Low-Income Housing Tax Credit Program

4.7 (404) In stock

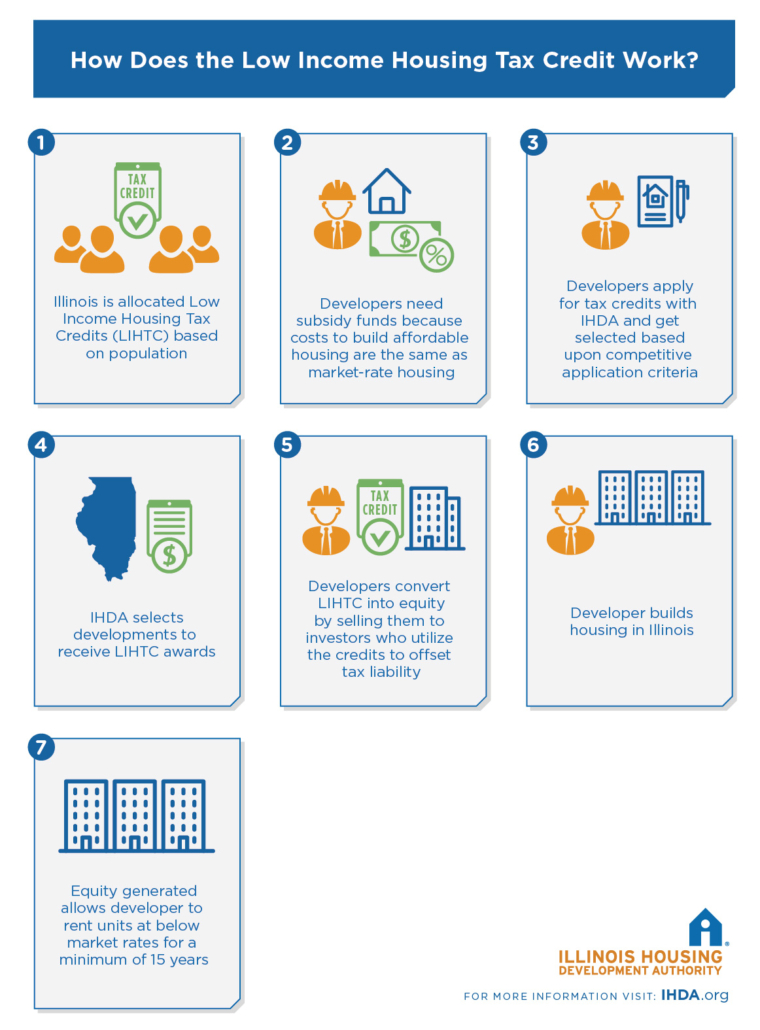

The Fund is responsible for administering the Low-Income Housing Tax Credit Program, which generates low-income residential rental units by encouraging private investment through federal tax credits. Since its inception, this program has produced more than 17,200 affordable rental units in West Virginia. If you are interested in receiving updates on the Fund’s Low-Income Housing Tax […]

LIHTC101: What Developers Need to Know About the Low-Income Housing Tax Credit Program – Ramaker and Associates

Everything You Need to Know about State LIHTCs in 2022

The Impact of Low-Income Housing Tax Credits on Affordable Housing in Texas - Texas State Affordable Housing Corporation (TSAHC)

Why Invest in Low-Income Housing Tax Credit Projects? - Withum

Shelterforce on X: Have you checked out this week's newsletter? ♦️ How to Reform the Low-Income Housing Tax Credit Program ♦️ Can Residents Get More Out of Tax Credit Housing? ♦️ Going

Missouri awards over $40 million in low-income housing tax credits • Missouri Independent

Neighborhood Lending Partners Low Income Housing Tax Credit Program

Low Income Housing Tax Credit – IHDA

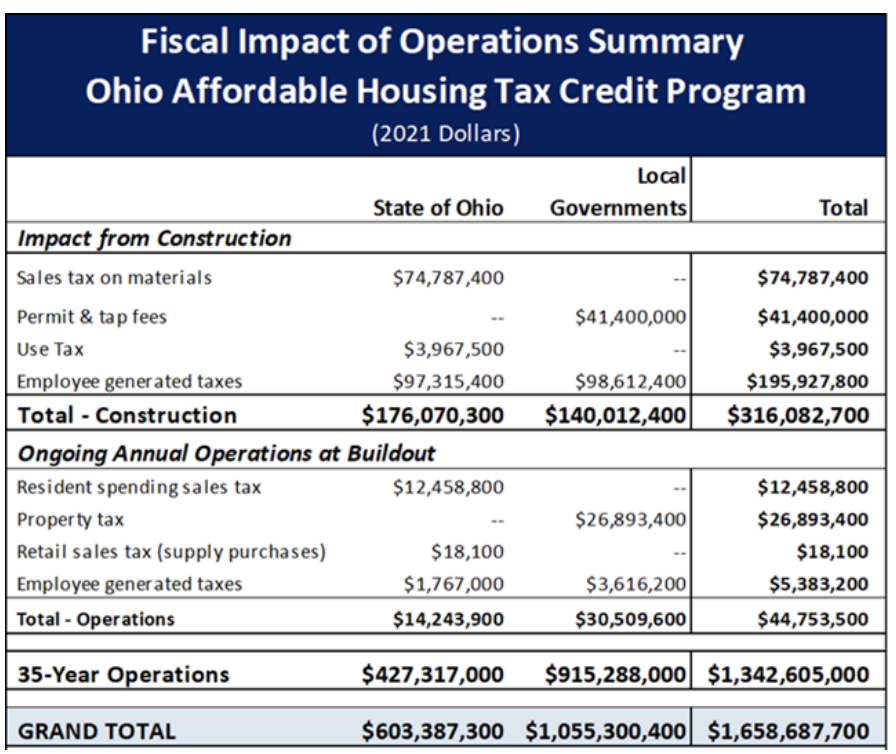

THE OHIO AFFORDABLE HOUSING TAX CREDIT PROGRAM: Creating Jobs While Solving Ohio's Affordable Housing Crisis

Gary Cohen Presents on Low Income Housing Tax Credits: Shutts & Bowen LLP

The Low-Income Housing Tax Credit Program Costs More, Shelters

Man Who Falls Into Low Income Stock Vector (Royalty Free

Majority of Nation's Public School Students Now Low-Income

Low-income housing: The negative effects on both physical and

Kook N Keech Cotton Leggings - Buy Kook N Keech Cotton Leggings online in India

Kook N Keech Cotton Leggings - Buy Kook N Keech Cotton Leggings online in India How to Get Rid of Man Boobs or Gynecomastia - InsideHook

How to Get Rid of Man Boobs or Gynecomastia - InsideHook Aspire Nautilus 2S MTL Tank - Canada

Aspire Nautilus 2S MTL Tank - Canada Lilvigor Post Surgery Bra Surgical Bra Compression Sports Bra Front Closure Cross Back Bras for Women Close Breast Augmentation Bra Wireless

Lilvigor Post Surgery Bra Surgical Bra Compression Sports Bra Front Closure Cross Back Bras for Women Close Breast Augmentation Bra Wireless Bra/Underwear

Bra/Underwear UFC Gym Yoga Sexy Sports Bras

UFC Gym Yoga Sexy Sports Bras