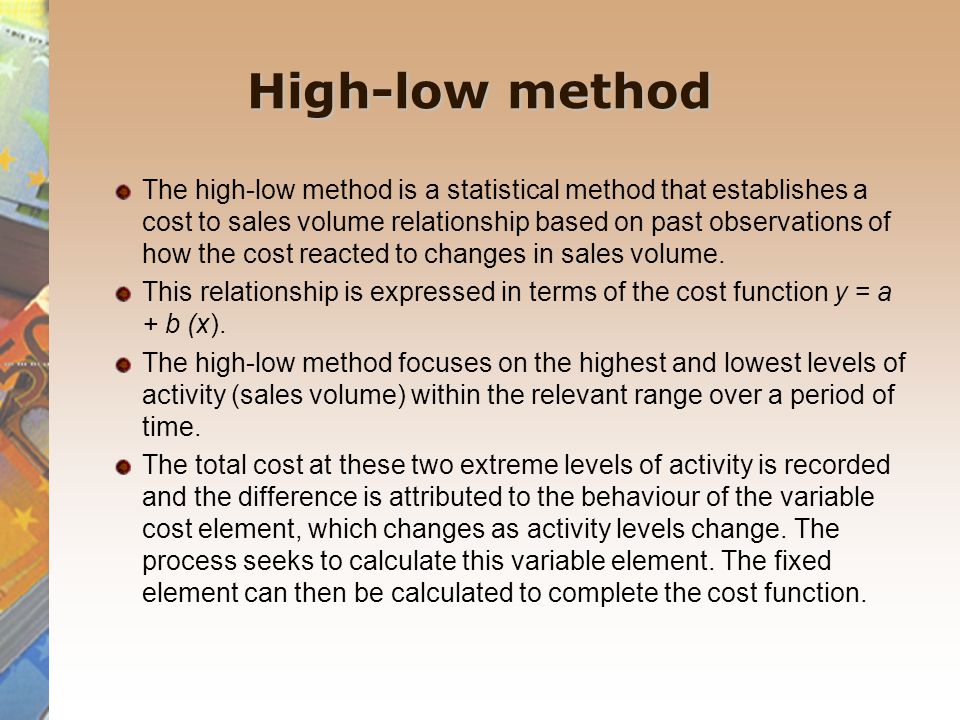

High-Low Method Definition

4.7 (204) In stock

:max_bytes(150000):strip_icc()/high-low-method-4195104-4x3-01-final-1-4a515f17b88946c89aea45241a23dc1e.png)

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data.

Cost Analysis and Classification Systems - ppt video online download

Cost variance: Managing Cost Variance through the High Low Method - FasterCapital

:max_bytes(150000):strip_icc()/valuation.asp-final-4ef03f976ffd45c681a5fe107a5e6e93.png)

Financial Analysis

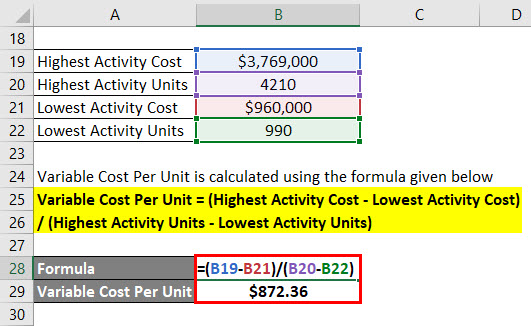

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

:max_bytes(150000):strip_icc()/terms_c_cost-volume-profit-analysis_Final-c64baee383cd4154b5fc2715e3e1dbb7.jpg)

Cost-Volume-Profit (CVP) Analysis: What It Is and the Formula for Calculating It

High Low Method, Accounting

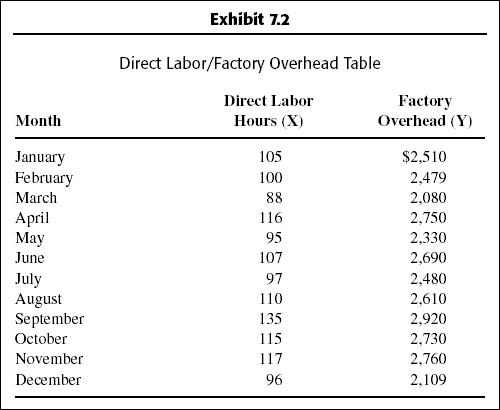

High-low Method - Budgeting Basics and Beyond [Book]

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

CMA Part 2 Financial Decision Making - ppt download

The High Low Method Explained with Examples

Last Night at the Telegraph Club — Malinda Lo

Air Jordan 13 Retro Defining Moments Pack Last Shot - Original São Paulo

This Avatar: The Last Airbender coasts along by improving on M. Night Shyamalan's mess

Use Low Power Mode on your Apple Watch - Apple Support (CA)

Ask The Super Strong Guy: For Max Gains, Do Low Reps Go First Or Last?

Lululemon Taryn Toomey Heart Opener Bodysuit size 8 Faint Mauve NWT Tank Top

Lululemon Taryn Toomey Heart Opener Bodysuit size 8 Faint Mauve NWT Tank Top Goodbye Lulu, Hello Zyia, Gallery posted by Taylor Musser

Goodbye Lulu, Hello Zyia, Gallery posted by Taylor Musser Kyra Corset Top

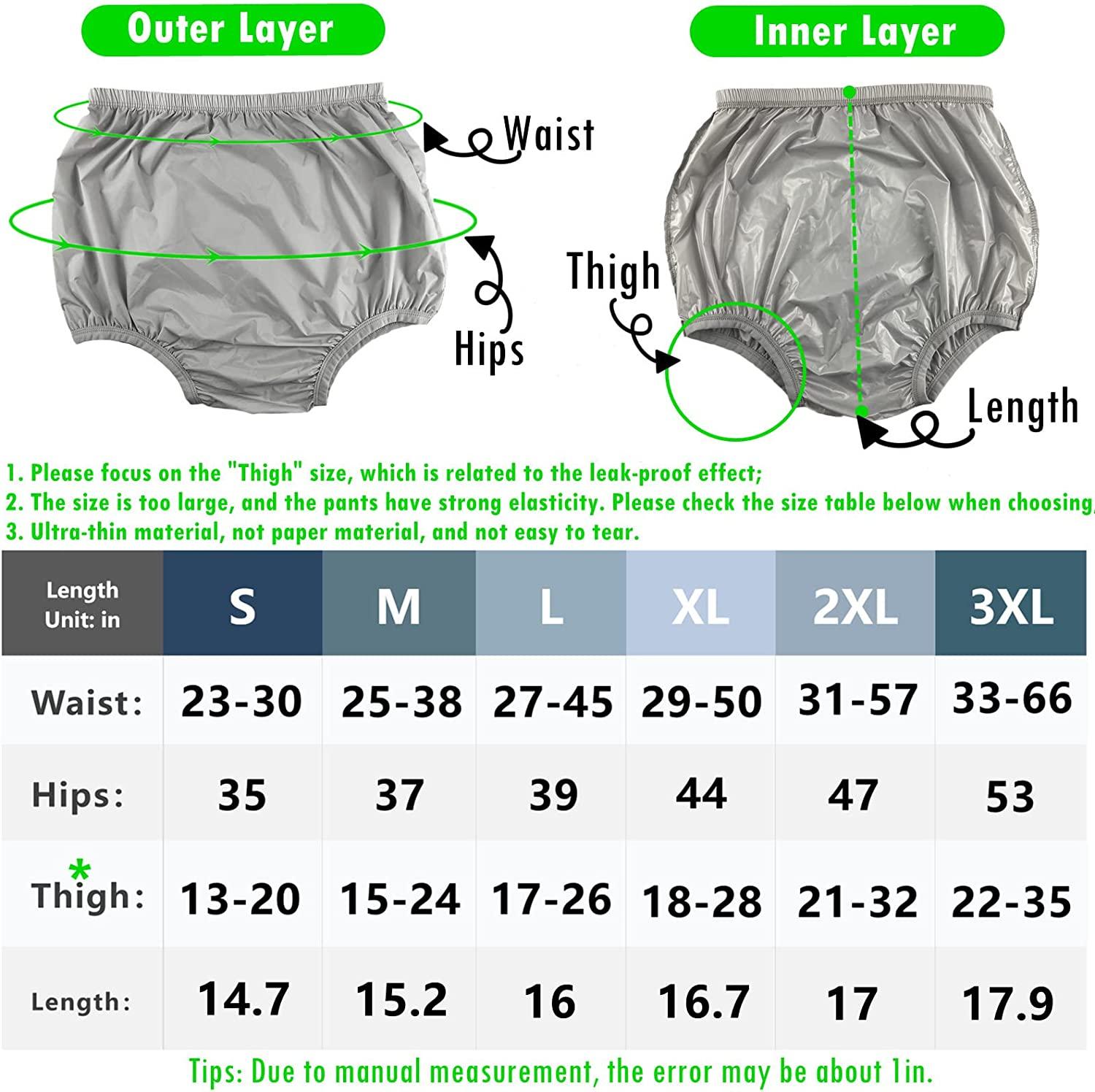

Kyra Corset Top Adult Leakproof Underwear for Incontinence, Washable Low Noise

Adult Leakproof Underwear for Incontinence, Washable Low Noise Rose ll Yoga Leggings – Munchkin Place Shop

Rose ll Yoga Leggings – Munchkin Place Shop Camisa Raphy Custom Fit Extra Cotton Manga Longa 526212 - Lojas

Camisa Raphy Custom Fit Extra Cotton Manga Longa 526212 - Lojas