When to sell your parents' home: The tax consequences - Ross Law

4.8 (117) In stock

Let’s say you’ve known for years that you are inheriting your father’s home when he dies. Hopefully, you also know that he has a will that indicates clearly that the house will go to you.

2024 is here, and tax relief with it

Sold Your Parents' Home in 2014? Check This Tax Advice

Trump commerce secretary's business links with Putin family laid out in leaked files, Donald Trump

The costs of selling a home and the tax implications

2660 Ross Pl, Walnut Creek, CA 94597, MLS# 41028621

Crossover Day wrap: Flurry of bills passed at pivotal deadline • Georgia Recorder

Avoid Capital Gains Tax on Inherited Property • Law Offices of Daniel Hunt

2601 Ross Rd, Chevy Chase, MD 20815, MLS# MDMC2112676

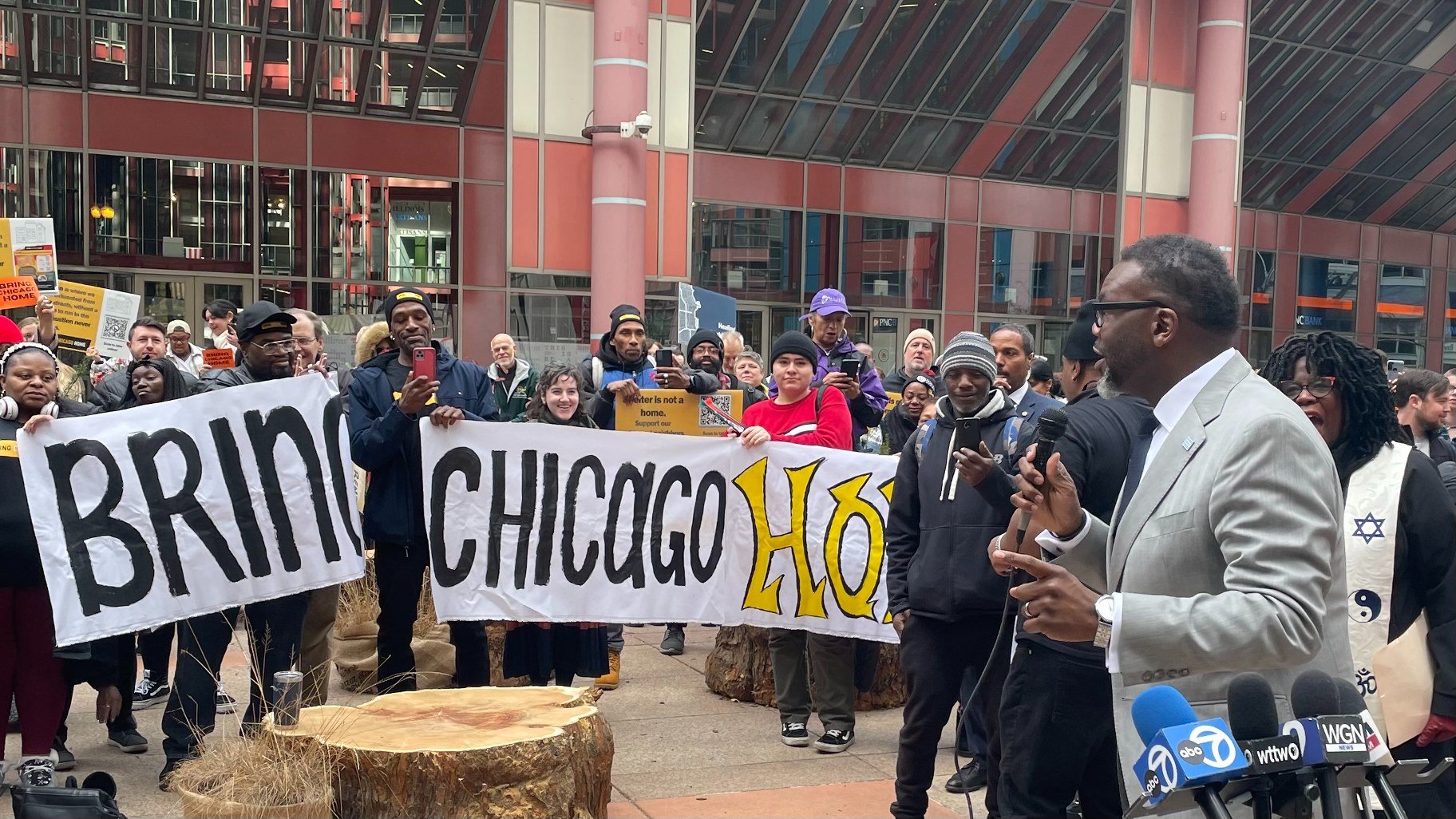

Chicago Voters to Decide Whether to Hike Taxes on Sales of Million-Dollar Homes to Fight Homelessness, Chicago News

H. Ross Perot Dies at 89; Billionaire Ran for President Twice - Bloomberg

The Book on Tax Strategies for the Savvy Real Estate Investor: Powerful techniques anyone can use to deduct more, invest smarter, and pay far less to the IRS! by Amanda Han, Matthew

Understanding the Tax Consequences of Selling One's Personal Home: Part I

What to Know Before Buying a Home With Your Parents - The New York Times

Do I have to pay taxes on proceeds from my garage sale?

Sell your car in Australia VS UK

2024 Guide to Selling Products Online

When's the Best Time to Sell a House? 4 Tips for When to Sell

Brandon Maxwell Spring 2021 Was a Journey From Dark to Light

Brandon Maxwell Spring 2021 Was a Journey From Dark to Light Investigation: How TikTok's Algorithm Figures Out Your Deepest Desires

Investigation: How TikTok's Algorithm Figures Out Your Deepest Desires- What's the best Indian traditional dress for women this winter

Beach Riot Summer Leggings

Beach Riot Summer Leggings Abdominal Belt Elastic Back Warmer Heat Belt Elastic Self-heating Belt Waist Support Rejuvenation Belt Postpartum Belly Belt

Abdominal Belt Elastic Back Warmer Heat Belt Elastic Self-heating Belt Waist Support Rejuvenation Belt Postpartum Belly Belt Breathable Short Tights Underwear Soft DoubleLayer Short Summer Safety Under Shorts Skirt D0V5

Breathable Short Tights Underwear Soft DoubleLayer Short Summer Safety Under Shorts Skirt D0V5