Tax Credits for Individuals and Families

4.6 (380) In stock

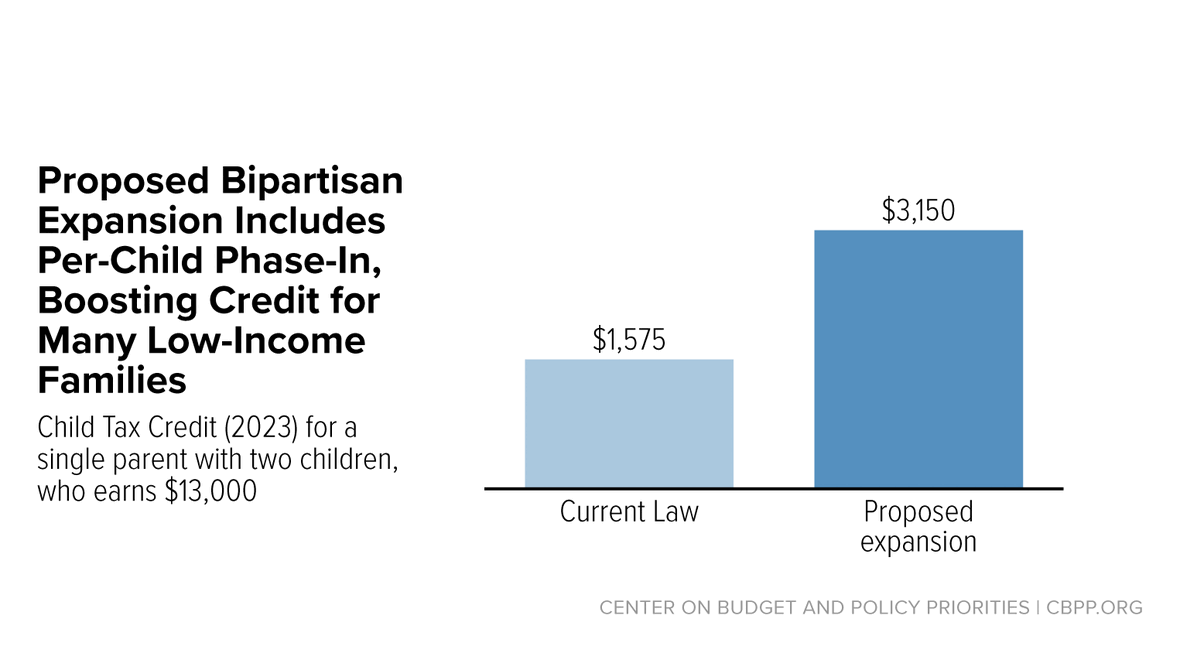

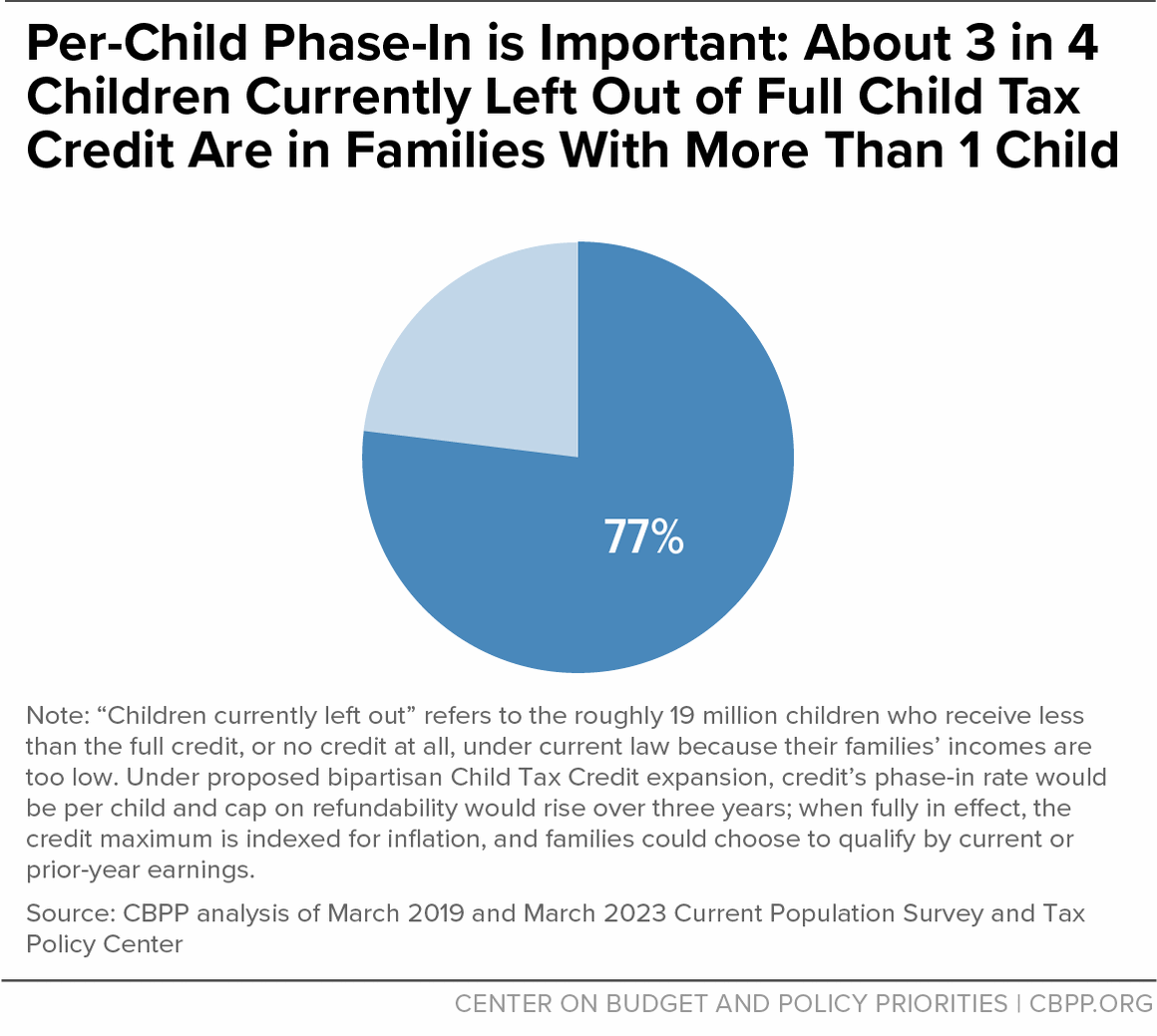

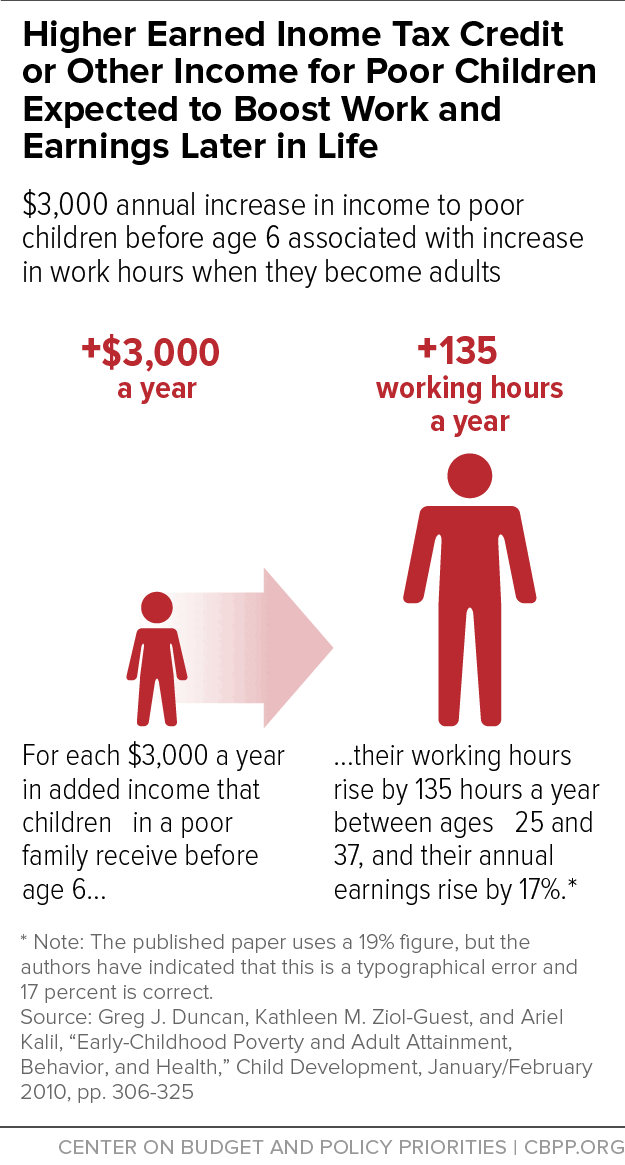

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

Benefits of Expanding Child Tax Credit Outweigh Small Employment

.jpg)

Health Insurance Webster Chamber of Commerce

Resources For Individuals And Families - FasterCapital

The Benefits Of Allotment Communities For Individuals And Families

About 16 Million Children in Low-Income Families Would Gain in

EITC: General Information and Fact Sheets

Best Income Tax Saving Investment Options in India

Resources For Individuals And Families - FasterCapital

EITC and Child Tax Credit Promote Work, Reduce Poverty, and

32 Easy Low Calorie Desserts under 100 Calories (2024)

Cars Under 3 lakhs: Cheapest Small Cars To Buy in India

Levels of Management - Top, Middle and Lower - GeeksforGeeks

ADIV - Banded Triangle Bikini Top for Women

ADIV - Banded Triangle Bikini Top for Women) Buy Shylina Seamless Padded Bra For Women B-79 Online at Best Prices in India - JioMart.

Buy Shylina Seamless Padded Bra For Women B-79 Online at Best Prices in India - JioMart. Utah Wedding Venues Wedding Reception in Utah - Events Venue Utah

Utah Wedding Venues Wedding Reception in Utah - Events Venue Utah XL Red Hot Spanx Convertible Strapless Cupped Mid-Thigh Bodysuit 10173R

XL Red Hot Spanx Convertible Strapless Cupped Mid-Thigh Bodysuit 10173R Secure (1 Pair Ultra Soft Non Slip Grip Slipper Socks

Secure (1 Pair Ultra Soft Non Slip Grip Slipper Socks- Men's Ripstop Rain Jacket - Goodfellow & Co™ : Target