Can you claim tax benefit for tax paid on insurance premium?

4.5 (636) In stock

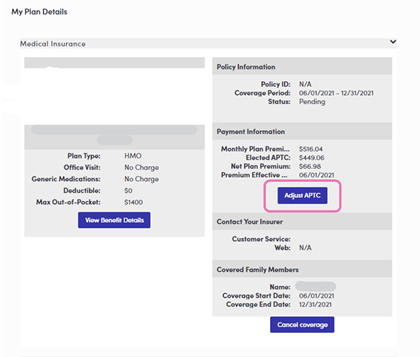

I qualify for premium tax credits, but I chose to pay my full monthly premium instead. Can I claim the amount of reduced premiums during tax time when I file my taxes? –

Self-Employed Health Insurance Deductions

:max_bytes(150000):strip_icc()/GettyImages-514211407-7890c9f9232844d1863ab073895a7c6f.jpg)

7 Insurance-Based Tax Deductions You May Be Missing

Amrg Associates

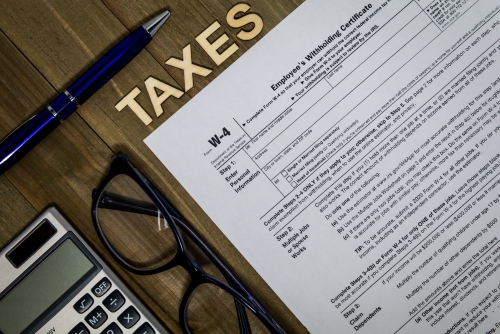

401(k) Tax 'Deduction:' What You Need to Know

Are Tax Preparation Fees Deductible for Personal or Business

nallur padmanabhan (@nrp_235) / X

Health Insurance Tax Benefit under Section 80d of Income Tax Act

.jpg)

Are Insurance Premiums Tax Deductible?

Is GST paid on insurance premium eligible for tax benefit?

Will I get a tax benefit on the insurance premium? - Quora

Do humans provide any benefit to planet Earth except for ourselves

Some employers are adding psychedelic drugs to their roster of health benefits

Malaria vaccine brings surprise benefit to children : Goats and Soda : NPR

New Student Loan Repayment Plan Benefits Borrowers Beyond Lower Monthly Payments, CEA

Multicolor Latex Resistance Exercise Bands with Door Anchor

Multicolor Latex Resistance Exercise Bands with Door Anchor Molas de mão e hand grips Musculação

Molas de mão e hand grips Musculação:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/AY23ZPAJPRDJNBS5IB6IFY4JXM.jpeg) The Business of Fashion

The Business of Fashion Getty Images Review: How to Make Money Selling Your Photos

Getty Images Review: How to Make Money Selling Your Photos Vanity Fair Women's Full Coverage Beauty Back Smoothing Bra (34B

Vanity Fair Women's Full Coverage Beauty Back Smoothing Bra (34B Maidenform Girl Big Girls' Slim Bra Crop Seamless, White, Small : : Clothing, Shoes & Accessories

Maidenform Girl Big Girls' Slim Bra Crop Seamless, White, Small : : Clothing, Shoes & Accessories