Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory

4.8 (590) In stock

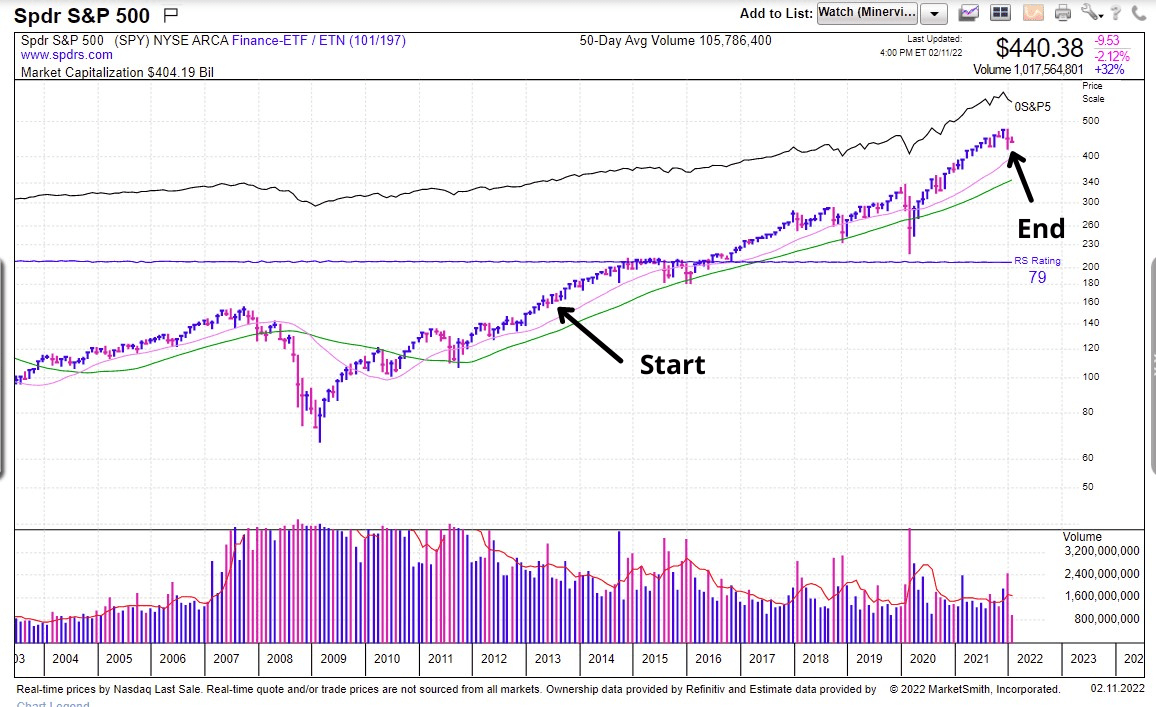

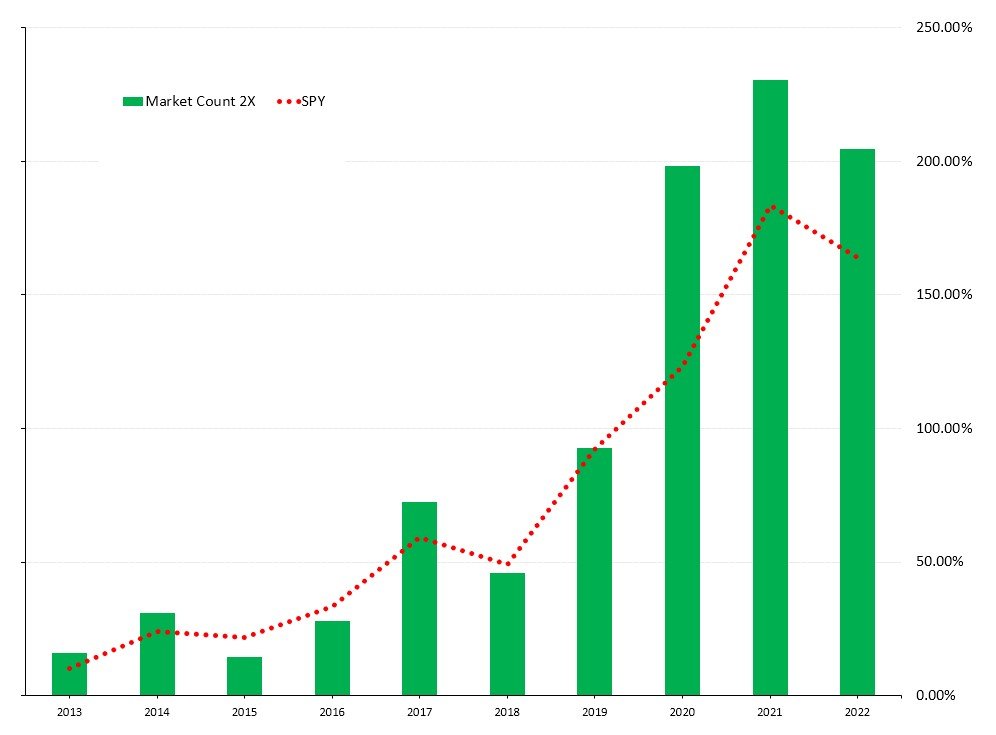

We compare a buy and hold strategy with index ETFs QQQ and SPY vs.our Market Trend Advisory returns. Check out which one had the best return and lowest risk

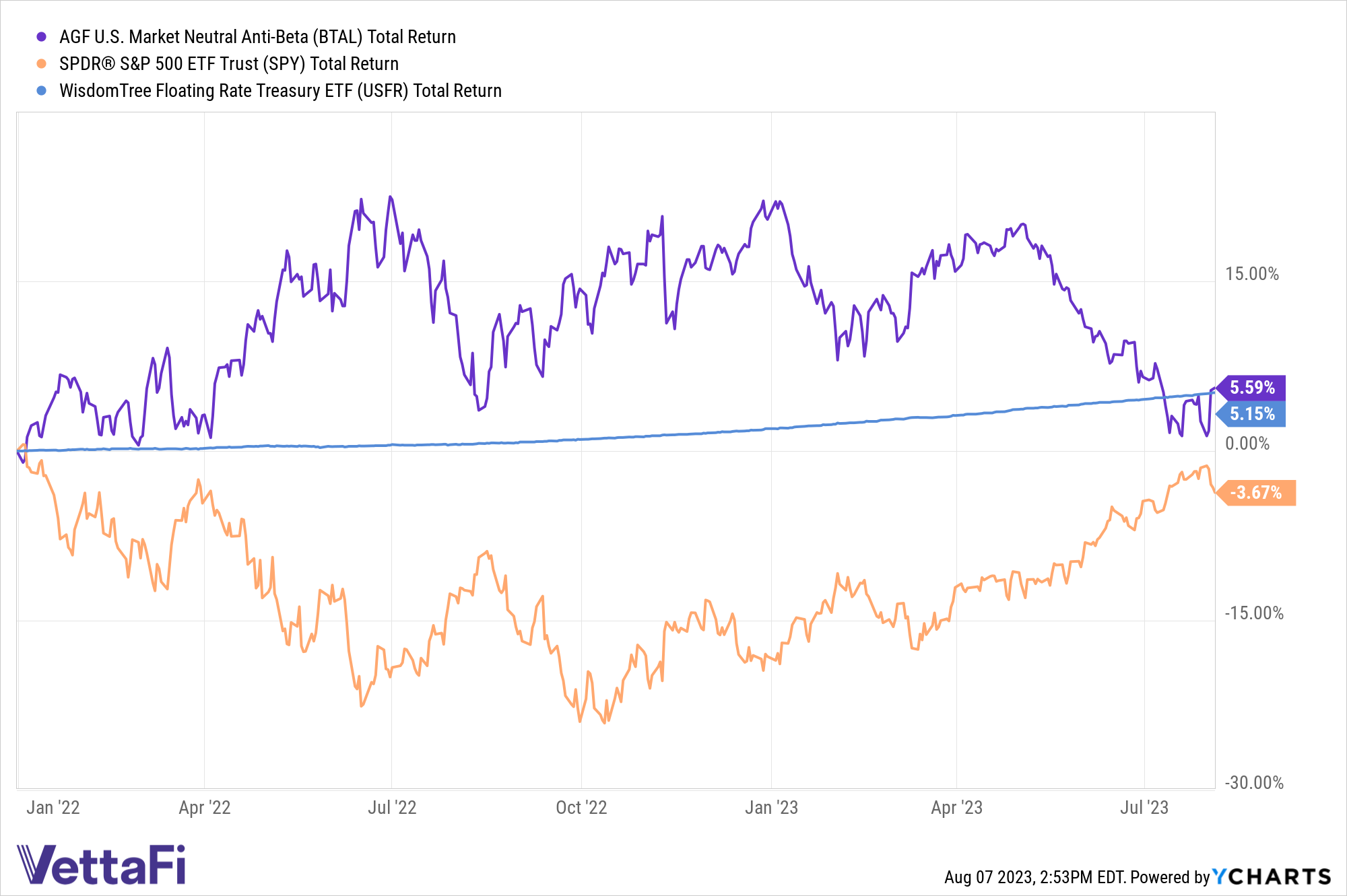

Bull vs Bear: Do Alts Deserve More Portfolio Allocation?

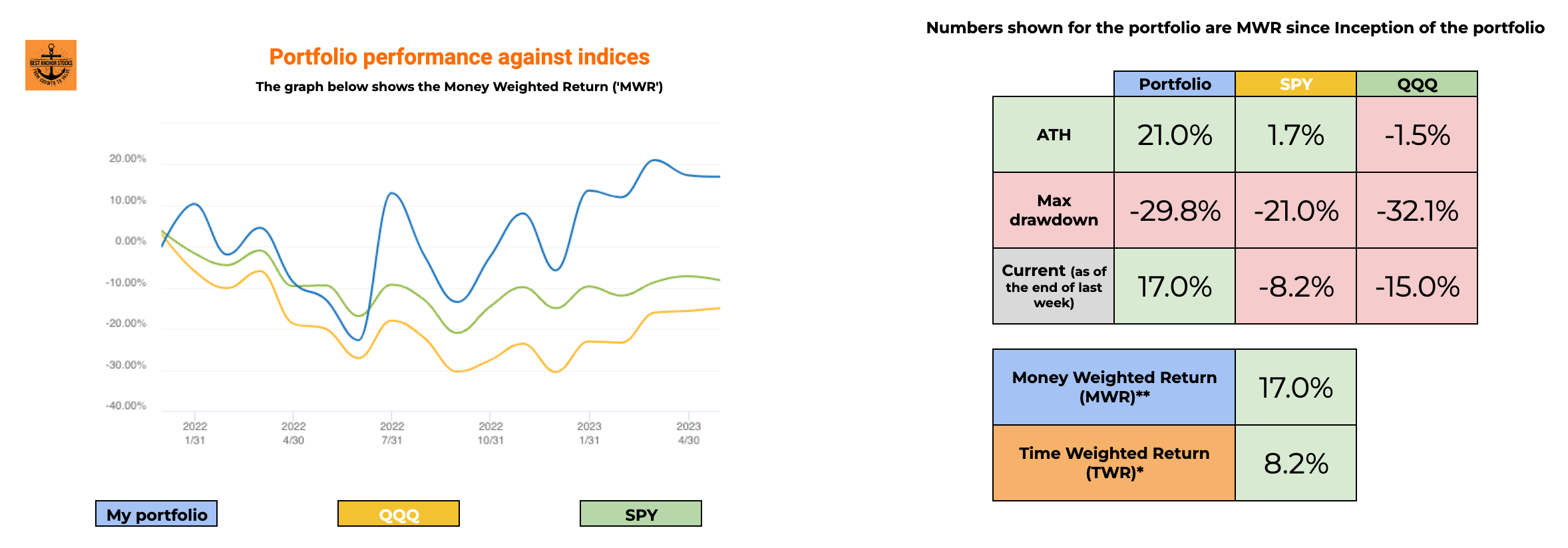

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory Strategies

SPY And QQQ: Almost All Investors Are Crowded Into The Same Side Of The Boat

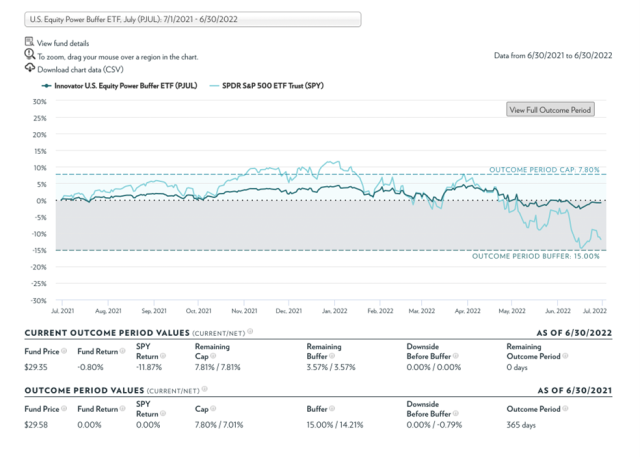

Defined Outcome ETFs™ From Innovator Buffered Against Bear Market Losses Over Recent Outcome Period

The Unusual Whales Congress Trading Report for 2023

SPY vs. VOO: Which S&P 500 ETF Is Better? - ETF Focus on TheStreet: ETF research and Trade Ideas

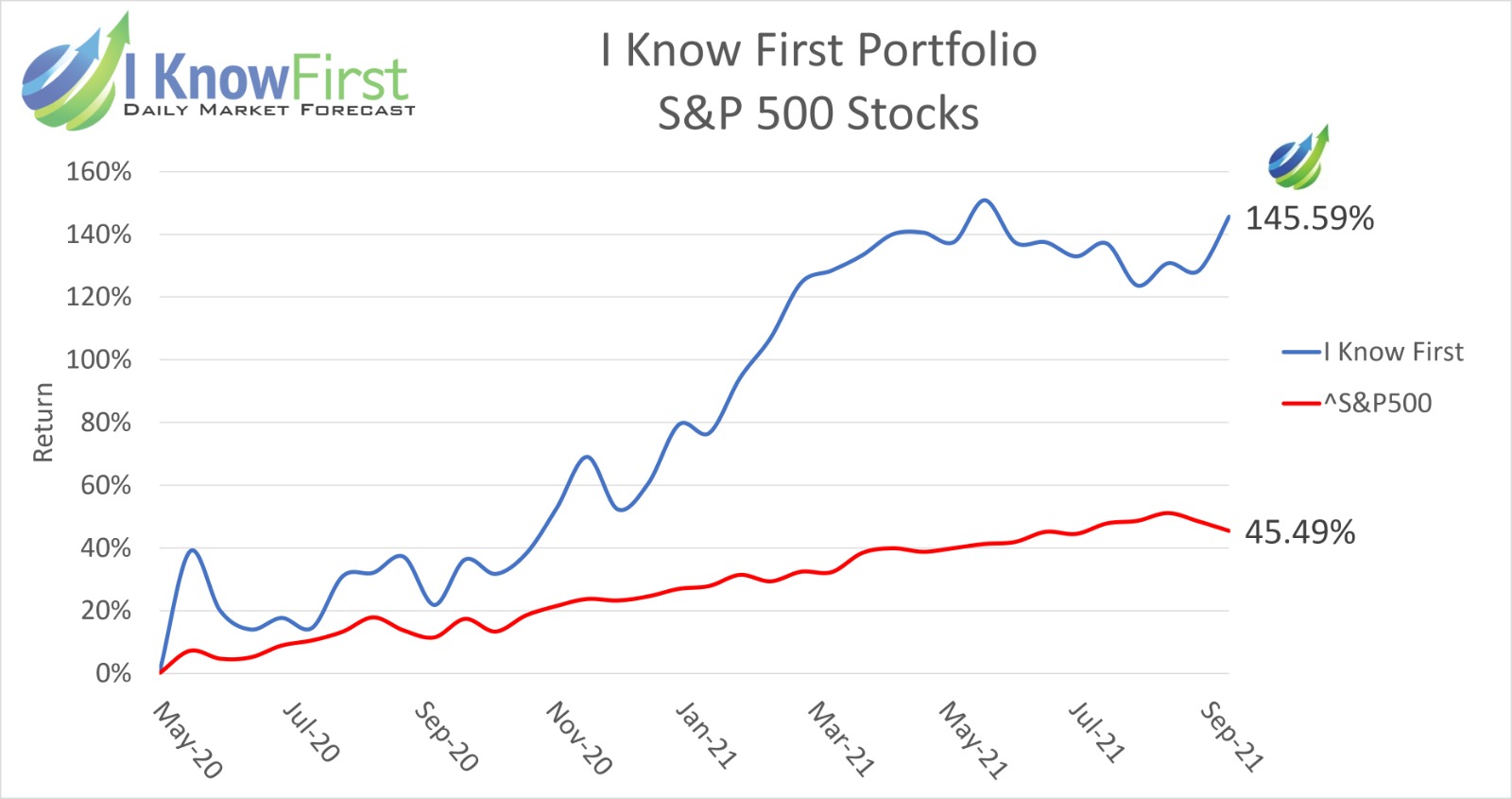

Stock Forecast Based On a Predictive Algorithm, I Know First

How To Use A Stock Screener to Find Top Stocks - Lifetime Investor

Discussing Copart At Chit Chat Money

How do you predict huge drops in the SPY? : r/Daytrading

Chart Advisor: Overhead Supply Halts the Advance

Quantifying the QQQ Effect on SPY, Art's Charts

A market bottom checklist update – Humble Student of the Markets

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory Strategies

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory Strategies

Invesco QQQ Trust Stock Forecast – QQQ Technical Analysis

QQQ Stock Price Today (plus 21 insightful charts) • ETFvest

Market Volatility: Navigating QQQ's Performance in Times of

Invesco QQQ (NASDAQ:QQQ) Stock Position Lifted by Commonwealth Equity Services LLC