Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

4.8 (629) In stock

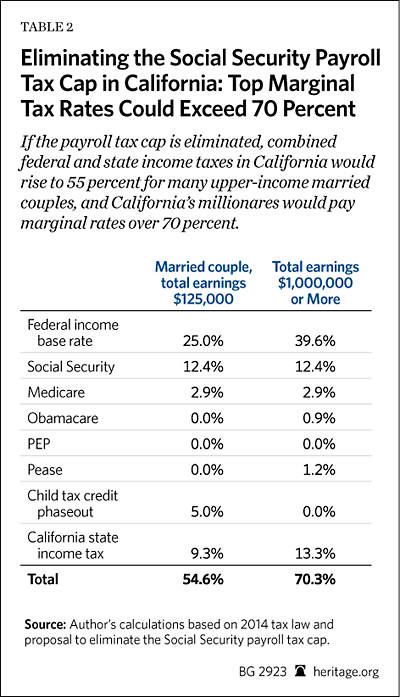

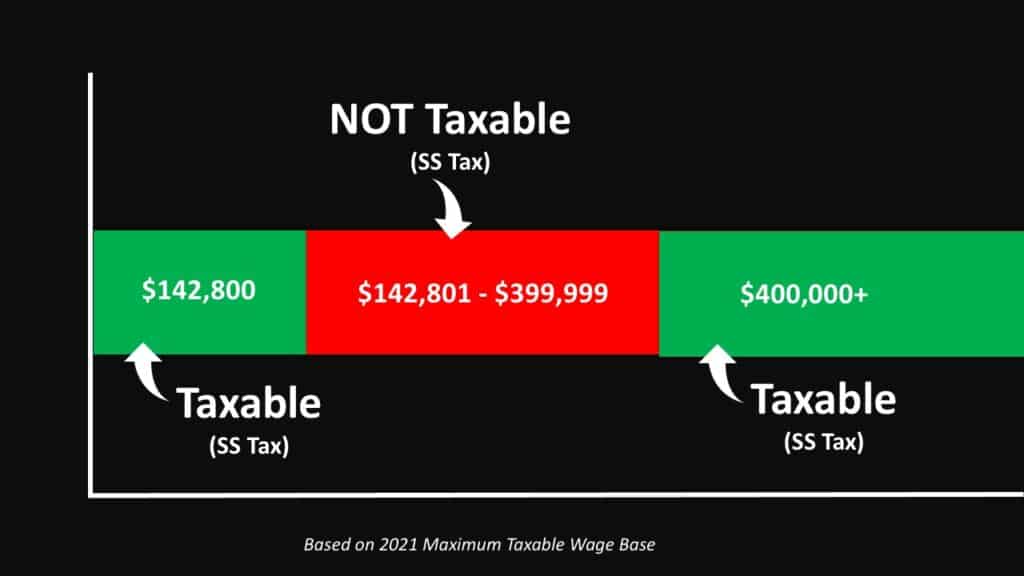

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, fica tax

Social Security Is Essential. So Why Do Some Want to Cut It?

How to fix Social Security? It's political but it can be done

No to Eliminating (or Raising) the Social Security Tax Maximum

Why Is There a Cap on the FICA Tax?, fica tax

Dan Tumis (@Dtumis41) / X

End the Tax Exclusion for Employer-Sponsored Health Insurance

Bill Monte, CLU® , ChFC®, CLTC®, LTCP®, RICP® on LinkedIn: Should

Should Social Security Be Privatized? Top 6 Pros and Cons

Dan Tumis (@Dtumis41) / X

Dan Tumis (@Dtumis41) / X

Social Security is now expected to run short of cash by 2033 : NPR

What Are Social Security Benefits, Social Security FAQ, What's Social Security

Social Security 2024: Payment Schedule for Checks With COLA

Why Most of Your Rides Should be Easy Zone 2 - Roberto Vukovic

Why Most of Your Rides Should be Easy Zone 2 - Roberto Vukovic lingerie pink sujetador transparente panties and bra set underwear set – Chilazexpress Ltd

lingerie pink sujetador transparente panties and bra set underwear set – Chilazexpress Ltd- Plus Size - 4 Pocket Full Length Active Legging - Performance Core Dusty Olive - Torrid

Cheap Monday Relaxed Fit Jeans In Light Blue in Black for Men

Cheap Monday Relaxed Fit Jeans In Light Blue in Black for Men Buy Wholesale China Fashion Sets Top Skin-friendly U-back Sports Bras For Exercise & Sports Bras at USD 8

Buy Wholesale China Fashion Sets Top Skin-friendly U-back Sports Bras For Exercise & Sports Bras at USD 8 Early 1900s Straight Fronted Corset Sewing Pattern Bust Sizes 32-48 Past Patterns Original, 0106

Early 1900s Straight Fronted Corset Sewing Pattern Bust Sizes 32-48 Past Patterns Original, 0106