Collateral damage: Foreclosures and new mortgage lending in the

4.9 (604) In stock

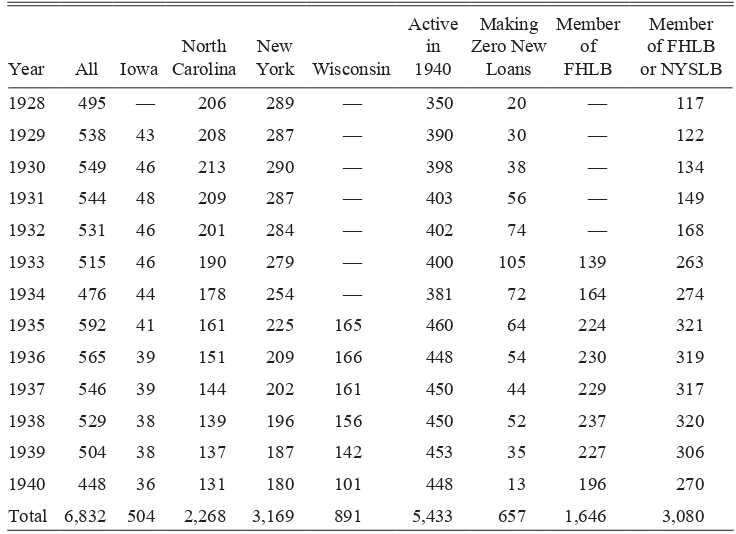

Although severe crises in housing markets contributed to both the Great Recession of 2007 and the Great Depression of the 1930s, the role that housing-related financial frictions played in the crises has yet to be explored. This column investigates the impact that foreclosures had on the supply of new home mortgage loans during the housing crisis of the 1930s. It shows that an increase in foreclosed real estate on a building and loan associations’ balance sheets had a powerful and negative effect on new mortgage lending during the 1930s.

Full article: From the Subprime to the Exotic: Excessive Mortgage

Lingering impact: Report on 2016 foreclosure trends

Columns

6 Best Home Loans After Foreclosure (2024)

Collateral Foreclosure Damage for Condo Owners - The New York Times

Foreclosed Homes: How To Buy One And The Risks Associated - New Silver

Collateral Damage: The Impact of Foreclosures on New Home Mortgage

Collateral Damage From Fed Policy (2) – A Broken Housing Market

Cleaning Up After The Foreclosure Tsunami: Tackling Bank Walk

Understanding Foreclosure —

Understanding Mortgage Default Causes in Foreclosures - DAK Mortgage

How the 1930s Echo in Today's Politics - WSJ

Great Depression Definition, History, Dates, Causes, Effects

Art for the Millions: American Culture and Politics in the 1930s

Entertainment in the 1930s History, Forms & Examples - Lesson

BALLY Zippered Slimmer Belt Sweat Waist Trainer Shaper Weight Loss

BALLY Zippered Slimmer Belt Sweat Waist Trainer Shaper Weight Loss Summer Thin Cotton Fashion Pants Women′ S Large Size High Waist Loose Feet Elastic Casual Pants - China Pants and Women Pants price

Summer Thin Cotton Fashion Pants Women′ S Large Size High Waist Loose Feet Elastic Casual Pants - China Pants and Women Pants price NKOOGH Camisole Shelf Bra Top Black Fitted Top Women

NKOOGH Camisole Shelf Bra Top Black Fitted Top Women Wedding Guest Outfit Ideas For Every Style And Season + Faqs

Wedding Guest Outfit Ideas For Every Style And Season + Faqs Fruit Motif One Piece Cupless Swimsuit, Swimsuits

Fruit Motif One Piece Cupless Swimsuit, Swimsuits High Moms Slim Organic Cotton Short Blue Rapture

High Moms Slim Organic Cotton Short Blue Rapture