Nonprofit Tax Compliance: Three Things You Need to Know

4.9 (581) In stock

Just because your nonprofit is tax-exempt doesn’t mean you can relax during tax season. Discover three things you need to know about nonprofit tax compliance.

Demystifying IRS Form 990-N: What Nonprofits Should Know

4 Essential Nonprofit Financial Statements Explained

Charity Compliance Solutions on LinkedIn: 24 Free Nonprofit Webinars for December 2023

How to Start a 501(c)(3) - The Ultimate Guide

Telling the not-for-profit story through Form 990 - Journal of Accountancy

Charity Compliance Solutions on LinkedIn: How to Track the ROI of Your Recurring Giving Program

Nonprofit - Grants & Fundraising Brief

process for Tax filing after due date

Navigating the Benefits of 501 c: 3: Status for Your Nonprofit - FasterCapital

New Tax Reporting Rules For Trusts: What Trustees Need To Know · Invested MD

How to File a Tax Extension for a Nonprofit: What You Need to Know

What is EIN & How to get EIN for nonprofit 501c3 organization

Not For Profits - FRSCPA, PLLC

Starting a Nonprofit : How to Start a 501c3 Non-Profit

6 Foolproof Ways to Get More Funding for Your Nonprofit

Non-Profit Enterprise Finance, HR and Planning Software

Nonprofit Organizational Charts: What are They and Why are They

ROSA FAIA Beach romance push-up bikini met beugel, voorgevormd

ROSA FAIA Beach romance push-up bikini met beugel, voorgevormd- NYX Hot Singles Eyeshadow - «This is a sumptuous collection of

Nike Zenvy Women's Gentle-Support High-Waisted 7/8 Leggings. Nike HU

Nike Zenvy Women's Gentle-Support High-Waisted 7/8 Leggings. Nike HU One Shoulder Swimsuits For Women Ruffle Bikini Two Piece Bathing

One Shoulder Swimsuits For Women Ruffle Bikini Two Piece Bathing/product/20/962104/1.jpg?1753) Fashion New Micro Striped Bikini Set Two-piece Swimsuit Patchwork

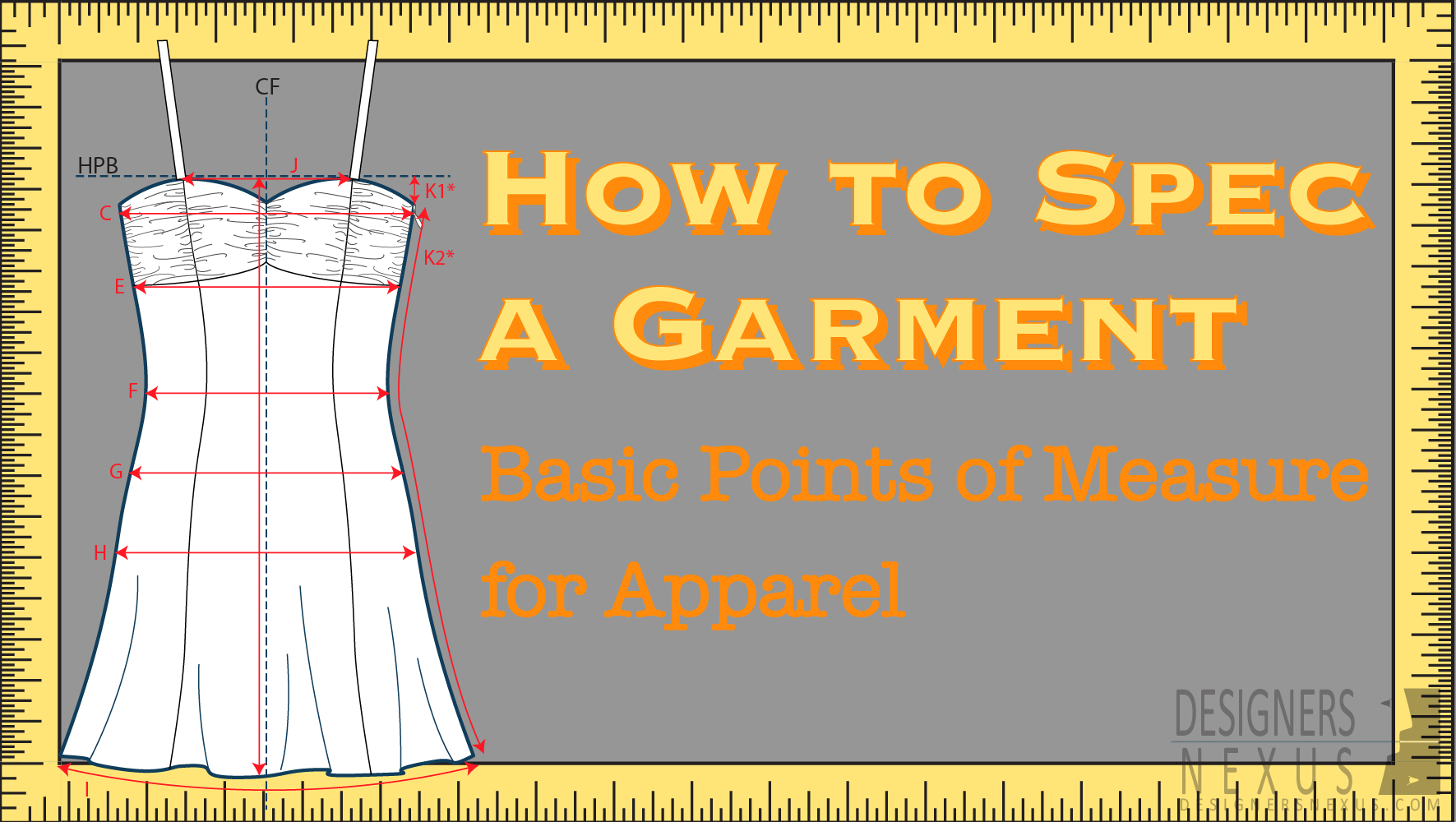

Fashion New Micro Striped Bikini Set Two-piece Swimsuit Patchwork How to Spec a Garment: Basic Points of Measure for Apparel

How to Spec a Garment: Basic Points of Measure for Apparel