroll Taxes, Laws & More

Severance Pay in California – What You Need to Know

Severance Pay vs: Ex Gratia Payments: Key Differences - FasterCapital

Gross Up for Severance Pay: Exploring Gross Up in Severance Packages - FasterCapital

Severance Pay in Nova Scotia - What am I owed?

Sportswear Set Women Fashion Casual Suit Short Sleeve Lady

Sportswear Set Women Fashion Casual Suit Short Sleeve Lady Trending Fade Hairstyles for Men in 2024 l Hairstyles for Men – Men Deserve

Trending Fade Hairstyles for Men in 2024 l Hairstyles for Men – Men Deserve Going backstage with 'Yo Gabba Gabba!

Going backstage with 'Yo Gabba Gabba! Stevens 🇨🇦 Shell Hockey Referee Pants – Hockey Ref Shop

Stevens 🇨🇦 Shell Hockey Referee Pants – Hockey Ref Shop Summer Dresses for Women's Loose Cotton Turn-Down Linen Top Shirt Dress Ladies Knee Midi Sundress Maxi Dress S/M/L/XL/XXL/XXXL

Summer Dresses for Women's Loose Cotton Turn-Down Linen Top Shirt Dress Ladies Knee Midi Sundress Maxi Dress S/M/L/XL/XXL/XXXL Womens Padded One Piece Swimsuit Plus Size Floral Monokini

Womens Padded One Piece Swimsuit Plus Size Floral Monokini