What is the journal entry to record a foreign exchange transaction

5 (218) In stock

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Foreign Currency Transactions and Hedging Foreign Exchange Risk - ppt download

Accounting Journal Entries for Foreign Exchange Gains and Losses

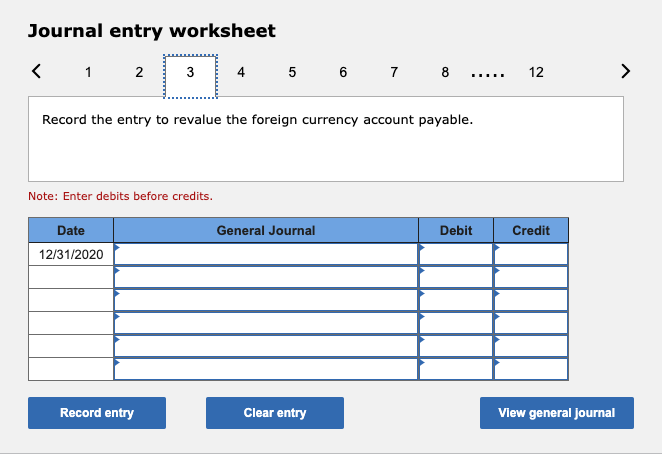

Solved Journal entry worksheet Record the foreign exchange

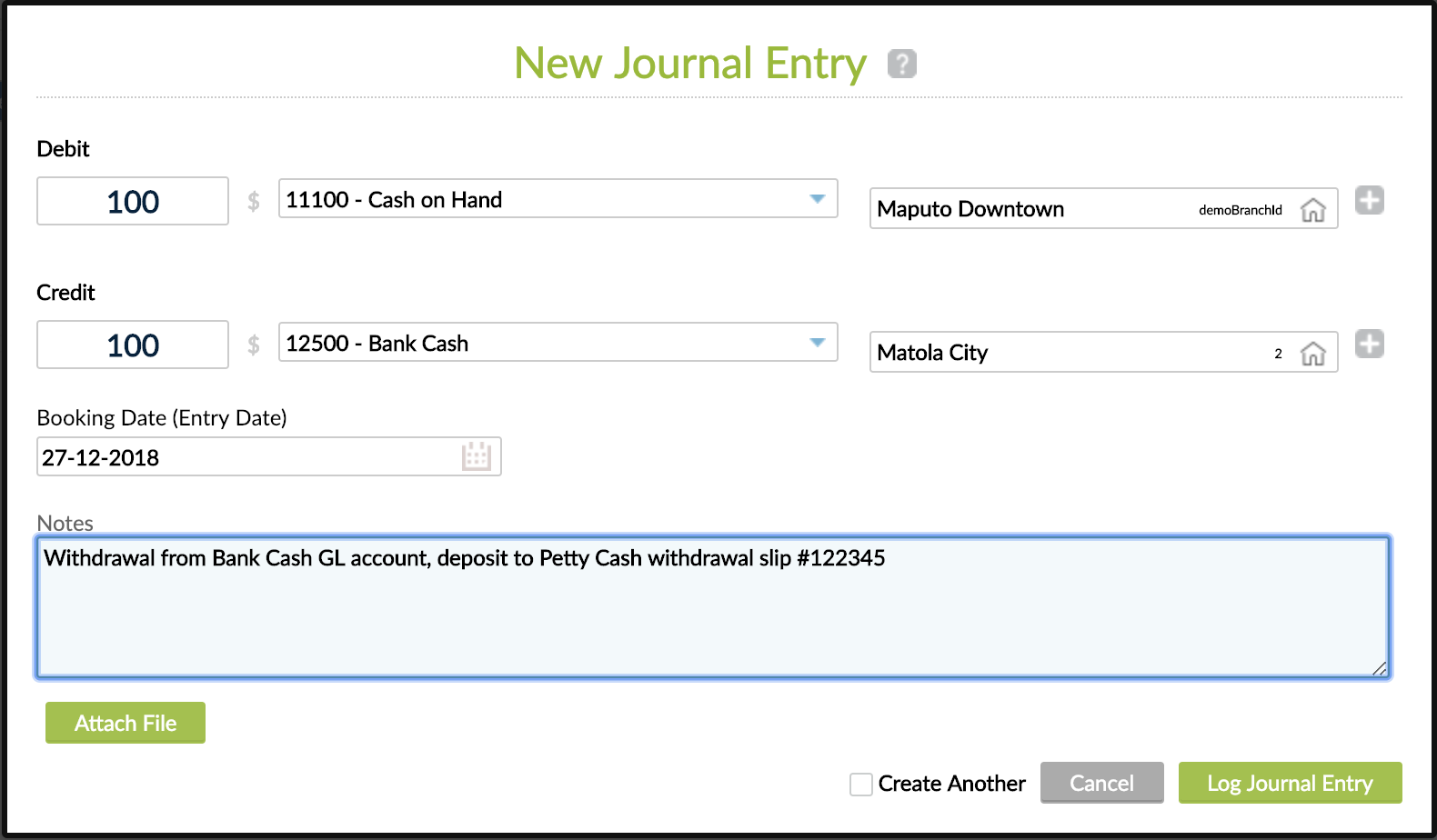

Journal Entries - Accounting

Accounting Journal Entries for Foreign Exchange Gains and Losses Foreign exchange gain or loss accounting example Foreign exchange fluctuation is a difference between rate of currency at the time of sale (

Foreign currency transactions and financial instruments

Cumulative Translation Adjustment (CTA): The Ultimate Guide

Double Entry Bookkeeping

Currency Exchange Gain/Losses

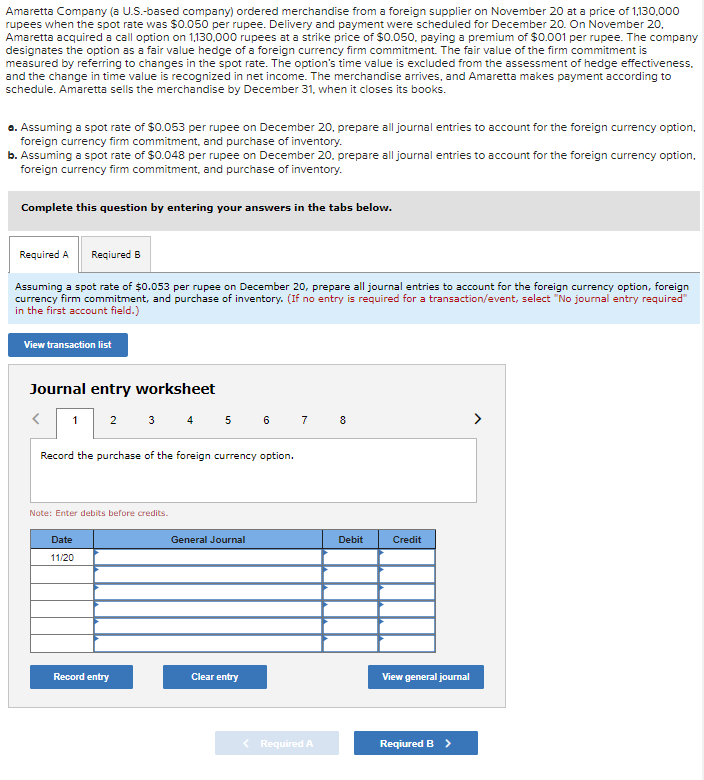

Solved A) 1. Record the purchase of the foreign currency

Foreign Exchange Gains or Losses in the Financial Statements – dReport in English

Foreign Currency Transaction & their Journal Entry

What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

Hyundai says first EV plant will open soon to gain $7,500 tax credit

Eating protein before bedtime does not cause weight gain - The truth behind the myth

Change the gain of audio regions in Logic Pro for Mac - Apple Support

Cleric Class (Adventures in the Forgotten Realms) - Gatherer

Cool Comfort Smoothing Cami Shapewear

Cool Comfort Smoothing Cami Shapewear- Ackermans - The Nude Colour Collection: seam-free underwear & shapewear for every shade and shape! Get yours from 99.95, sizes XS–XL

Faja Sacrolumbar Lumbo Sacra Reforzada Blunding M Blunding CC610M

Faja Sacrolumbar Lumbo Sacra Reforzada Blunding M Blunding CC610M Plus Size Swimsuits For Women 2pcs Bathing Suits Tankini Swim

Plus Size Swimsuits For Women 2pcs Bathing Suits Tankini Swim Playtex Love My Curves Beautiful Lift Lace Bras Choose Size/Color Ret $42 US4514

Playtex Love My Curves Beautiful Lift Lace Bras Choose Size/Color Ret $42 US4514- Minus33 Merino Wool Midweight - Ridge Cuff Beanie 100% Merino Wool