Latin America's Divergence From Fed Sets Up Win for Local Bonds

4.9 (72) In stock

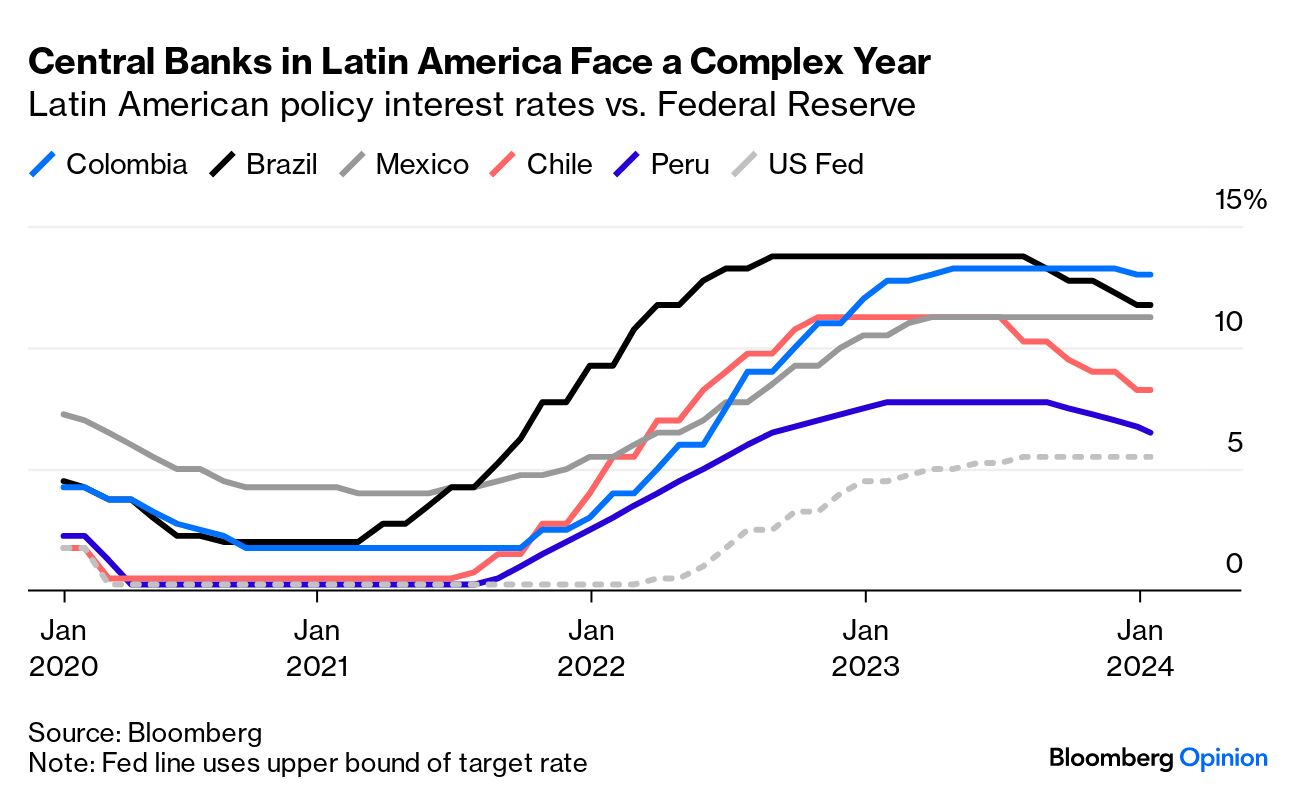

Latin America’s beaten-down local bonds are getting another look from investors who see an opportunity to profit from monetary policies that are out of sync with the developed world.

Capital Flows to Latin America and the Caribbean in five charts: A slowdown in 2022

Mexican Peso Benefits From U.S. Strength - WSJ

Pathways to Growth: Comparing East Asia and Latin America by IDB - Issuu

What Latin American Central Banks Should Do Next - Bloomberg

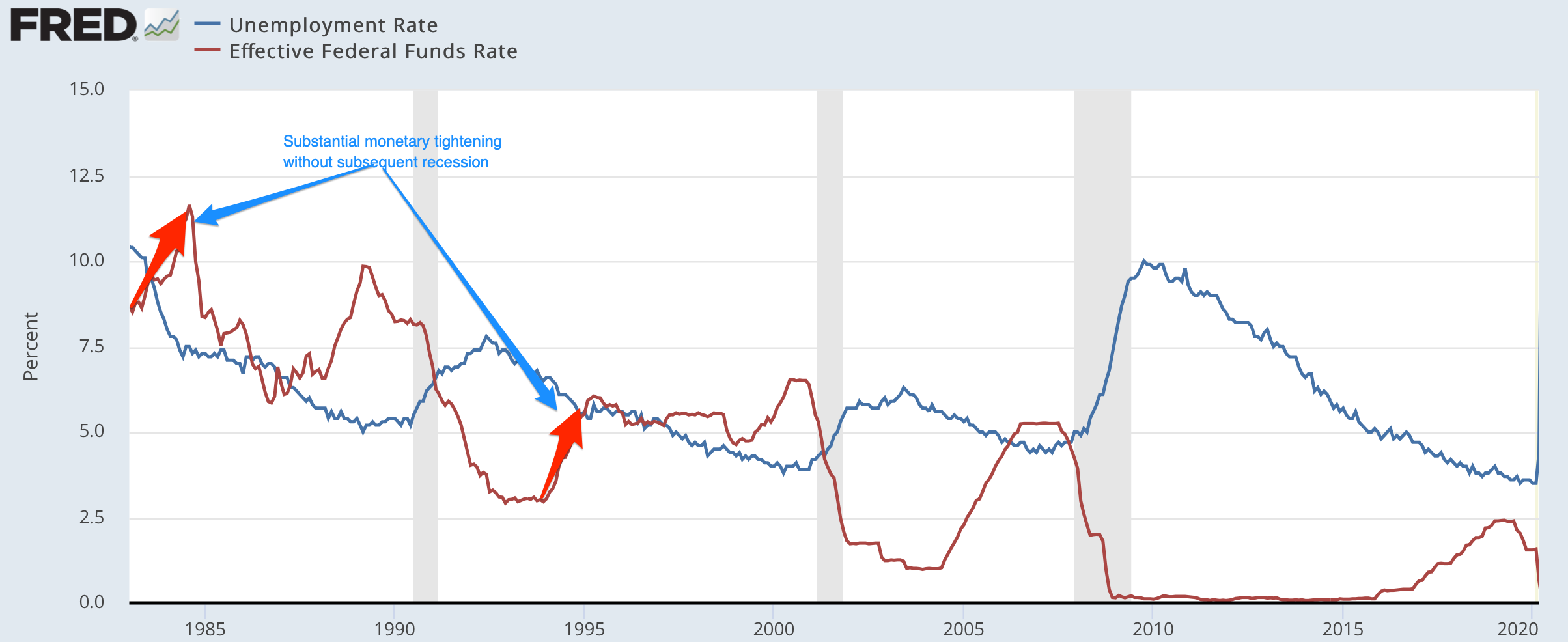

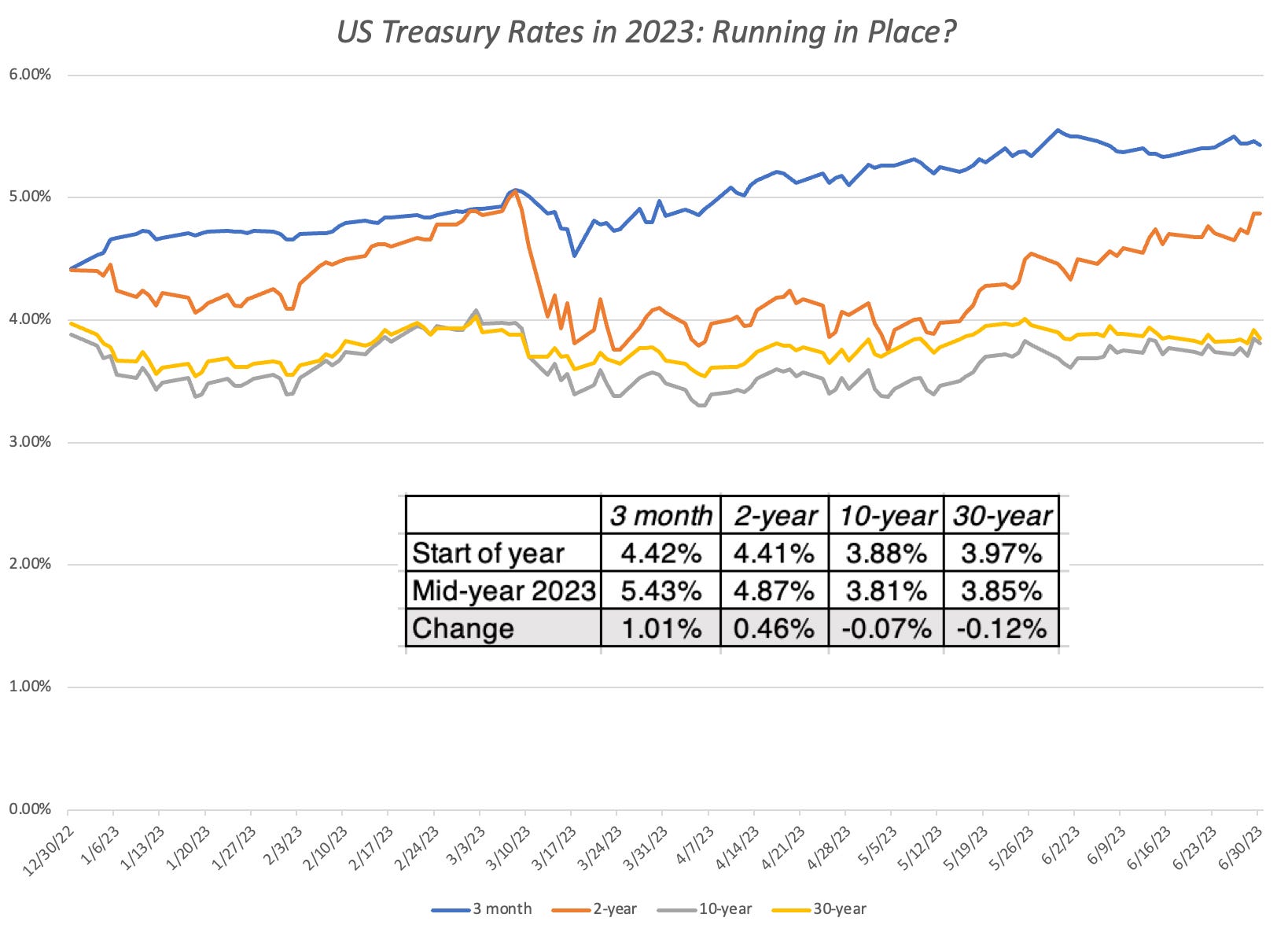

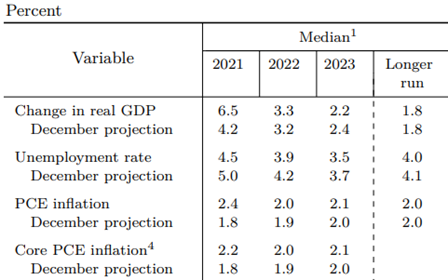

Market Resilience or Investors in Denial: The Market at Mid-Year 2023

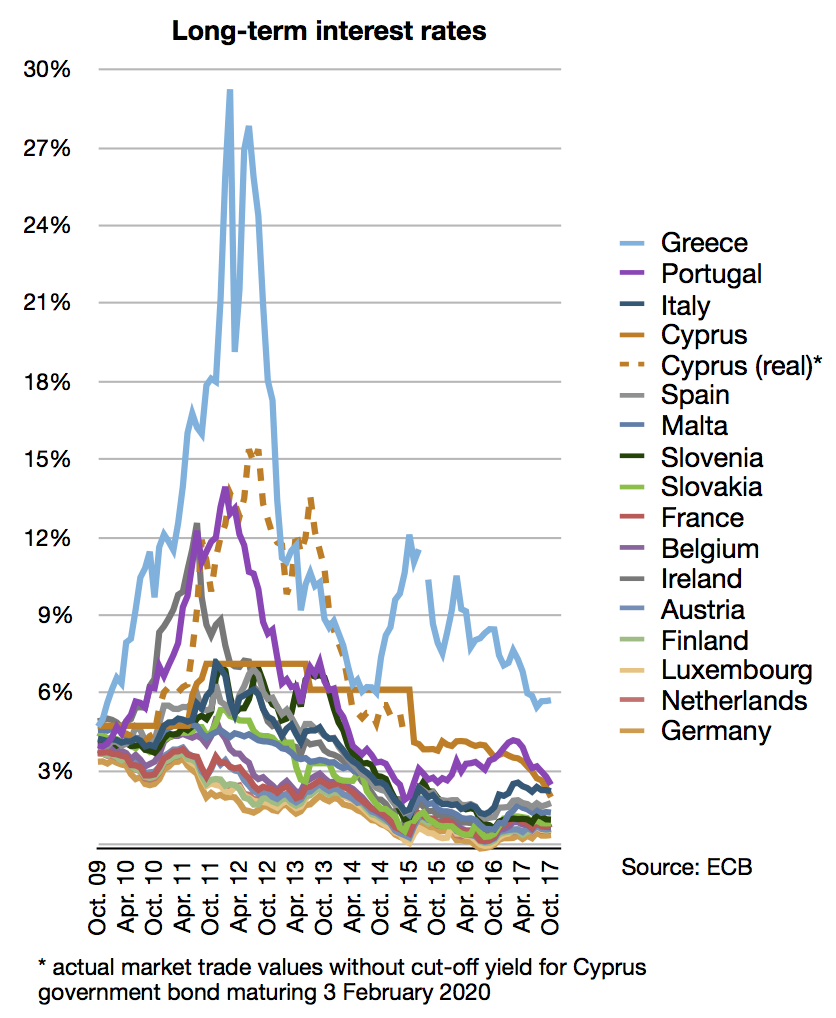

European debt crisis - Wikipedia

Coronavirus Watch: Governments Rush to Secure Ventilators, 2020-03-16

Grasping Reality on TypePad, by Brad DeLong

Market Resilience or Investors in Denial: The Market at Mid-Year 2023

Remittances and Development by World Bank Publications - Issuu

PDF) Economists in the Americas: Convergence, Divergence and Connection 1

Market Resilience or Investors in Denial: The Market at Mid-Year 2023

market: Latin America's troubled state companies lure bond investors - The Economic Times

A Possible Tug-of-war Between the Fed and the Markets

A Monetary and Fiscal History of Latin America, 1960-2017, PDF, Vector Autoregression

Green Bonds Brasil Green Bonds Brasil

Brazil could issue over USD 1 bn in green bonds - Agência de Notícias Brasil -Árabe

Brazil forms task force for negotiation of sovereign domestic

Climate Bonds Brasil on X: 🚀 NOVO RELATÓRIO! 🌍 Análise do

Fund of the Month (Oct'23): Fórum de Fundos Soberanos Brasileiros

- Bogner Elaine Zebra Stirrup Pants

2023 New Women Sneakers Platform Shoes PU Leather Patchwork Casual Sport Shoes Ladies Outdoor Running Walking Shoes Zapatillas Mujer

2023 New Women Sneakers Platform Shoes PU Leather Patchwork Casual Sport Shoes Ladies Outdoor Running Walking Shoes Zapatillas Mujer 10 Pcs/Pack Elegant Lace Cotton Women's Underwear Sexy Lingerie

10 Pcs/Pack Elegant Lace Cotton Women's Underwear Sexy Lingerie DODOING Women's Butt Lifter Shapewear Tummy Control Shapewear Cocktail Dresses Body Shaper Breif High Waist Weight Lost Body Shapewear

DODOING Women's Butt Lifter Shapewear Tummy Control Shapewear Cocktail Dresses Body Shaper Breif High Waist Weight Lost Body Shapewear No Boundaries Juniors Triangle Floral Lace Bralette

No Boundaries Juniors Triangle Floral Lace Bralette Wallpaper : ocean, sea, beach, sports, female, newjersey, nipples, nps, asburypark, young, teens, competition, lifeguard, row, teen, bikini, nationalparkservice, fitness, belmar, jerseyshore, nips, jonesbeach, sandyhook, baywatch, bikinis, lifeguards

Wallpaper : ocean, sea, beach, sports, female, newjersey, nipples, nps, asburypark, young, teens, competition, lifeguard, row, teen, bikini, nationalparkservice, fitness, belmar, jerseyshore, nips, jonesbeach, sandyhook, baywatch, bikinis, lifeguards