Qualified Vs Non-Qualified ESPPs

5 (285) In stock

Qualified vs Non-qualified ESPPs. We take you through an explanation of what they are, their differences and which one is best for you as an employee.

This post explains the two main types of employee stock purchase plans (ESPPs), detailing the differences between them and their tax implications.

ESPPs Uncovered: Qualified vs: Non Qualified Plans - FasterCapital

How Can You Utilize an Employee Stock Purchase Plan?

Qualified vs Non-qualified Stock Options - Difference and Comparison

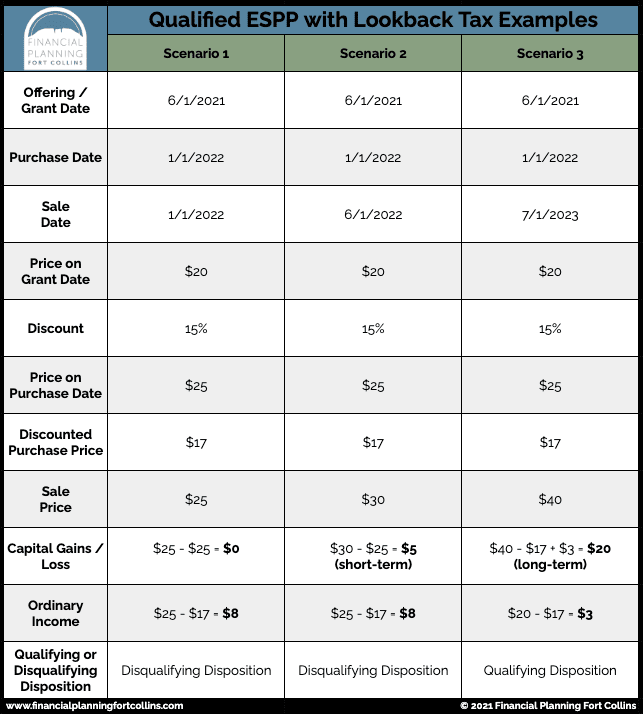

Tax, Accounting and Startups — Tax Treatment of ESPP

The Risks Of Waiting Too Long To Purchase Espp Stock - FasterCapital

Introduction To Espps And Qualified Dispositions - FasterCapital

Employee Stock Purchase Plan (ESPP): How ESPPs Work

ESOP vs. ESPP: What You Need to Know

All About ESPPs - Financial Planning Fort Collins

Verbal communication vs non-verbal communication

Crypto Wallets: Custodial vs. Non-Custodial Wallets

Difference between functional and non-functional requirements - javatpoint

Do You Need Waterproof or Non-Waterproof Hiking Boots? – Bearfoot Theory

Plus High Waist Capri Pants

Plus High Waist Capri Pants Carnival Halloween Lady West Cowboy Costume Vintage Steampunk Rock Hippy Tassels Outfit Cosplay Fancy Party Dress

Carnival Halloween Lady West Cowboy Costume Vintage Steampunk Rock Hippy Tassels Outfit Cosplay Fancy Party Dress Carhartt Aviation Pant Slim 2024

Carhartt Aviation Pant Slim 2024 Hello Kitty Celebrates the Lunar New Year in Cute New Art

Hello Kitty Celebrates the Lunar New Year in Cute New Art LATEX ALLERGY NURSING CARE Causes, Symptoms, & Types

LATEX ALLERGY NURSING CARE Causes, Symptoms, & Types Hip Hugging Short Shorts, Body Shaping Underwear

Hip Hugging Short Shorts, Body Shaping Underwear