Small Business - Automobile Taxable Benefits - Operating Cost Benefit

4.7 (774) In stock

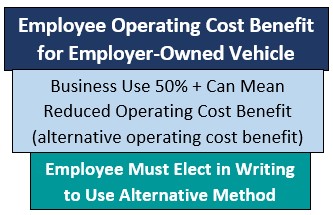

Automobile Taxable Benefits - Operating Cost Benefit, Reduction if Business Use 50% +

17 Big Tax Deductions (Write Offs) for Businesses

The Standby Charge And Operating Cost Benefit Trap — Burgess Kilpatrick

Taxable Benefits In Canada: What You Should Know As An Employer

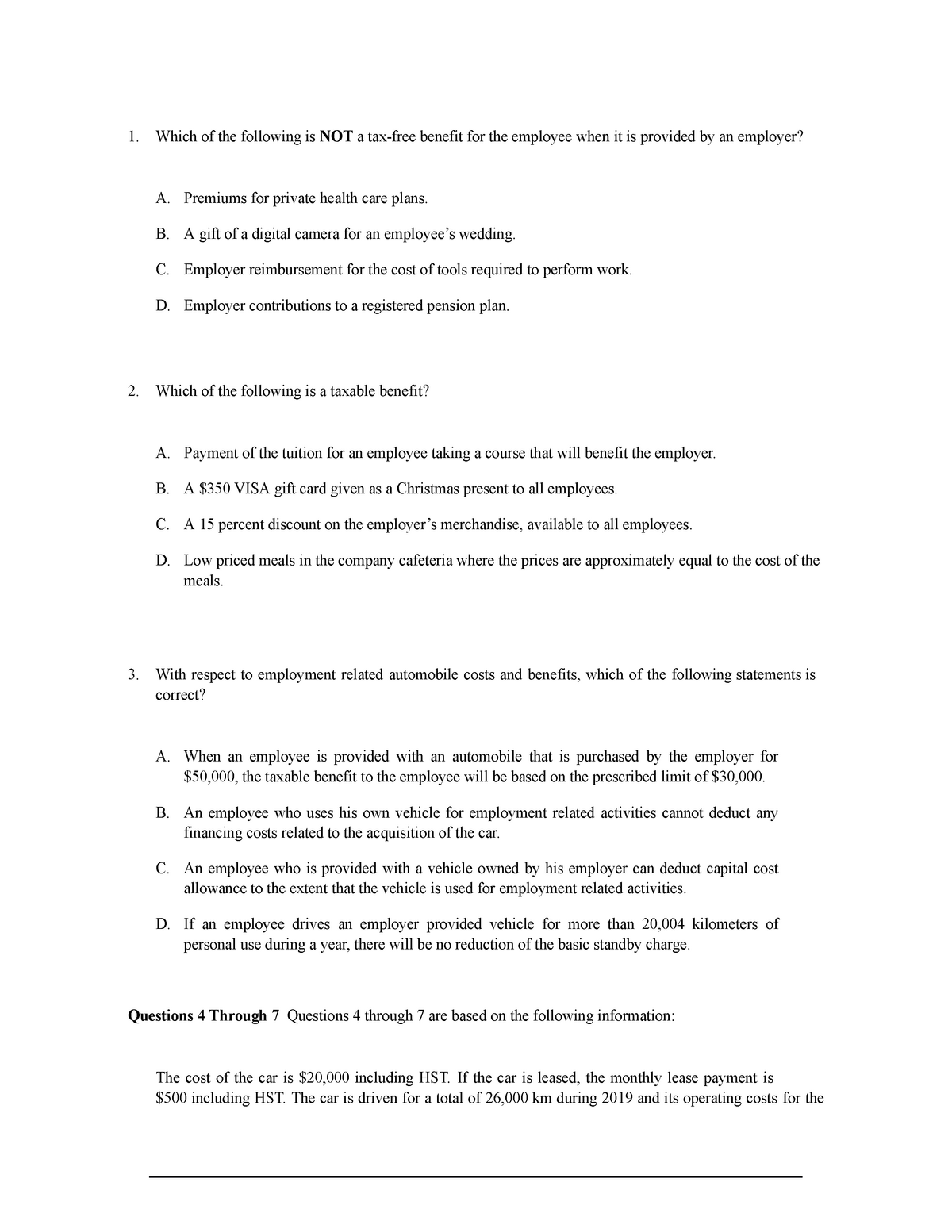

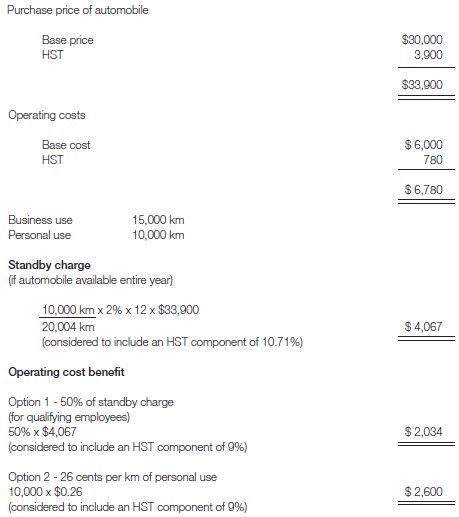

ACCT226 MCQ and Answer Chapter 3 #2 - Which of the following is NOT a tax-free benefit for the - Studocu

21 Tax Write-Offs for Small Businesses Tax Deductions - Guide

:max_bytes(150000):strip_icc()/Capitalize_V1-dc9f7f98f4394098a17818773eb73b71.jpg)

Capitalize: What It Is and What It Means When a Cost Is Capitalized

21 Tax Write-Offs for Small Businesses Tax Deductions - Guide

Business Expense Categories Cheat Sheet: Top 35 Tax-Deductible Categories

Important 2012 Tax Reporting Deadlines - Tax Authorities - Canada

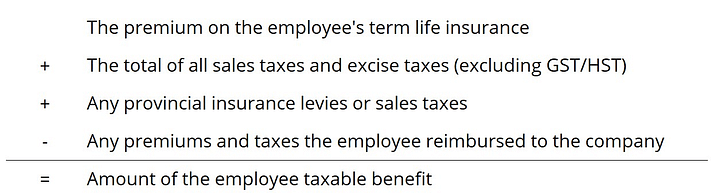

What are the Taxable Benefits for Non-Cash Operating Costs?

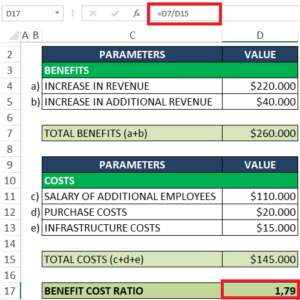

Cost Benefit Analysis Example and Steps (CBA Example) - projectcubicle

Benefit Period: What it Means, How it Works

7 Health Benefits Of Avocados & How To Eat Them

Making the most of Employee Benefits right now

7 Benefits of Garlic — YOGABYCANDACE

Safe Terrain Is Now Simple Terrain in the New Edition of Warhammer 40,000 - Warhammer Community

Nike Alpha Maximum Support Sports Bra A-

Nike Alpha Maximum Support Sports Bra A- Couple Men Women Jeans, Cargo Pants Women Men

Couple Men Women Jeans, Cargo Pants Women Men Buy Women's Bras Black Push Up Lingerie Online

Buy Women's Bras Black Push Up Lingerie Online ODODOS Crop Tank for Women Loose Sleeveless Workout

ODODOS Crop Tank for Women Loose Sleeveless Workout All About Shapewear tablas post operatorias para liposuccion, lipo board, lipo foams post surgery ab board post surgery liposuction

All About Shapewear tablas post operatorias para liposuccion, lipo board, lipo foams post surgery ab board post surgery liposuction Vintage 1960's Champion Brass Los Angeles Calif. Sprinkler

Vintage 1960's Champion Brass Los Angeles Calif. Sprinkler