The Venture Capital Risk and Return Matrix - Industry Ventures

4.8 (205) In stock

Generally speaking, we found that the likelihood of achieving expected returns is not simply a function of high multiples. In fact, it varies depending on risk profile. For direct investments, loss rates and holding periods play a significant role. For venture fund counterparts, the same holds true, but exit strategies – whether through IPO or M&A – and capital-deployment timing also matter a great deal.

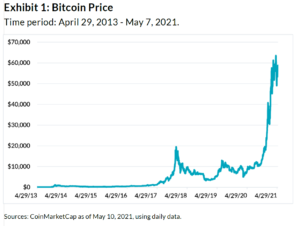

Risk Analysis of Crypto Assets - Two Sigma

スタートアップ経営の鉄則】~代替卵ユニコーンEat Justや培養肉Upside Foodsが陥った罠に共通する「教訓」

April'19 Startup Funding: Corporate Gushers

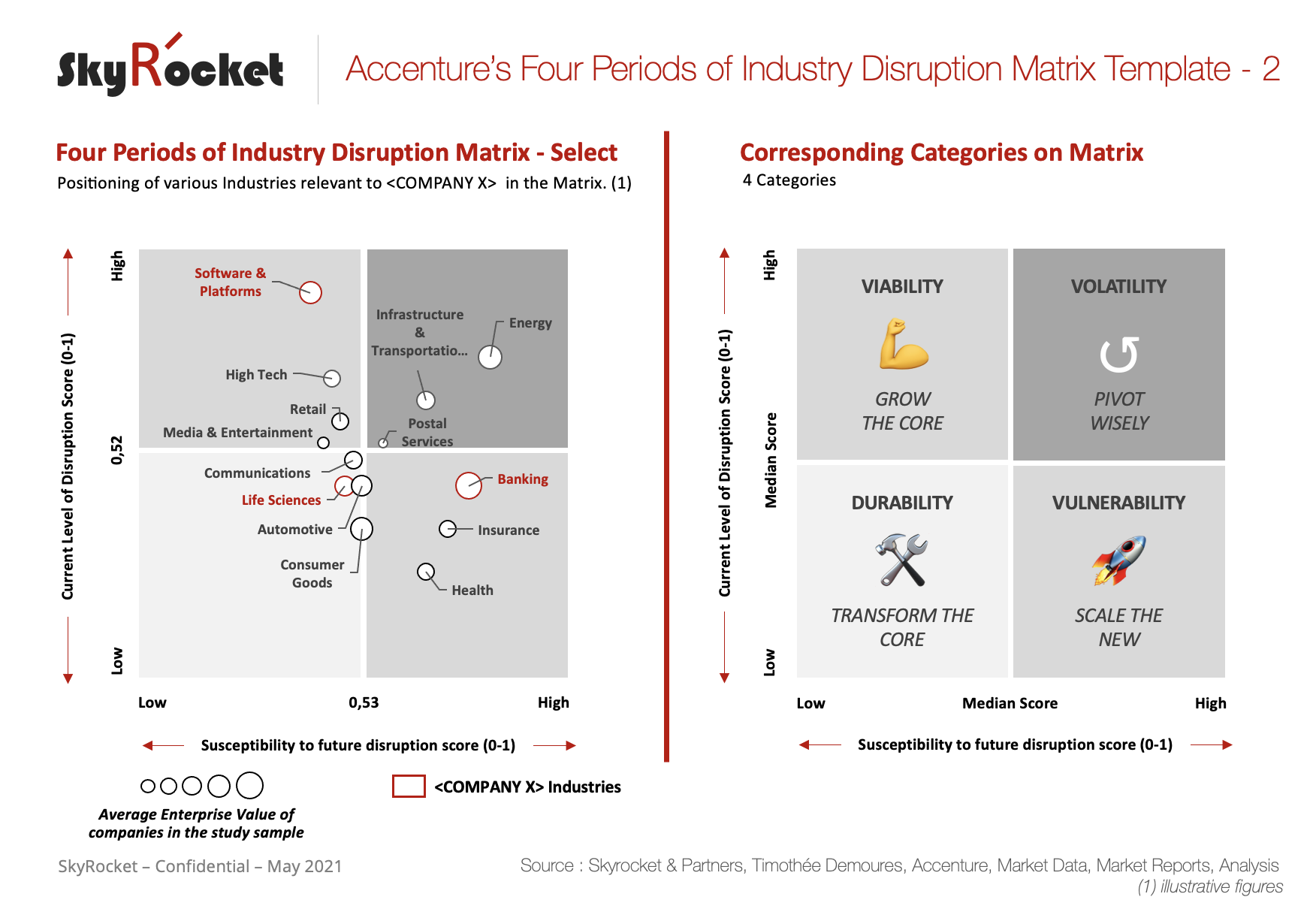

Accenture's Four Periods of Industry Disruption Matrix Template

Risk in the business - FasterCapital

4 types of innovation : are they the same in corporate tech and

In The Loop—Chapter 12: Justifying Transformation Investments, by Tom Mohr, CEO Quest Insights

Bseed Investments Investor Profile: Portfolio & Exits, bseed

Can I fundraise in COVID times ? — the “New” Fundraising Matrix, by specht.p

Venture Capital : Patience & Patterns

Senior Software Engineer (Full Stack) DTCC Candidate, 49% OFF

The Venture Capital Risk and Return Matrix - Industry Ventures

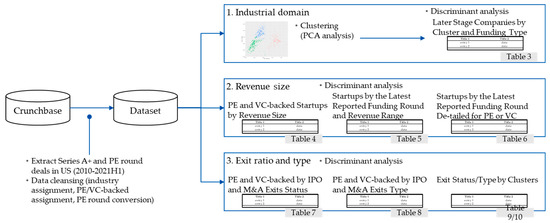

JRFM, Free Full-Text

How to Get Into Venture Capital: Recruiting and Interviews Full Guide

What is a Venture Capital Fund?

Vault Career Guide to Venture Capital, Seventh Edition – Career

The United States Of Venture Capital: The Most Active VC In Each State

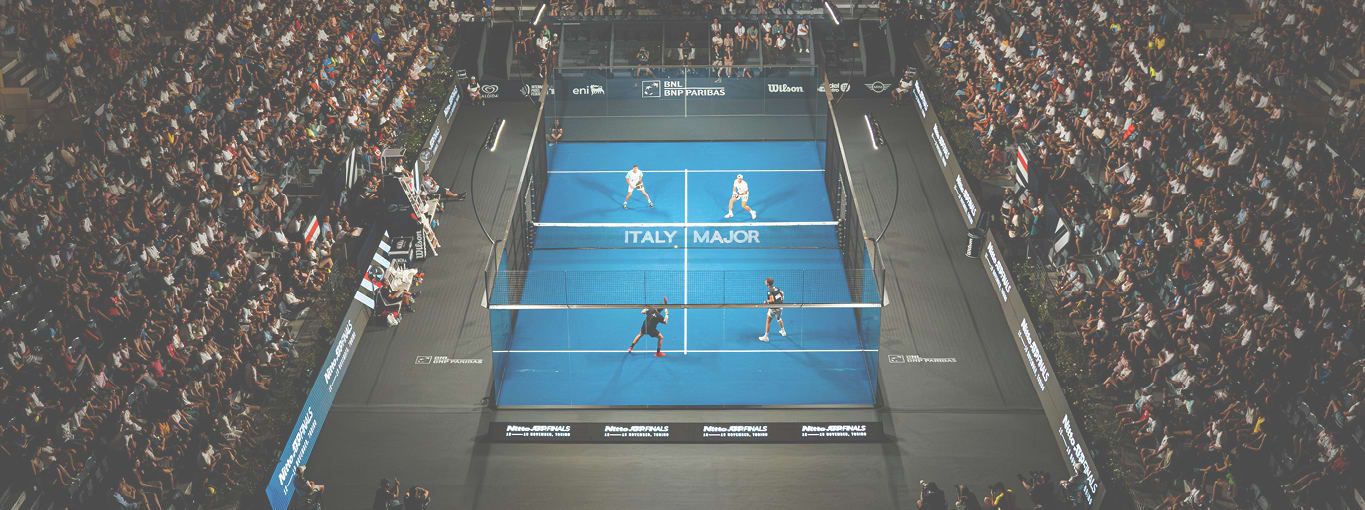

Como funciona o circuito profissional de padel ?

Como funciona o circuito profissional de padel ? Shop Cookies Pack 12 Sweatpants CM233BKP04 grey

Shop Cookies Pack 12 Sweatpants CM233BKP04 grey Cramps In Pregnancy- 10 Causes of Lower Abdominal Pain During

Cramps In Pregnancy- 10 Causes of Lower Abdominal Pain During- Ribbed High-Neck Longline Swim Top C/D Cup

Sanuk, Shoes, Sanuk Size Yoga Sling Wedge 15 Black On Black Yoga Mat Sandals Womens New

Sanuk, Shoes, Sanuk Size Yoga Sling Wedge 15 Black On Black Yoga Mat Sandals Womens New- Puma Training Evoknit Seamless Leggings In Charcoal Grey for Women

:quality(80):fill(white)/https:%2F%2Fimages.asos-media.com%2Fproducts%2Fpuma-training-evoknit-seamless-leggings-in-charcoal-grey%2F23239415-2%3F$XXL$)