What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

4.5 (323) In stock

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Accounting for Foreign Exchange Transactions - Withum

SEC Filing International Flavors & Fragrances Inc.

Automate Client Accounting Services

What is Foreign Exchange Accounting?

Accounting For Cryptocurrencies: All You Wanted to Know Know About Cryptocurrency Accounting [Crypto Accounting Guide]

What types of journal entries are tested on the CPA exam

Chapter 1 Introduction to Accounting and Accounting Systems Part - I

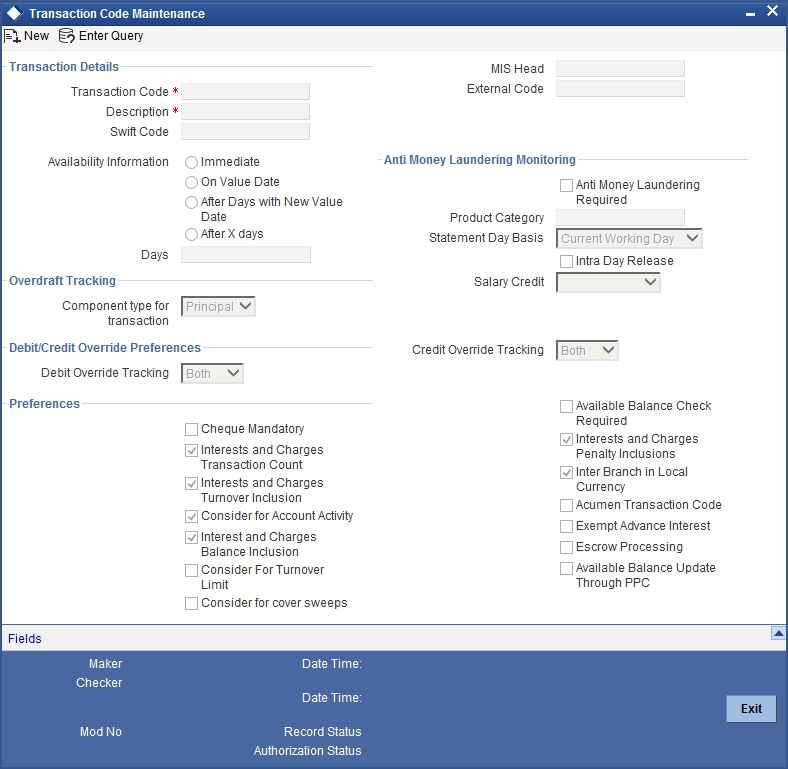

21. Transaction Code

Entering and Processing Foreign Currency Journal Entries

Becker FAR - Intercompany Transaction Retained Earnings Example

Papaya Global Review & Analysis – Is It a Legit EOR?

Foreign Currency Transaction w/ Journal Entries (FAR MCQ

Top 200 Bob Marley Quotes (2024 Update) - QuoteFancy

50% Off Gain The Edge Discount Code: (11 active) March 2024

Change the gain of audio regions in Logic Pro for Mac - Apple Support

- Underscore Plus Innovative Edge® High-Waist Thigh Slimmers 129

Close Up on Female Boobs in Black Bra Stock Photo - Image of

Close Up on Female Boobs in Black Bra Stock Photo - Image of SPANX, Pants & Jumpsuits, Spanx Look At Me Now Leggings In Black Camo Size Large Nwt

SPANX, Pants & Jumpsuits, Spanx Look At Me Now Leggings In Black Camo Size Large Nwt Porque fazer Musculação - Be Exclusive Gym

Porque fazer Musculação - Be Exclusive Gym Proboscis Monkey mother and baby, Borneo, Malaysia, Southeast Asia, Asia Stock Photo - Alamy

Proboscis Monkey mother and baby, Borneo, Malaysia, Southeast Asia, Asia Stock Photo - Alamy How to Choose the Best Plastic Water Storage Tank? - Vectus

How to Choose the Best Plastic Water Storage Tank? - Vectus