Labour Mobility Tax Deduction for Tradespeople • Canada's Building

4.7 (121) In stock

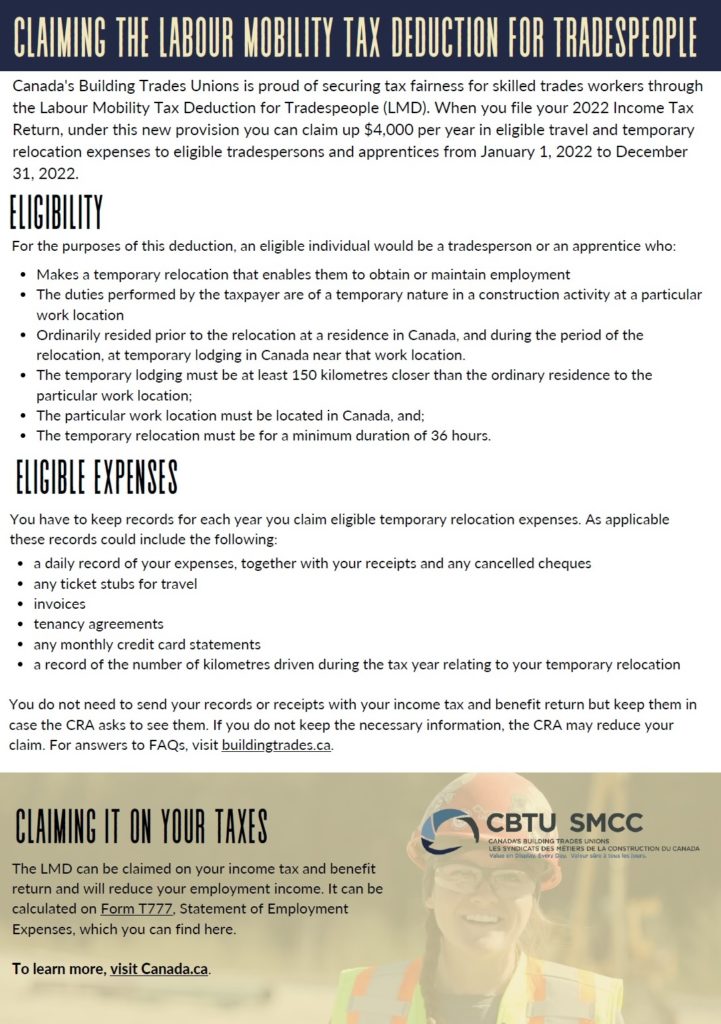

After over two decades of advocacy, tax fairness is now a reality for tradespeople across Canada.

Claiming the Labour Mobility Tax Deduction Webinar - UA Local 740

Federal budget includes Labour Mobility Deduction for tradespeople

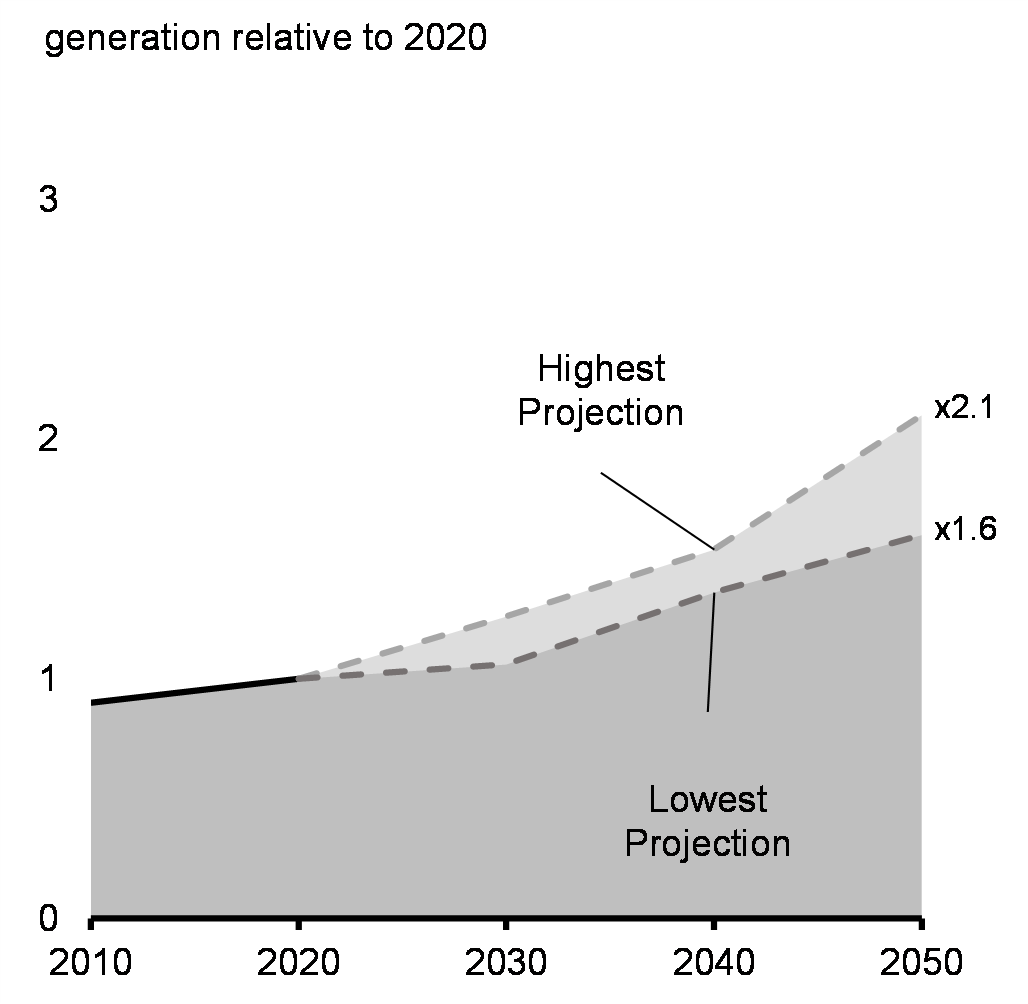

Chapter 3: A Made-In-Canada Plan: Affordable Energy, Good Jobs

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

SEAN STRICKLAND: One small step for skilled trades will pay off

Moving our agenda forward… together! - SMART Union

Let's face it, solving Canada housing crisis will be unpopular and

EY Tax Alert 2023 no 20 - Federal budget 2023–24

Tax Bytes - Monthly Newsletter & Traning

Tax Updates for Employers and Employees in 2023

Canada's 2023 Federal Budget: A win for workers

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

Knowledge Bureau - World Class Financial Education

Labour Mobility Tax Deduction for Tradespeople • Canada's Building

Chapter 3: A Made-In-Canada Plan: Affordable Energy, Good Jobs

9 Benefits of Hula Hooping & How to Start

BENEFIT definition and meaning

Canada Dental Benefit Factsheet

Deliver with DoorDash? Enjoy an exclusive DashPass benefit for Dashers.

After-Tax Real Rate of Return Definition and How to Calculate It

How to Target the UNDERBUTT - Lower Glutes Workout

How to Target the UNDERBUTT - Lower Glutes Workout Passionata PRISCA SUSPENDER BELT - Suspenders - black

Passionata PRISCA SUSPENDER BELT - Suspenders - black 1pc Men's Sexy Elephant Underwear Thong T-back Briefs

1pc Men's Sexy Elephant Underwear Thong T-back Briefs Eivy Icecold Rib Women's Tights - Faded Fog

Eivy Icecold Rib Women's Tights - Faded Fog Bras N Things Bryanna Underwire Bodysuit - Black

Bras N Things Bryanna Underwire Bodysuit - Black Romania National Flag Colors Horizontal Striped Leggings, Zazzle

Romania National Flag Colors Horizontal Striped Leggings, Zazzle