Guide to Schedule R: Tax Credit for Elderly or Disabled - TurboTax

5 (419) In stock

The Internal Revenue Service extends a special credit to older taxpayers called the Credit for the Elderly or the Disabled. This tax break allows individuals and couples to reduce the amount of their income tax by their allowable credit. While a taxpayer may qualify for a larger credit under this provision, the IRS limits the allowable credit to the amount of income tax due. If your credit exceeds your income tax, you will not be able to receive the excess credit as a refund.

The Disability Tax Credit Guide

Transportation Services For The Elderly And Disabled, 54% OFF

Transportation Services For The Elderly And Disabled, 54% OFF

Schedule R Walkthrough (Credit for the Elderly or the Disabled

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)

Form 1040: U.S. Individual Tax Return Definition, Types, and Use

How To Organize Your Taxes and Money: Forms and Organizers

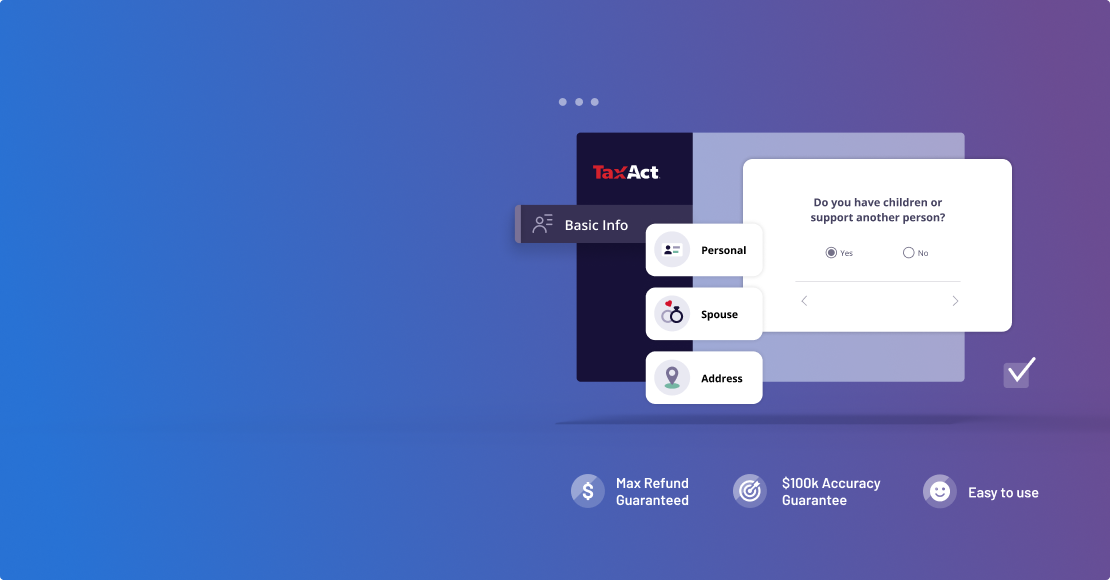

Free Tax Filing, File Simple Federal Taxes Online for Free

FreeTaxUSA - 2017 Software Review - HubPages

Transportation Services For The Elderly And Disabled, 54% OFF

Form 1040: U.S. Individual Income Tax Return for Tax Year 2017, PDF, Irs Tax Forms

Free IRS Tax Return Forms and Schedules for Tax Year 2022

Schedule R Walkthrough (Credit for the Elderly or the Disabled

Healthy Aging Programs for Seniors

Aging in Place: Growing Older at Home

Home Care for the Elderly (HCE) Program - DOEA

Guide to Schedule R: Tax Credit for Elderly or Disabled - TurboTax Tax Tips & Videos

Brandon Blackwood Blows Up - The New York Times

Brandon Blackwood Blows Up - The New York Times Women's White Flare Jeans with Pull-on Design

Women's White Flare Jeans with Pull-on Design Hanes Women's EcoSmart Crewneck Sweatshirt, Bold Blue Heather, Small at Women's Clothing store

Hanes Women's EcoSmart Crewneck Sweatshirt, Bold Blue Heather, Small at Women's Clothing store Sterling Silver Adjustable Ring S925 Silver Rings for Women Cubic Zirconia Twist Love Knot Dainty Ring Silver Minimalist Open Finger Rings Silver Thumb Sterling Silver Ring : : Clothing, Shoes & Accessories

Sterling Silver Adjustable Ring S925 Silver Rings for Women Cubic Zirconia Twist Love Knot Dainty Ring Silver Minimalist Open Finger Rings Silver Thumb Sterling Silver Ring : : Clothing, Shoes & Accessories 534 Crazy Yoga Poses Royalty-Free Photos and Stock Images

534 Crazy Yoga Poses Royalty-Free Photos and Stock Images All-Seasons Dynamic Fleece Cropped Hooded Jacket

All-Seasons Dynamic Fleece Cropped Hooded Jacket