Low-Income Housing Tax Credit Could Do More to Expand Opportunity

5 (488) In stock

As the nation’s largest affordable housing development program, the Low-Income Housing Tax Credit has substantial influence on where low-income families are able to live.

The Fight to Expand the Low-income Housing Tax Credit - Route Fifty

Low-Income Housing Tax Credit Impact in Massachusetts

Better State Budget, Policy Decisions Can Improve Health

The Low Income Housing Tax Credit - PRRAC — Connecting Research to Advocacy

A D.C. Suburb Finds a Creative Answer to America's Housing Shortage - The New York Times

Project-Based Vouchers: Lessons from the Past to Guide Future Policy

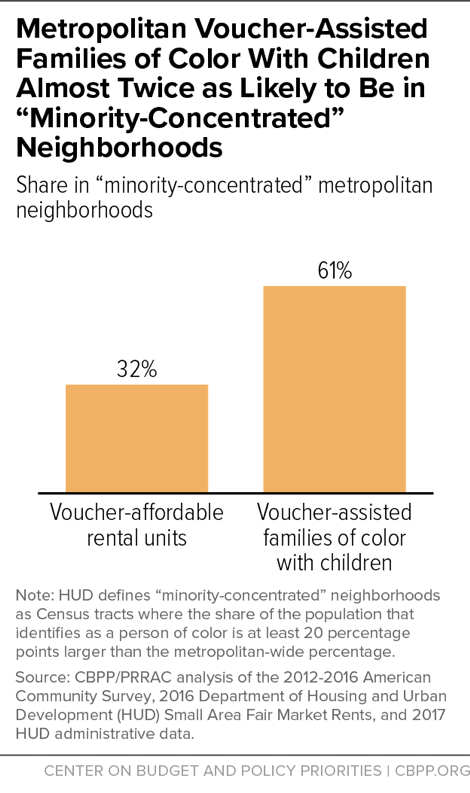

Where Families With Children Use Housing Vouchers

Housing Mobility Strategies and Resources

The New Social Housing - Harvard Design Magazine

The 30-year clock is running out on affordable housing

Low Income and a High Credit Score: Is it Possible? ~ Credit Sesame

Low-Income Apartments: The Difference Between Section 8 and Public

How To Get Out Of Debt On A Low Income - Loans Canada

Dental Care For Low-Income Adults In Ontario - Loans Canada

Sequestration's Rising Toll: 100,000 Fewer Low-Income Families Have Housing Vouchers

)