Rate Hike or Not: ETFs in Focus Ahead of FOMC Meet

4.6 (771) In stock

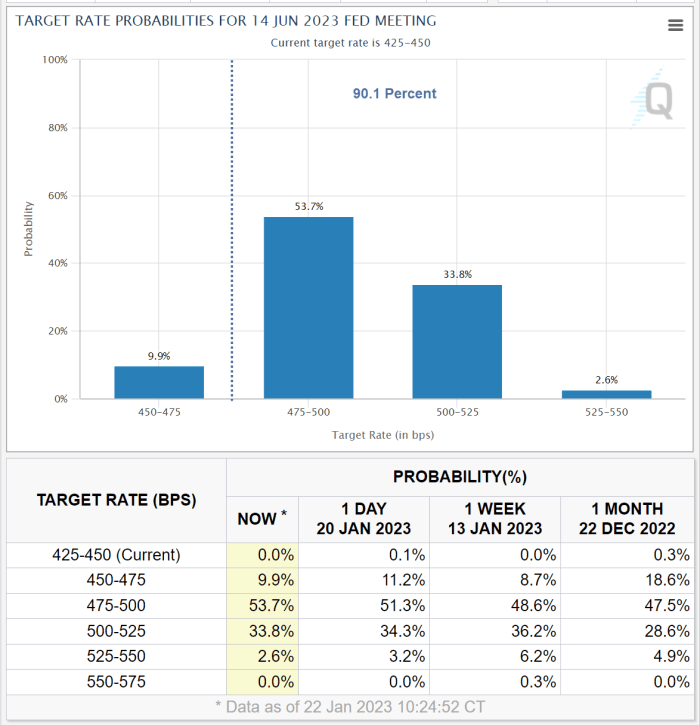

All eyes are currently on the crucial two-day FOMC meeting to see whether the hawkish central bank will go for a 50-bps hike or a smaller one or a halt following the latest crunch in the financial sector.

All eyes are currently on the crucial two-day FOMC meeting to see whether the hawkish central bank will go for a 50-bps hike or a smaller one or a halt

One and done for Fed rate hikes in 2023?

EEM - Emrg Mkts Ishares MSCI ETF Price

Ecoinometrics - Fed pause and BlackRock Bitcoin ETF

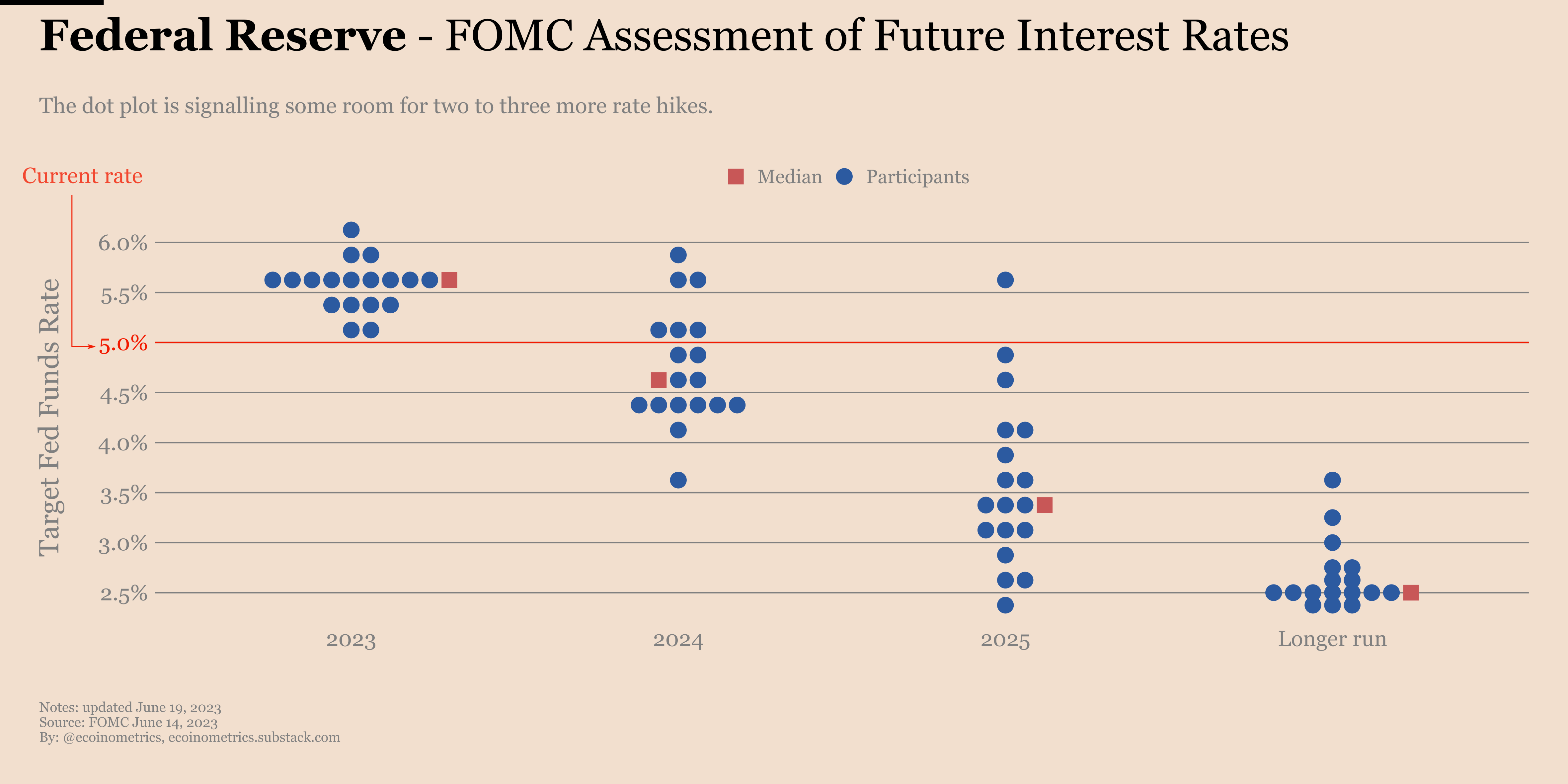

3 Reasons Why the Fed Will Have to Be Even More Hawkish in 2024

Fed dot plot and Bank of England meeting in focus - macro week ahead

How Asset Classes Have Performed After Interest Rate Hikes

FOMC Meetings (Trading Strategy Backtest) - Stocks, Gold, And Bonds - Quantified Strategies

Rate Hike May Be Fed's Next Move If Growth Picks Up, SocGen Says - BNN Bloomberg

Rate Sensitive ETFs in Focus Ahead of Fed Meeting

Stocks Slightly Lower Ahead Of FOMC Meeting Results And Powell

7 Best Sector ETFs to Buy for Growth

The market is mispricing Webster Financial's return potential