Property Tax: Definition, What It's Used for, and How It's Calculated

4.6 (476) In stock

:max_bytes(150000):strip_icc()/propertytax.asp-Final-768e8c036b94413591376e5baa43dbb9.png)

Property tax is an annual or semiannual charge levied by a local government and paid by the owners of real estate within its jurisdiction.

:max_bytes(150000):strip_icc()/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png)

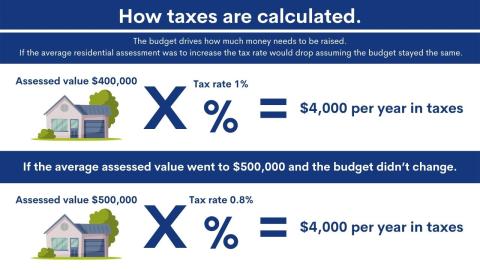

How Are Property Taxes Calculated?

How to Calculate Property Tax: 10 Steps (with Pictures) - wikiHow Life

Your Assessment Notice and Tax Bill

Sec 12.1 Property Tax Objectives –Define fair market value and assessed valuation –Use the formula for tax rate –Use the formula for property tax –Express. - ppt download

:max_bytes(150000):strip_icc()/melloroos.asp-final-17c242cd403540d9bb4f1176d838ab73.png)

Special Assessment Tax Definition, Who Pays, Example

:max_bytes(150000):strip_icc()/shutterstock_136842914-5bfc367e46e0fb00511c070b.jpg)

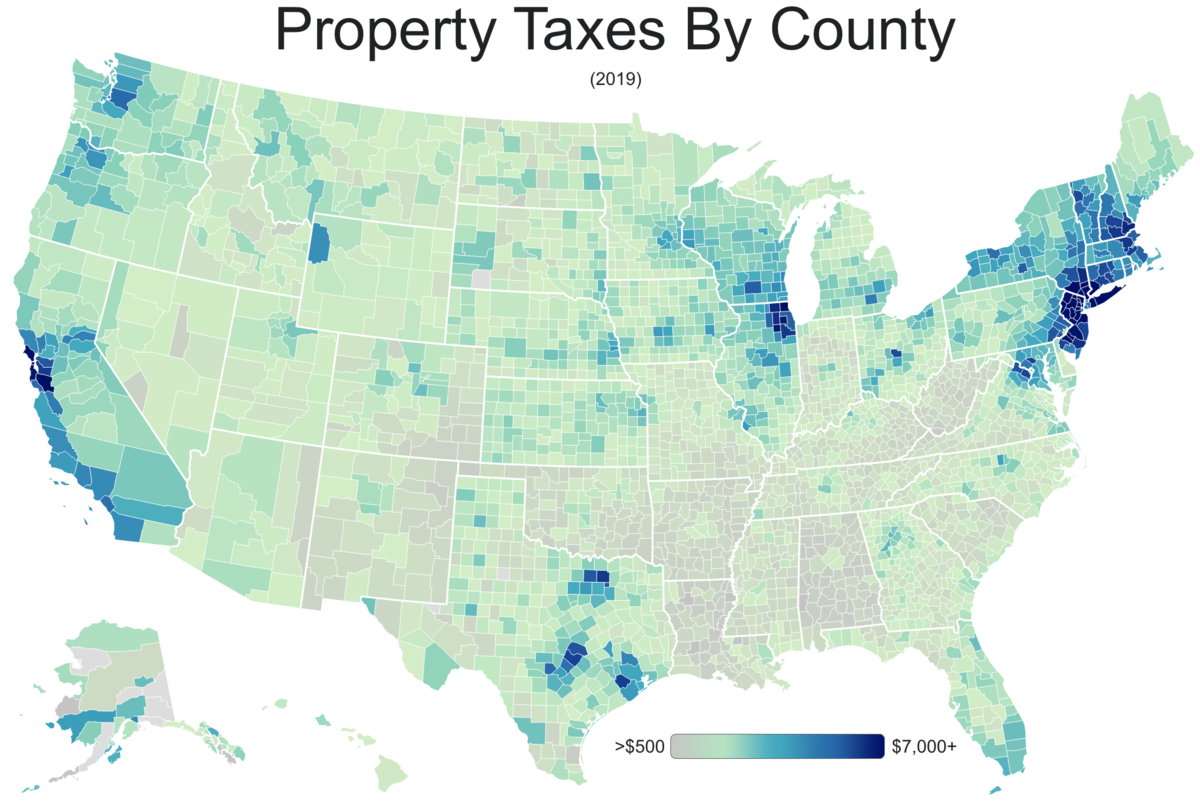

10 Best States for Property Taxes—and Why

:max_bytes(150000):strip_icc()/GettyImages-1418128037-ed9dac1025514e5fb5d507edf18b2577.jpg)

What Is a Mill Rate, and How Are Property Taxes Calculated?

How Property Taxes Are Calculated

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules for Claiming a Property Tax Deduction

Property Taxation and Current Value Assessment (CVA)

Property tax in the United States - Wikipedia

:max_bytes(150000):strip_icc()/GettyImages-1053987380-2c41a15b473147e998a2e36afd42de79.jpg)

Property Tax: How It Works

Properties of Multiplication - Definition, Facts, Examples, FAQs

zero property of addition ~ A Maths Dictionary for Kids Quick Reference by Jenny Eather

DBMS Transaction Property - javatpoint

What is the Associative Property?, 3rd Grade Math

Associative Property of Multiplication Explained in 3 Easy Steps

Custom Size Custom Color Formal Dress For Women Manufacturers at Rs 800/piece in Gurgaon

Custom Size Custom Color Formal Dress For Women Manufacturers at Rs 800/piece in Gurgaon 370+ Exercise With Hanging Fitness Belt Stock Photos, Pictures

370+ Exercise With Hanging Fitness Belt Stock Photos, Pictures 59 best beauty products on 2024: Makeup, skincare, more

59 best beauty products on 2024: Makeup, skincare, more Carbon Fiber/Spectra 1000 Fabric 2x2 Twill 3k 6oz/203gsm-Sample (4x4)

Carbon Fiber/Spectra 1000 Fabric 2x2 Twill 3k 6oz/203gsm-Sample (4x4) FeelinGirl Fajas Body Shaper for Women Firm Tummy Control Full Body Compression Shapewear Open Bust with Zipper Black S - ShopStyle

FeelinGirl Fajas Body Shaper for Women Firm Tummy Control Full Body Compression Shapewear Open Bust with Zipper Black S - ShopStyle AKANYA - Tie Shoulder Plain Flowy Camisole Top

AKANYA - Tie Shoulder Plain Flowy Camisole Top