Can you claim tax benefit for tax paid on insurance premium?, ET RISE MSME DAY

4.5 (645) In stock

Section 80C and 80D of Income-tax Act entitles specified taxpayers to claim deductions for the entire amount paid to the insurance company for specified insurance schemes.

Health Insurance Tax Benefits For Small-Business Owners

Business Income-Tax Deductions for Life-Insurance Premiums

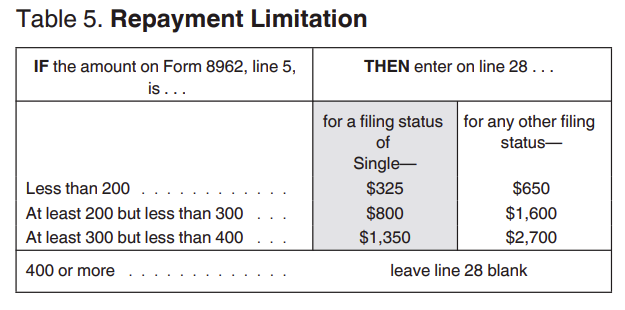

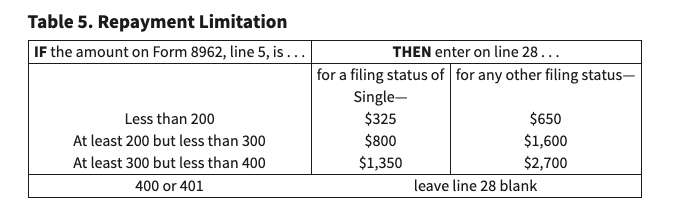

Advanced Tax Credit Repayment Limits

Premium Tax Credits

Minnesota Health Insurance Subsidy

Insurance-Based Tax Deductions

Are Life Insurance Premiums Tax-Deductible In Canada?

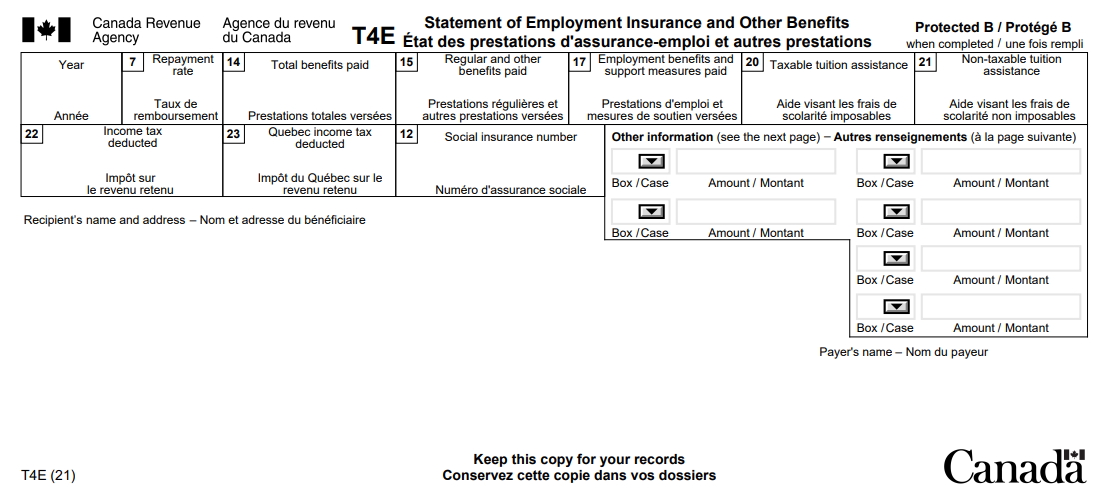

T4E slip: Statement of Employment Insurance and Other Benefits - Personal income tax

How Can I Pay My Life Insurance With Pre-Tax Dollars Rather Than After-Tax Dollars?

Tax Deductible Life Insurance

Compensation and Benefits: The Complete Guide - AIHR

About my Benefits Department of Administrative Services

RadioActive: a benefit for KCUR KCUR - Kansas City news and NPR

LC Lauren Conrad, Pants & Jumpsuits

LC Lauren Conrad, Pants & Jumpsuits Should You Buy? BALEAF Women's Hiking Cargo Shorts

Should You Buy? BALEAF Women's Hiking Cargo Shorts Vintage Deadstock Eaton's Birkdale Pants, Made in Czechoslovakia, 30”x – KingsPIER vintage

Vintage Deadstock Eaton's Birkdale Pants, Made in Czechoslovakia, 30”x – KingsPIER vintage Everyday Shaping Thong

Everyday Shaping Thong What is the Associative Property?, 3rd Grade Math

What is the Associative Property?, 3rd Grade Math No Show Everyday Wear Push Up Bras for Women Comfy Comfortable

No Show Everyday Wear Push Up Bras for Women Comfy Comfortable