Climate Bonds & Banco Central do Brasil sign agreement to develop sustainable finance agenda: New partnership to share technical knowledge on climate & financial sector

4.6 (661) In stock

The partnership aims to share technical knowledge about financial instruments and sustainable capital markets The Central Bank of Brazil (Banco Central do Brasil) and Climate Bonds Initiative have signed a new Memorandum of Understanding (MoU) with the objective of promoting a sustainable finance agenda and integration of socio-environmental and climatic risks in the national financial sector.

ESG News - Latest ESG Headlines Breaking ESG Investing News

banco-central-do-brasil, class central brasil

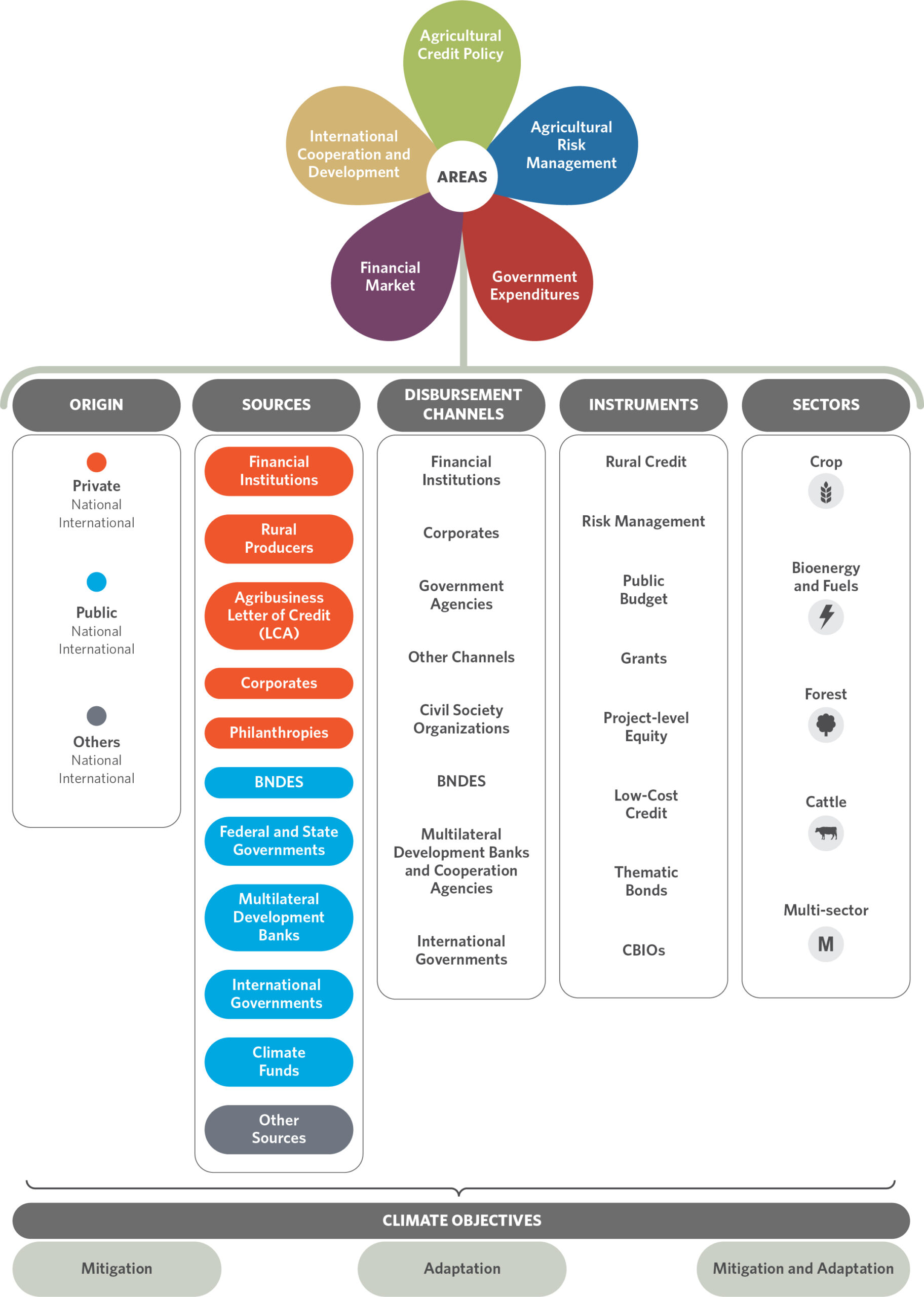

Landscape of Climate Finance for Land Use in Brazil - CPI

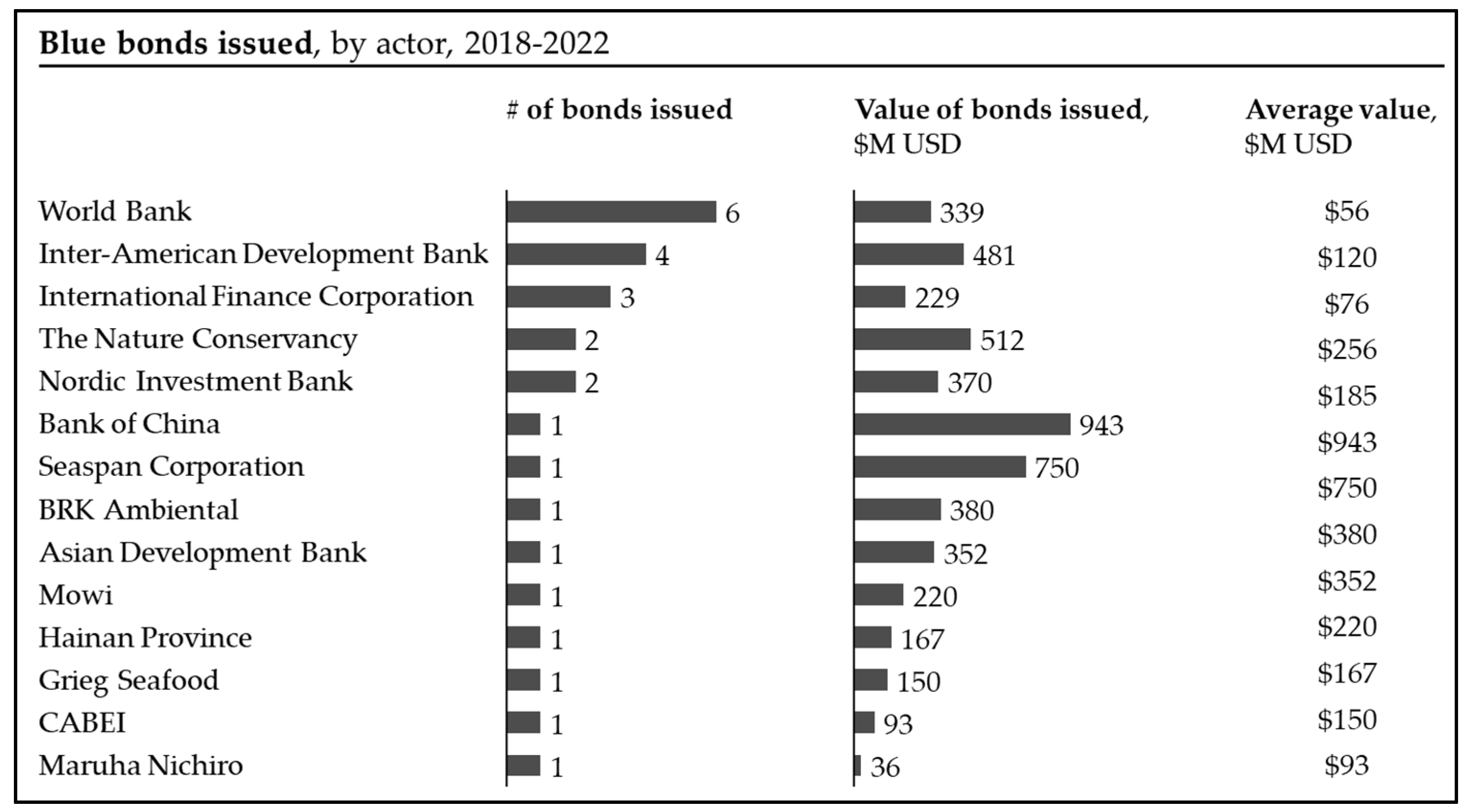

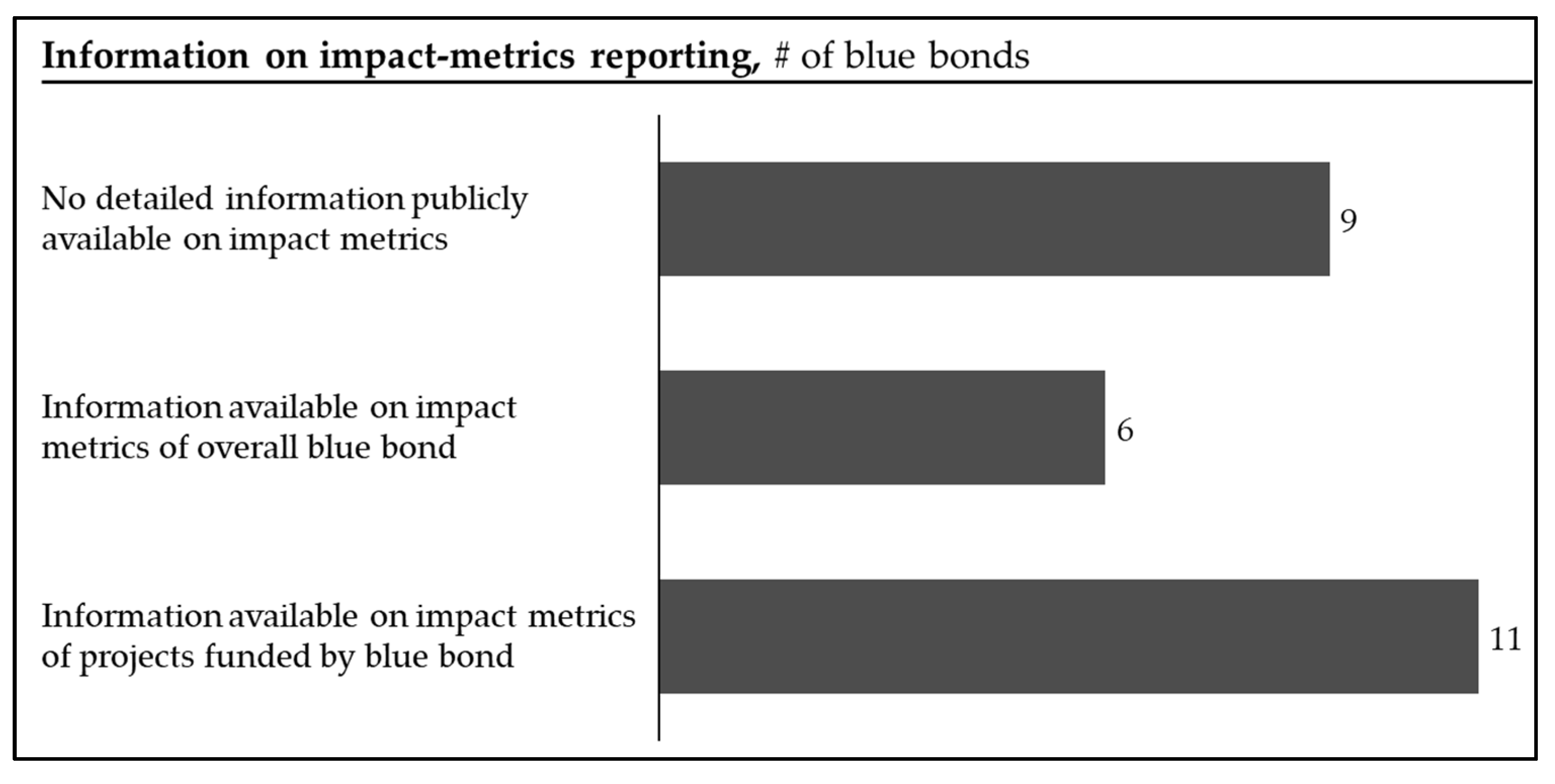

Energies, Free Full-Text

Agriculture Sustainable Finance State of the Market 2023 - Brazil

JRFM, Free Full-Text

JRFM, Free Full-Text

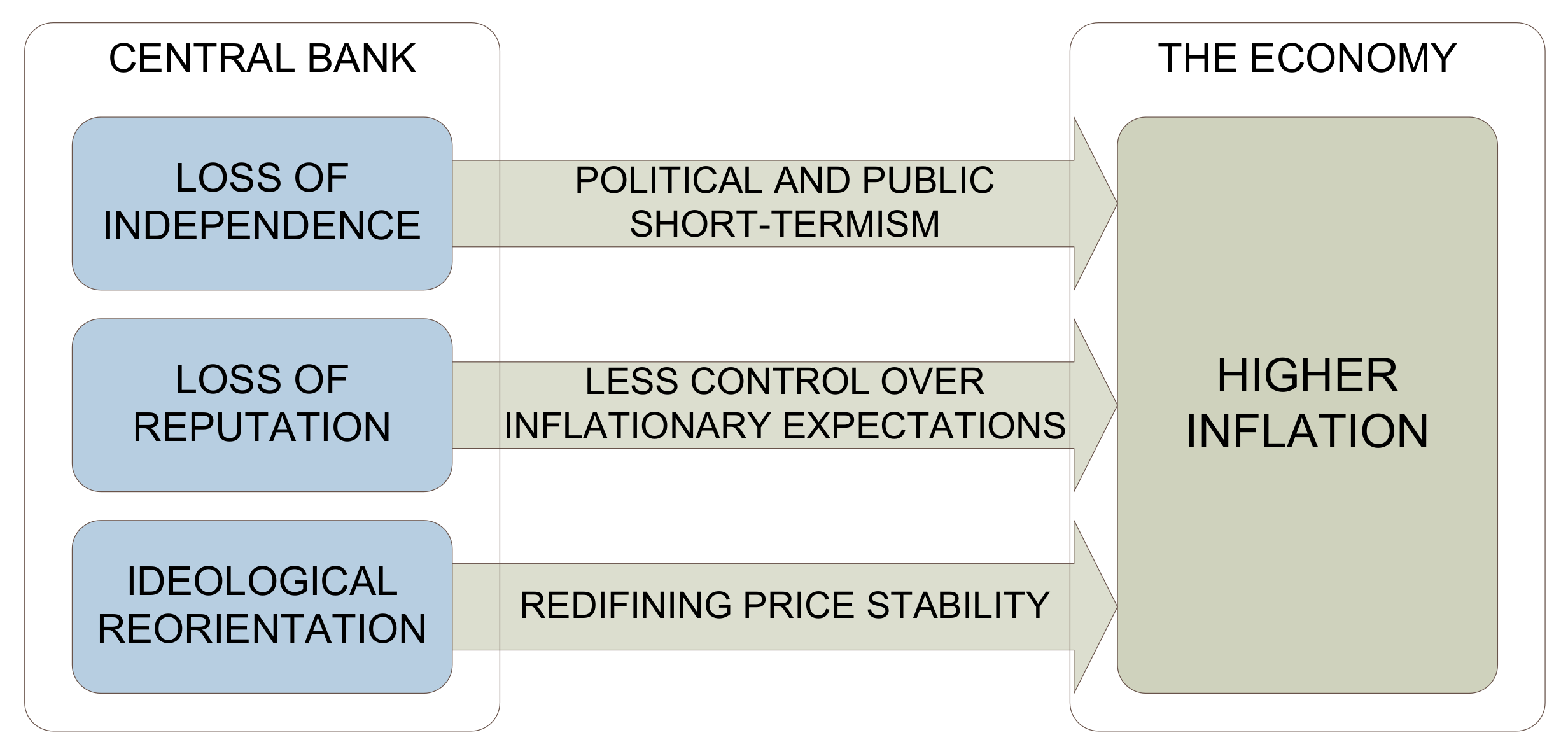

PDF) MARKETS, FINANCIAL INSTITUTIONS AND CENTRAL BANKS IN THE FACE

Climate Bonds Initiative Mobilizing debt capital markets for

Brazil plans September roadshow for first sovereign green bonds

Climate Bonds & Banco Central do Brasil sign agreement to develop

Green Finance in Brazil and Prospects for Sino-Brazilian Cooperation

Brazilian bill seeks to make infrastructure bonds appealing to global pension funds - BNamericas

Green bonds: títulos verdes são opção para investir seu dinheiro em projetos ambientais, Finanças

Once-Unloved CoCo Bonds Now Give Brazil Traders a Big Windfall - Bloomberg

Hidrovias do Brasil plots refi

Green bonds: títulos verdes são opção para investir seu dinheiro

TC Unicorn Leggings by LuLaRoe

TC Unicorn Leggings by LuLaRoe Guess Crossbody Bag Powder White - Lolly Pop Kindermode

Guess Crossbody Bag Powder White - Lolly Pop Kindermode Women's Black Flare Pants

Women's Black Flare Pants Kyodan Outdoor Romper Women's Size XS Gray Short Sleeve V-Neck Pockets

Kyodan Outdoor Romper Women's Size XS Gray Short Sleeve V-Neck Pockets Glamorise Full Figure Plus Size Lace Comfort WonderWire Bra Underwire

Glamorise Full Figure Plus Size Lace Comfort WonderWire Bra Underwire Old Navy - NEW! PowerLite LYCRA® ADAPTIV Racerback Shelf-Bra Tank Top for Women

Old Navy - NEW! PowerLite LYCRA® ADAPTIV Racerback Shelf-Bra Tank Top for Women