Cash Flow Analysis of a Non-Profit Entity - Linda Keith CPA

5 (231) In stock

Stephanie’s question: How do you apply the cash flow analysis rules of a business to a non-profit entity instead? Linda's answer: The non-profit entities file a Form 990: Return of Organization Exempt From Income Tax. The process for calculating cash flow is similar to a business return. Here are my suggestions for the 2017 Form 990.

How to Use Tax Returns for Global Cash Flow with Multiple Pass

PPT - Dr. Crumbley is the Editor of the Journal of Forensic

How to Use Tax Returns for Global Cash Flow with Multiple Pass

How to Use Tax Returns for Global Cash Flow with Multiple Pass

Got questions? 2 quick resources for answers on cashflow analysis

Academy Courses

New Road Map Accounting and Finance Curricullum

Non-obligated entities. Is the K-1 enough? - Linda Keith CPA

Do I include Foreign Source Income in Tax Return Cash Flow

Linda Keith CPA (@LindaKeithCPA) / X

Why Do So Many Nonprofits Fail? - Asset Panda

Terms of Service Nonprofit Expert

You Became a NonProfit's Treasurer - Here's what you need to know

State of NJ - Department of the Treasury - Division of Taxation - Nonprofit Organizations

- Shooting: An assortment of c100 collectable, paper cased and modern 12 bore shotgun cartridges by El

- Levi's Women's The Ultimate Western Cotton Denim Shirt - Macy's

New Multiway Silicone Straps Women Deep Plunge Sexy Bra Cross Backless Low Push Up Bras Plus Size Underwire Padded - Bras - AliExpress

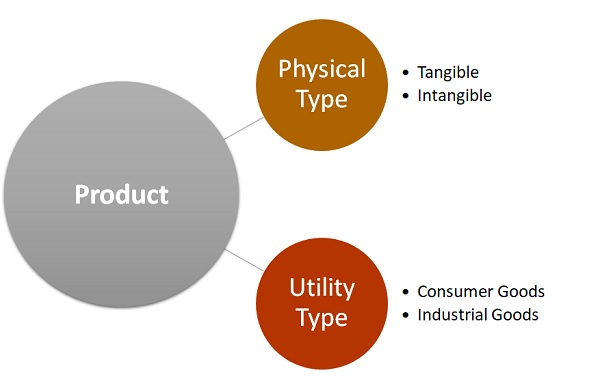

New Multiway Silicone Straps Women Deep Plunge Sexy Bra Cross Backless Low Push Up Bras Plus Size Underwire Padded - Bras - AliExpress Product - Definition, Importance, Types & Example

Product - Definition, Importance, Types & Example Vintage vixen, FASHION magazine

Vintage vixen, FASHION magazine Buy Jockey Women's Bra Forever Fit Low Impact Unlined Active Bra

Buy Jockey Women's Bra Forever Fit Low Impact Unlined Active Bra