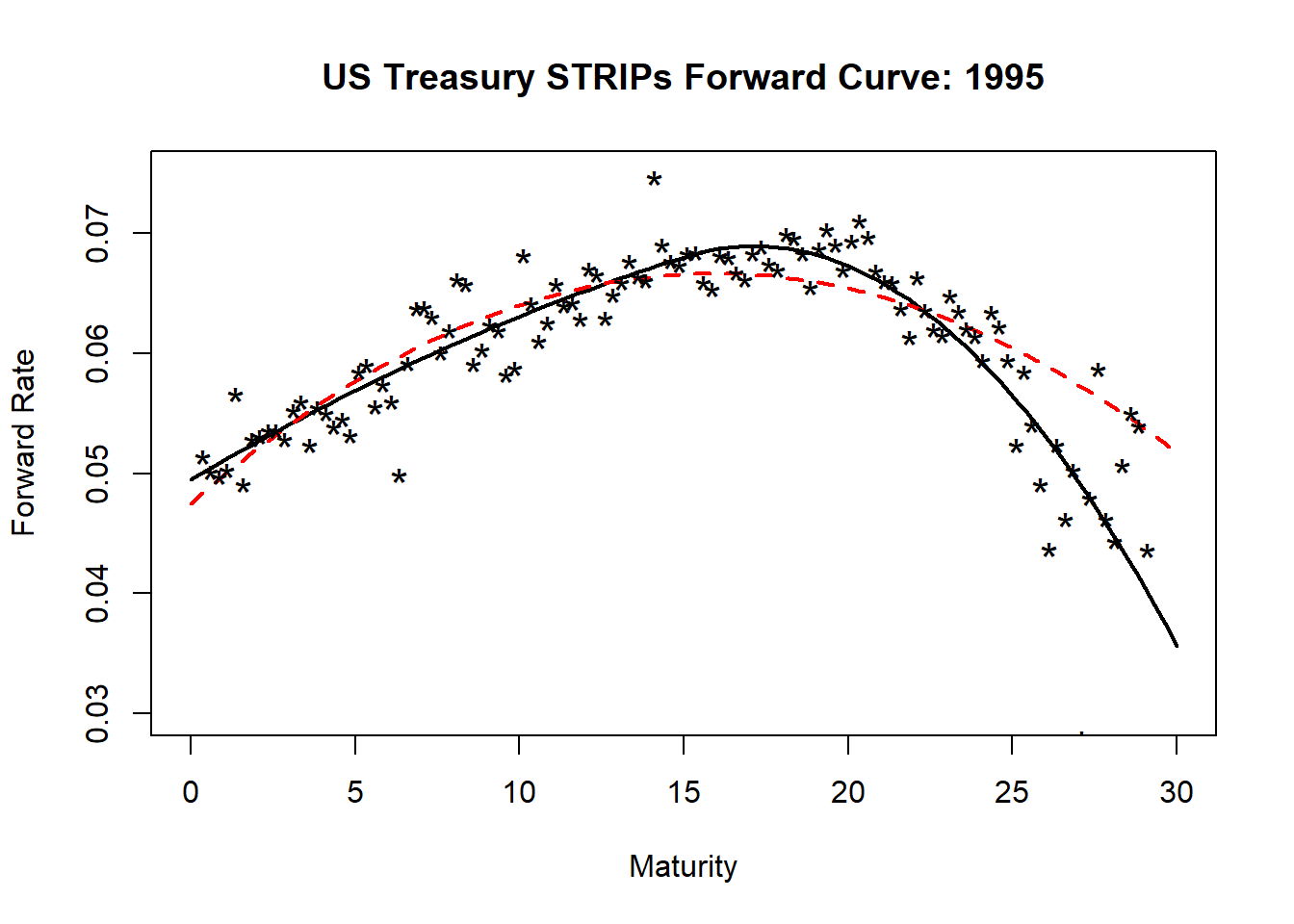

Carry and Roll-Down on a Yield Curve using R code

4.8 (421) In stock

lt;div style = "width:60%; display: inline-block; float:left; "> This post shows how to calculate a carry and roll-down on a yield curve using R. In the fixed income, the carry is a current YTM like a dividend yield in stock. But unlike stocks, even though market conditions remain constant over time, the r</div><div style = "width: 40%; display: inline-block; float:right;"><img src=

Riding the yield curve – BSIC Bocconi Students Investment Club

How to calculate carry and roll-down (for a bond future's asset swap) –

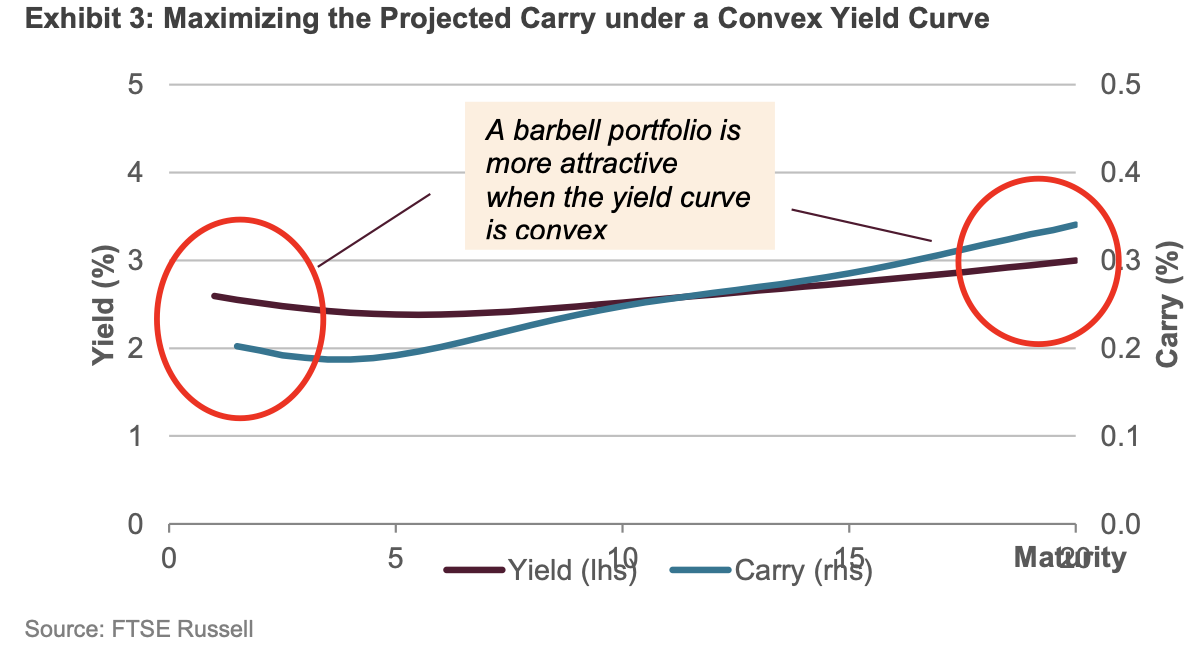

On The Finer Details of Carry and Roll-Down Strategies - Moorgate Benchmarks

Carry and Roll-Down on a Yield Curve using R code

🔴Riding the Yield Curve or Rolling down the yield curve simplified

Financial Engineering Analytics: A Practice Manual Using R

OC] The US Treasury Yield Curve still points towards recession : r /dataisbeautiful

Applied Sciences, Free Full-Text

Yield curve: Analyzing Yield Curves in Carry Trade Decision Making - FasterCapital

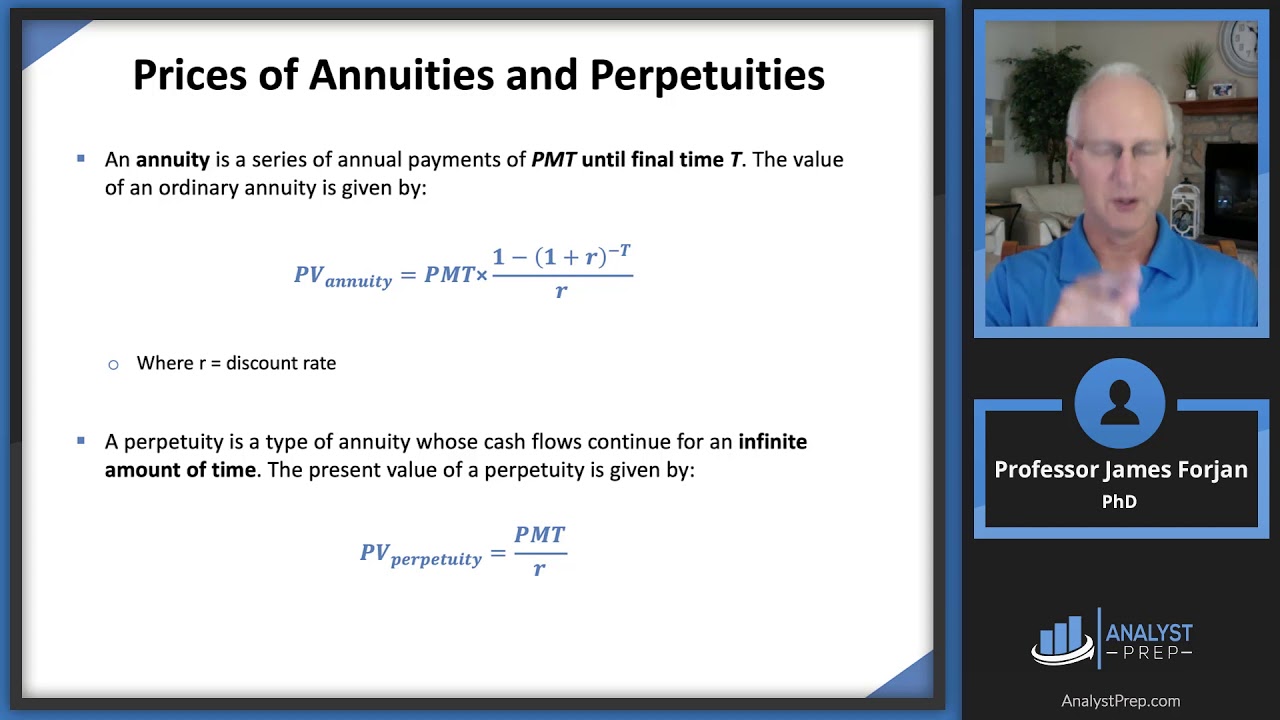

Returns, Spreads, and Yields AnalystPrep - FRM Part 1 Study Notes

Zero-Coupon Bond Formula + Calculator

Mastering Carry Roll-Down with Leverage, by Secured Finance Official, Secured Finance

:max_bytes(150000):strip_icc()/Yield-Curve-6b685b5093f9425eada22cedf85d4d4f.jpg)

Yield Curve: What It Is and How to Use It

Fixed income: Carry roll down (FRM T4-31)

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

Is it advisable to roll down windows before switching on AC

Girls Black Teddy Bear Hoodie (4-13yrs) - Matalan

Girls Black Teddy Bear Hoodie (4-13yrs) - Matalan Palacio de hierro department store hi-res stock photography and images - Alamy

Palacio de hierro department store hi-res stock photography and images - Alamy Stella York Dora Grace Bridal - 7370

Stella York Dora Grace Bridal - 7370 1pc Red Sexy Bra For Women, Padless Thin Type, Push Up & Anti-sagging, Sizes Available

1pc Red Sexy Bra For Women, Padless Thin Type, Push Up & Anti-sagging, Sizes Available Millet Hiking Jacquard Tank Women Tank Top - Shirts & T-Shirts

Millet Hiking Jacquard Tank Women Tank Top - Shirts & T-Shirts Carhartt Mens Pants

Carhartt Mens Pants