What Qualifies for HSA Medical Expenses? - Ramsey

4.8 (72) In stock

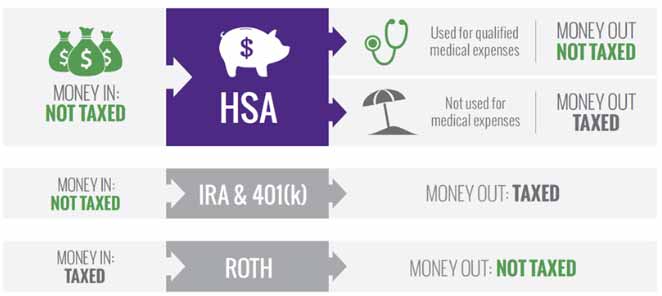

Make your health savings account (HSA) work for you when you use your funds on HSA qualified expenses. Find out what’s covered.

Did you know your health savings account (HSA) can be used for everything from hearing aids to a visit to your chiropractor? Find out what else is considered an HSA qualified expense.

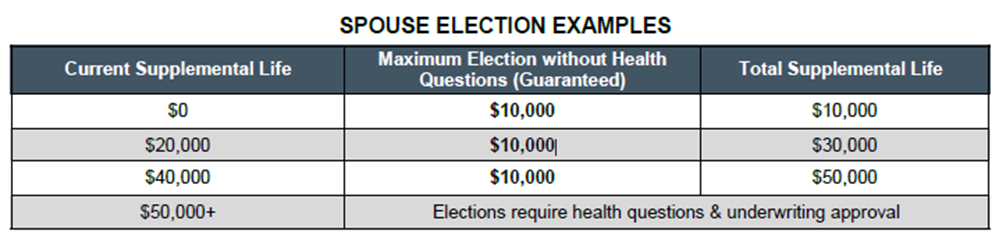

Open Enrollment Information

The HSA Triple Tax Advantage - What You Should Know - Debt-Free Doctor

Who Is Dave Ramsey And What Are His Baby Steps?

2022 HSA Eligible Expenses

FOO - Your Ultimate Guide to The Financial Order of Operations

Life After Dave Ramsey's Baby Step 7 – Marriage Kids and Money

I DID IT! I have completed the Ramsey Financial Coach Master

The Dave Ramsey Method: Rethink Money Now

Michael Kitces on LinkedIn: Preserving HSA Eligibility And

Why HSAs Could Be Your Company's Health Care Solution - Ramsey

IRS Courseware - Link & Learn Taxes

Cold Therapy Machines for Home Use at

21 HSA and FSA-eligible items to shop in 2023, per experts

10 FSA- & HSA-Eligible Products You Can Buy At CVS Today

Under Armour Pure Stretch Thong 3 Pack Print - Everyday Base Layer Women's, Buy online

Under Armour Pure Stretch Thong 3 Pack Print - Everyday Base Layer Women's, Buy online- Intime - La Senza Babydoll Lingerie Hot Pink Black Fishnet and Lace Size: XL #i.n.t.i.m.e #lingerie #lingeriesexy #lingerieaddict #lingerielove #lingeriemodel #shapewear #tunisia #tunisie #tunis #like4likes #likeforlikes #like4follow #liketime

20/50 Metros 10mm Nylon Bandas Elásticas para Bra Vestuário Decoração Belt Underwear Shoulder Strap Tape DIY Material de costura Acessório

20/50 Metros 10mm Nylon Bandas Elásticas para Bra Vestuário Decoração Belt Underwear Shoulder Strap Tape DIY Material de costura Acessório White Sweatshirt with Grey Wool Pants Outfits For Men (2 ideas & outfits)

White Sweatshirt with Grey Wool Pants Outfits For Men (2 ideas & outfits)- Aerie Real Happy Wireless Lightly Lined Bra

SMihono Linen Pants Women Fashion Plus Size Casual Loose Ladies

SMihono Linen Pants Women Fashion Plus Size Casual Loose Ladies