What Is Driving Higher Revenue And Profitability Expectations For

4.7 (779) In stock

Lululemon Athletica (NASDAQ: LULU) is expected to release its Q1 2019 results on June 12, 2019, followed by a conference call with analysts. As per Trefis estimates, the company is expected to report revenue of $755 million in Q1 2019, marking y-o-y growth of over 16%. Higher revenue is likely

Customer Experience: Where Does Your Company Rank — PNI

What is a Good Gross Profit Margin? (2024) · Polymer

5 Regional Sales Representative Resume Examples & Guide for 2024

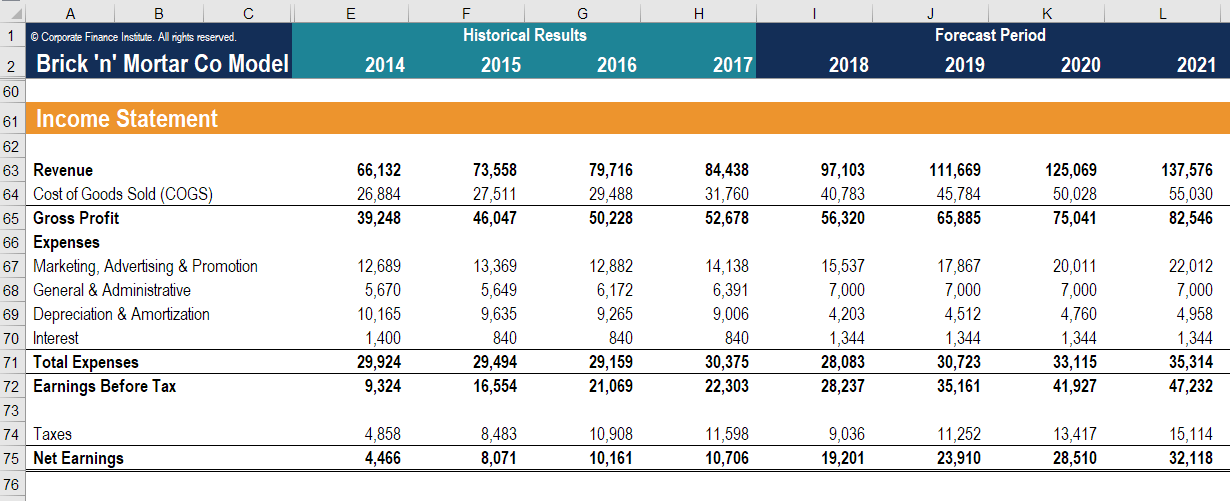

Financial Forecasting Guide - Learn to Forecast Revenues, Expenses

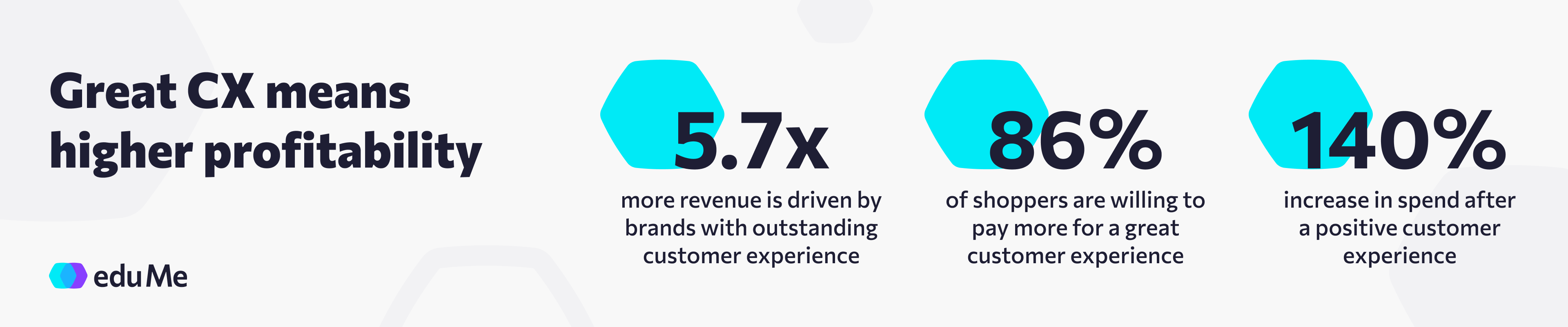

Driving Profits Through the Customer Experience

.webp?width=750&name=8%20essential%20succcess%20drivers%20in%20new%20product%20development%20process%20opt%20(1).webp)

8 essential success drivers in a new product development process

Ford Pro, Ford Blue Drive Solid Second-Quarter Results; Company

Remitly's path to profit: CEO Matt Oppenheimer on FY 2022

Business Tips: Driving Revenue vs. Optimizing Profitability - Work

.jpeg?width=661&height=441&name=AdobeStock_144659669%20(1).jpeg)

Using the Contribution Margin and Gross Profit to Calculate Break Even

40+ Statistics That Highlight the Importance of Customer

Driving Revenue vs. Driving Profits: Striking the Balance for

What Is Driving Higher Revenue And Profitability Expectations For Lululemon Athletica In Q1 2019?

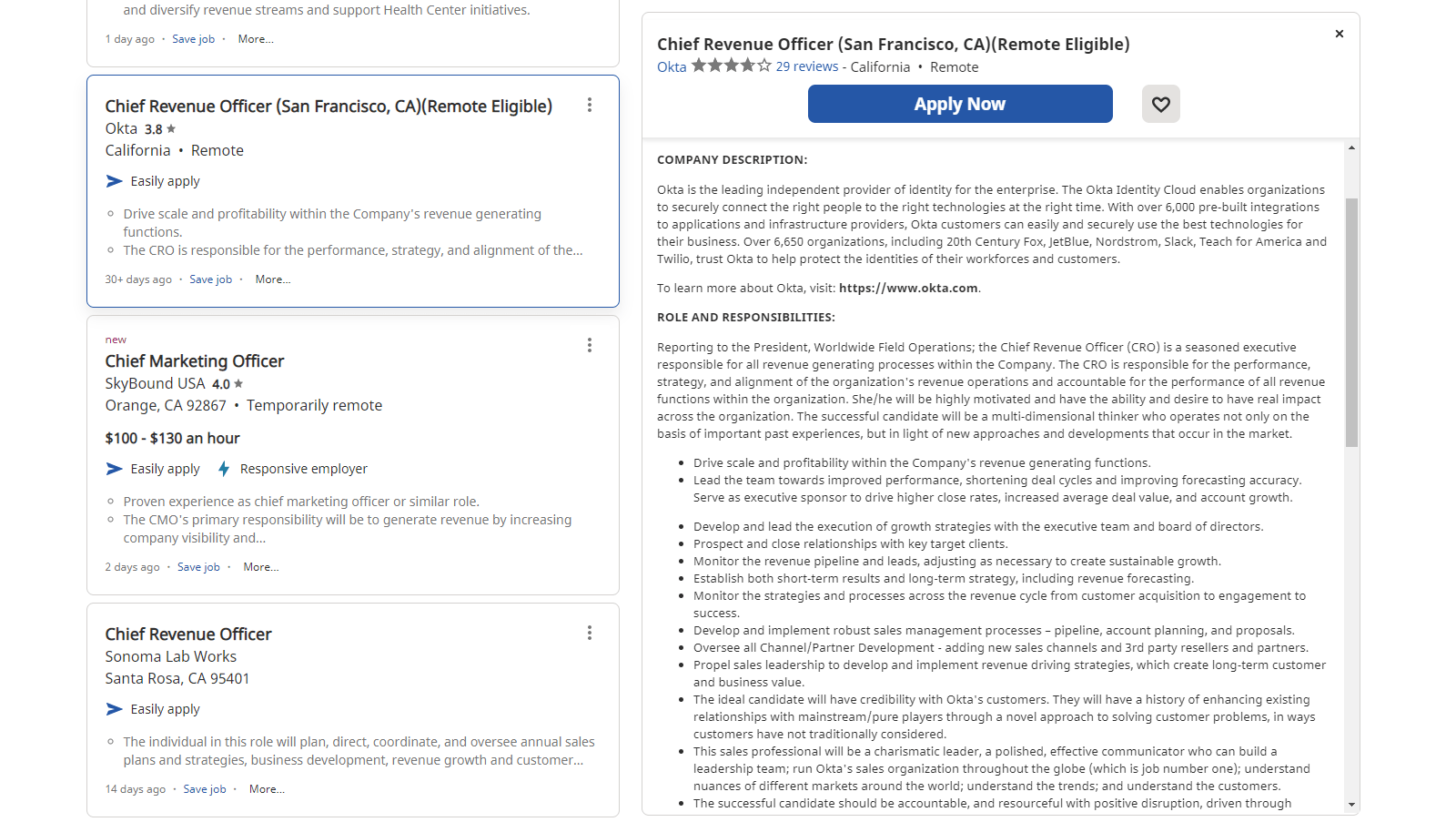

6 Metrics Chief Revenue Officers Care About & How to Impact Them

Lululemon Athletica: Demonstrating Resilience Through Innovation (NASDAQ:LULU)

Lululemon Athletica raises financial guidance for fourth quarter

lululemon athletica inc. and Enel Green Power: Sustainable and

LULULEMON ATHLETICA EATON CENTRE - 18 Photos & 20 Reviews - 218

Off-White logo-tape Sports Bra - Farfetch

Off-White logo-tape Sports Bra - Farfetch SANKOM Patent Posture Correction Bra (XL-XXL, Beige): Buy Online

SANKOM Patent Posture Correction Bra (XL-XXL, Beige): Buy Online Hi-Line Gift Ltd Tabby Sleeping Cat Statue, Orange : Patio, Lawn & Garden

Hi-Line Gift Ltd Tabby Sleeping Cat Statue, Orange : Patio, Lawn & Garden Women's Plus Size Suits, Plus Size Workwear

Women's Plus Size Suits, Plus Size Workwear- Dannii Minogue Petites Crop Wide Leg Denim Jeans

Una rama de algodón algodón y bastoncillos de algodón sobre un fondo beige productos de algodón natural

Una rama de algodón algodón y bastoncillos de algodón sobre un fondo beige productos de algodón natural