Optimize Your Portfolio Using Normal Distribution

4.5 (77) In stock

:max_bytes(150000):strip_icc()/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-01-7b5b43d1e34d44229a3bd4c02816716c.jpg)

Normal or bell curve distribution can be used in portfolio theory to help portfolio managers maximize return and minimize risk.

3 Distribution of Willingness to Pay for Double Bounded Form of, dom dom yes yes letra

Decision Model in Marketing, PDF, Regression Analysis

Excel Exam 01, PDF, Median

:max_bytes(150000):strip_icc()/thinkstockphotos-166162153-5bfc2b5746e0fb0083c0735f.jpg)

Conditional Value at Risk (CVar): Definition, Uses, Formula

Risk Neutral Definition, PDF, Risk Aversion

:max_bytes(150000):strip_icc()/dotdash_final_Optimize_Your_Portfolio_Using_Normal_Distribution_Jan_2021-02-7952a22f3cc5400c96af85625a1ee03e.jpg)

Optimize Your Portfolio Using Normal Distribution

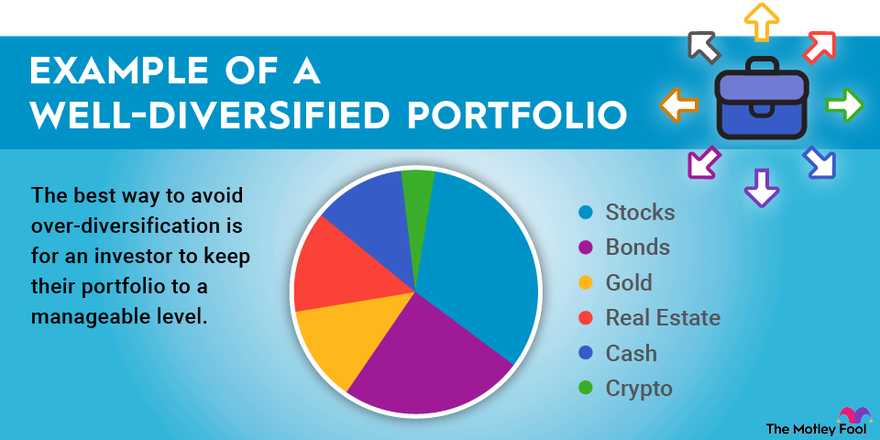

Tips For A Diversified Portfolio The Motley Fool, 56% OFF

Tips For A Diversified Portfolio The Motley Fool, 56% OFF

Article 1 Optimize Your Portfolio Using Normal Distribution References, PDF, Normal Distribution

Article 1 Optimize Your Portfolio Using Normal Distribution References, PDF, Normal Distribution

:max_bytes(150000):strip_icc()/risk-analysis.asp-final-fc95681c1cd94d52b1062195ce01a527.png)

Risk Management Essentials

Normal Distribution - What It Is, Properties, Uses, and Formula, PDF, Normal Distribution

Market Update September 8, 2020

Yours Shop Yours fuller bust , plus-size clothing and plus-size

Yours, Shop Yours fuller bust , plus-size clothing and plus-size dresses

Yours Westwood Cross Shopping Centre

Manage Your Team's Learning Curve – Mark Truelson

How To Create And Analyze Simple Demand Curves for Your Business

Girl's Butterfly Print 2pcs, Hoodie & Sweatpants Set, Color Clash Casual Outfits, Kids Clothes For Spring Fall

Girl's Butterfly Print 2pcs, Hoodie & Sweatpants Set, Color Clash Casual Outfits, Kids Clothes For Spring Fall Free Crochet Flamingo Pattern for Flikka Flamingo - The Loopy Lamb

Free Crochet Flamingo Pattern for Flikka Flamingo - The Loopy Lamb Burgundy Shirt And Tie

Burgundy Shirt And Tie Premium Vector Two pink dumbbells from multicolored paints

Premium Vector Two pink dumbbells from multicolored paints ボード「Fashion & Beauty」のピン

ボード「Fashion & Beauty」のピン Naomi and Nicole Women's Unbelievable Comfort Bodybriefer, Black, 36C

Naomi and Nicole Women's Unbelievable Comfort Bodybriefer, Black, 36C