Venture Capital Trust - Overview, Life Cycle, Criteria, Types, Tax Benefits

4.7 (503) In stock

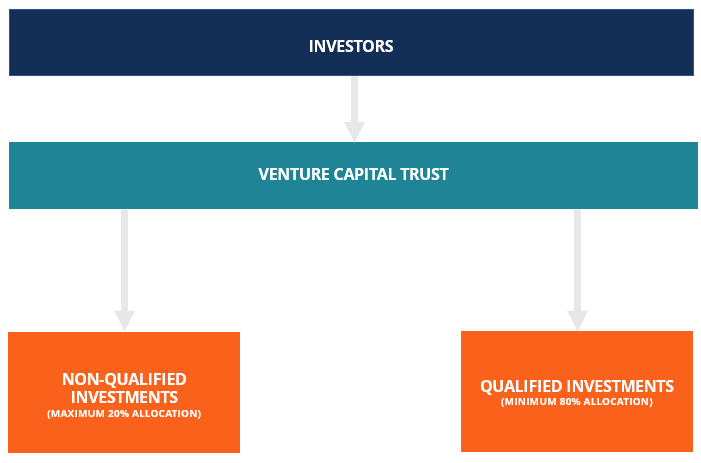

A venture capital trust (VCT) is a tax-efficient investment vehicle that provides capital to small, growing businesses in the United Kingdom. A specialized

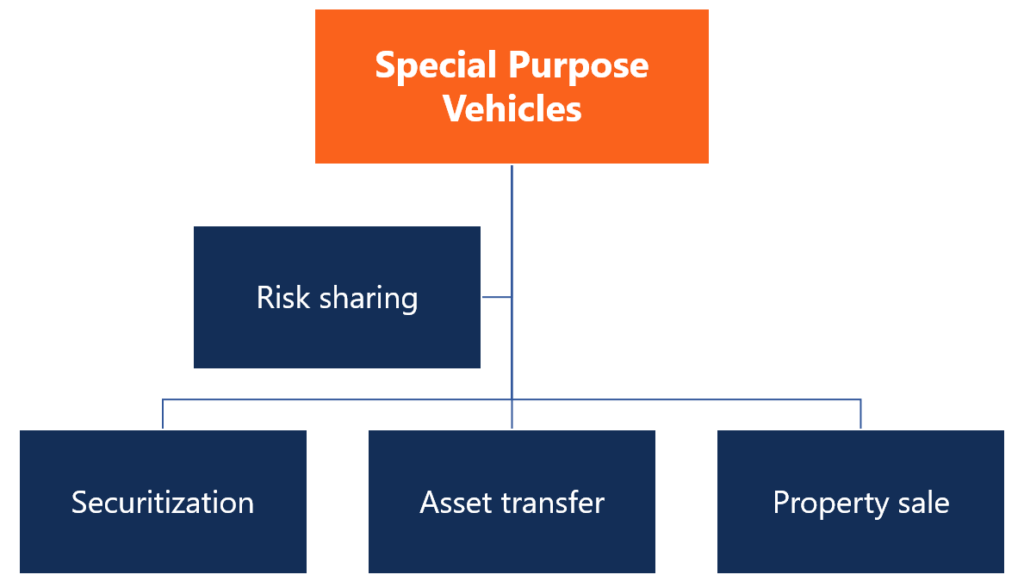

Special Purpose Vehicle (SPV) - Guide, Examples, What You Need to Know

VCT (Venture Capital Trusts) Tax Relief Guide For Investors

Flexible Estate Planning Strategies That Adapt To Change

Tax Efficiency: Maximizing Tax Benefits with Venture Capital Trusts - FasterCapital

What Is the Thrift Savings Plan and How Does It Work? - Ramsey

2024 commercial real estate outlook

Tax Relief: Exploring Tax Benefits of Venture Capital Trust Investments - FasterCapital

:max_bytes(150000):strip_icc()/Real-Estate-Investment-Trust-189c6cf51a03412b880b12f10ff1ee05.jpg)

Venture Capital Trust (VCT): Meaning, Types, Example

:max_bytes(150000):strip_icc()/Investmentcompany_final-9f1325f8e80f4538a2dace17c669e49c.png)

Investment Company: Definition, How It Works, and Example

What Are the Different Types of Trusts?

The Steps Required for Investment Due Diligence

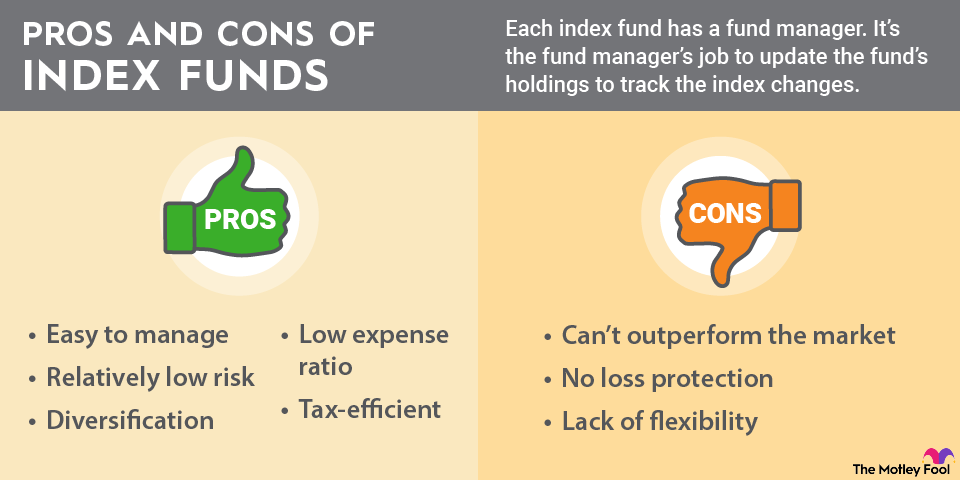

How to Invest in Index Funds: A Beginner's Guide

Tax Relief: Exploring Tax Benefits of Venture Capital Trust Investments - FasterCapital

Publication 17 (2023), Your Federal Income Tax

The Basics of Venture Capital Fund Distributions

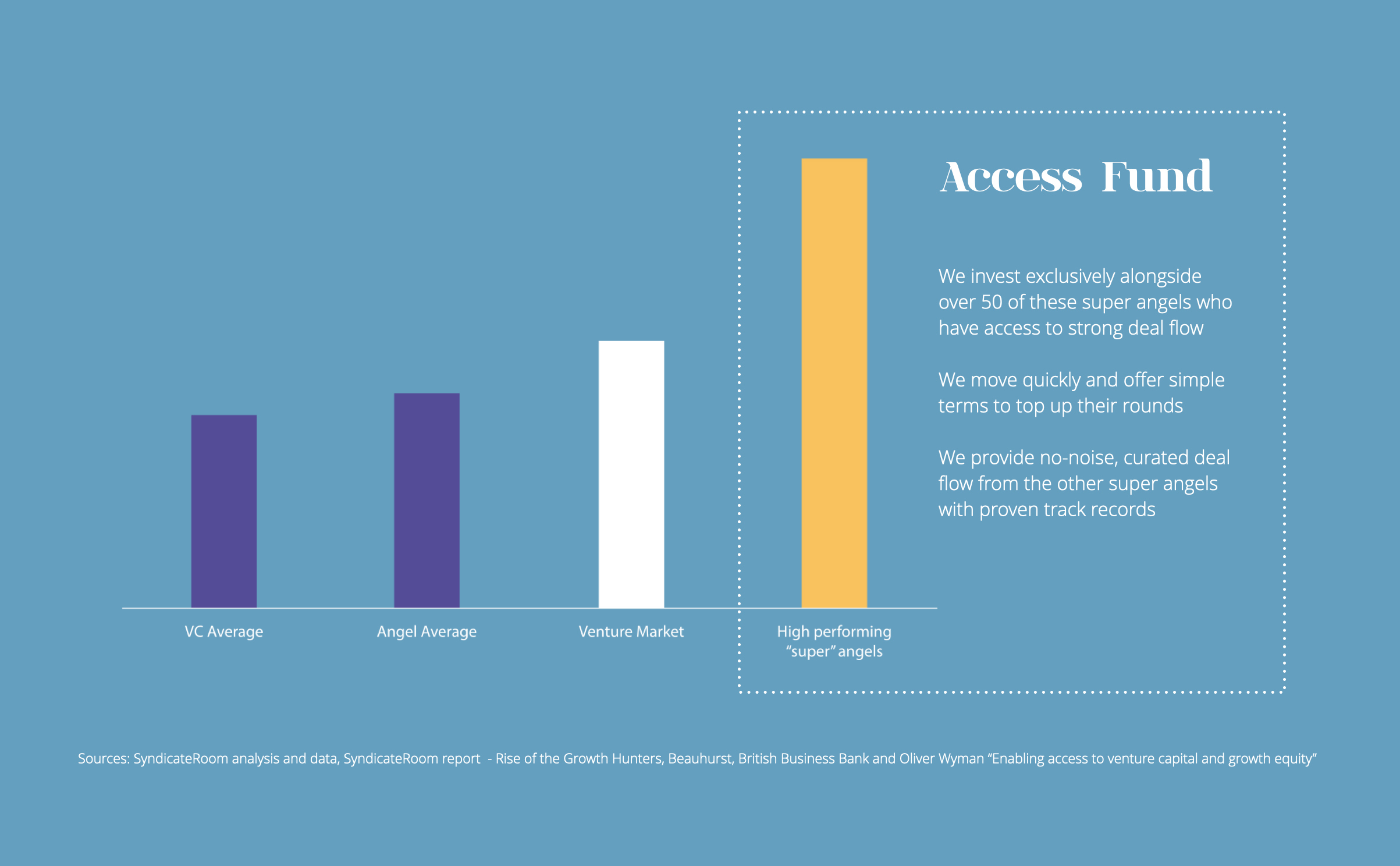

Introduction to VC - Venture Forward

Venture Capital How It Works, Benefits, Types, & Risks

Free People Mid-rise Full Length Low And Flow Legging By Fp Movement in Purple

Free People Mid-rise Full Length Low And Flow Legging By Fp Movement in Purple Under Armour Mens Woven Vital Workout Pants Pant : : Clothing, Shoes & Accessories

Under Armour Mens Woven Vital Workout Pants Pant : : Clothing, Shoes & Accessories- Summer Cole - Brown Community Management

Women Push Up Embroidery Bras Set Lace Lingerie Bra and Panties and Socks 4 Piece

Women Push Up Embroidery Bras Set Lace Lingerie Bra and Panties and Socks 4 Piece- Standoffs, Hex Spacer, Threaded Hex Spacers

- Swimsuits For All Women's Plus Size Ruler Bra Sized Underwire Bikini Top, 44 G - Blue Tie-dye : Target